March 28, 2025

March 28, 2025

This week, we celebrate 50 years of the federal Earned Income Tax Credit (EITC) and the impact it’s had on millions of workers and families. Over time, the credit has grown at both the federal and state levels. In 2023 alone, the latest year of available data, the federal EITC alongside the refundable portion of the Child Tax Credit lifted 6.4 million people and 3.4 million children out of poverty.

In 1975, after years of debate over guaranteed income programs, cash benefits, and other mechanisms to boost the wages of low-income workers and families, both Republican and Democratic members of Congress voted to create the EITC.

The legislation at the time mandated the credit for one year and allowed a maximum benefit of $400 which began phasing out after $4,000 of income. Considering the poverty line for a family of four was $5,500 at the time, the credit was clearly targeted to the lowest earning households.

The credit was structured to be means-tested and phased in at 10 percent of a household’s first $4,000 of earned income as a way of reducing opposition from lawmakers who did not want to assist children of parents who weren’t employed outside the home. The EITC ended up winning out over a guaranteed income program proposed by then-President Nixon that would have supplemented the income of households making under $3,000 a year – including households with no earnings.

The credit was extended until it was made permanent in 1978. Over the years, the federal EITC has changed and expanded. In 1986, it was permanently indexed to inflation, allowing it to keep up with the cost of living. In the early 1990s, the credit was increased based on family size and became available, at a modest level, to workers without children in the home. In the early 2000s, the credit was altered to better benefit married families and years later it was modified again to boost the maximum credit for households with three or more children.

As the credit changed, so did its impact. What was once a means of boosting low wages was now emerging as an anti-poverty tool.

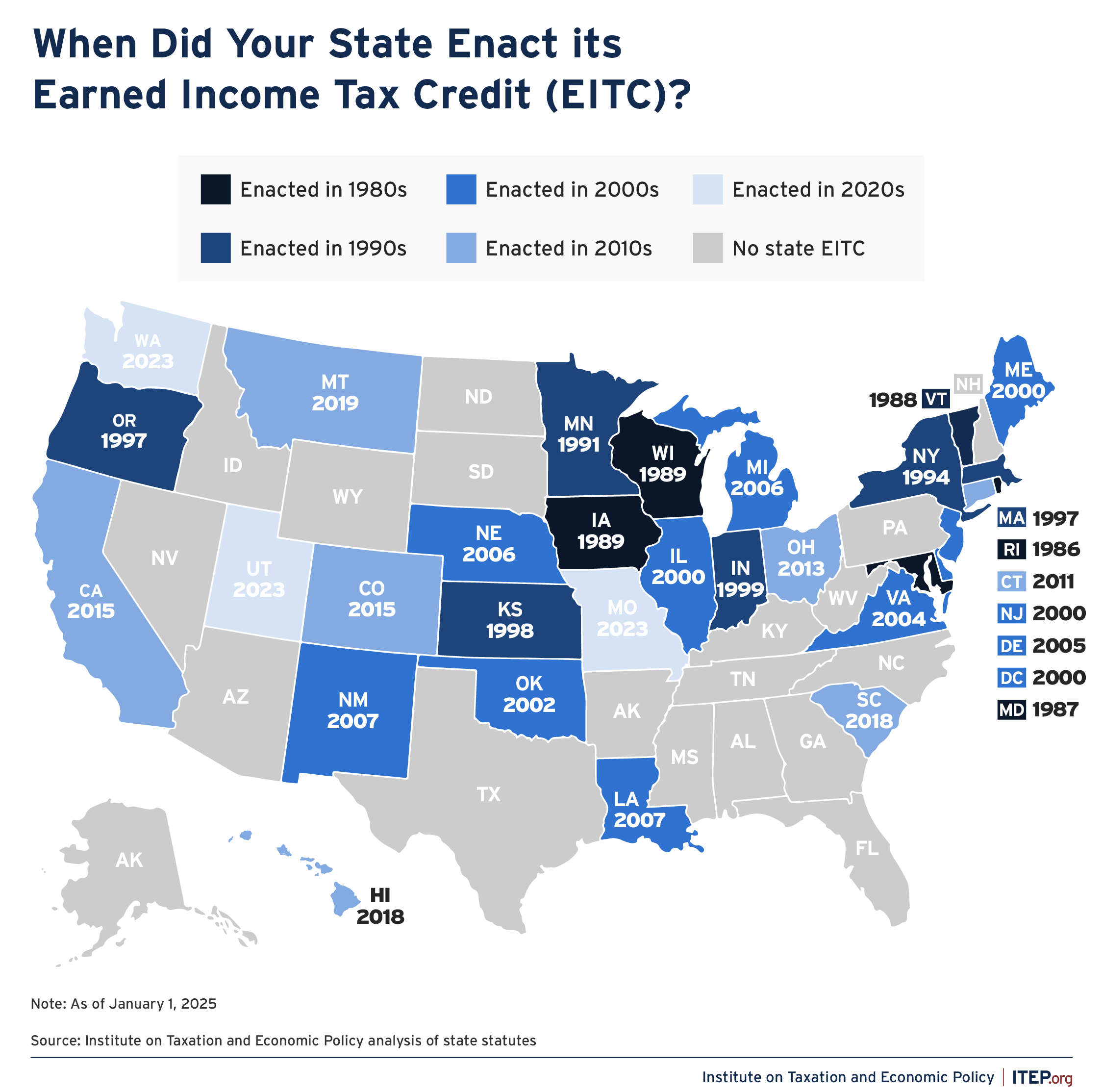

States, looking to build on this success, began to couple to the federal credit. Rhode Island became the first state to enact its own EITC in 1986. By the turn of the millennium, 11 states had passed an EITC. Today, 31 states plus the District of Columbia and Puerto Rico offer EITCs. These credits have gained momentum even at the local level. Local EITCs can also now be found in Montgomery County, Maryland, New York City, and San Francisco where they benefited 700,000 households in 2023.

State and local taxes are overwhelmingly regressive, requiring low and middle-income families to pay more of their income in taxes than wealthier taxpayers. This makes the EITC a helpful and important tool at the state level. Refundable tax credits can offset the upside-down nature of state and local tax systems, which often rely heavily on regressive sales, excise and property taxes.

These state credits have also grown and been improved to address shortcomings of the federal credit. For instance, as of 2025, 10 states have extended their EITCs to people filing with both Social Security and Individual Tax Identification Numbers, and eight states have expanded the age qualifications to workers without children in the home who are not eligible for the federal credit if under 25 or over 65 years of age.

In the wake of the recent Covid-19 pandemic, Congress temporarily expanded the federal EITC’s amount and qualifying age for workers without children in the home who – prior to 2021 – could receive a maximum credit of just $543 and who had to be at least 25 to qualify. This marked the first real expansion, temporary or permanent, of the federal EITC in over a decade, and paired with a concurrent expansion of the Child Tax Credit, had a tremendous impact in reducing poverty.

While these credit expansions were not extended beyond 2021, their success spurred a wave of state EITC proposals, with 17 states plus the District of Columbia enacting or expanding their credits in 2022 and the years since. This year, another handful of states – Illinois, Montana, New Mexico, New York, North Carolina, Oklahoma, and Virginia – are considering creating, expanding or improving their existing credits.

The EITC may have begun as a way to modestly boost the wages of low-income workers and families, but today it is undeniably an important tool available to lawmakers to lift up workers, reduce the regressivity of state and local tax systems, and tackle one of our nation’s biggest problems: poverty. Amid debates over tax cuts for our nation’s wealthiest residents, lawmakers can use this historic 50-year milestone as inspiration to instead focus on improving the lives of workers, children, and families.