The House Judiciary Committee last week held an antitrust hearing to scrutinize Amazon and other tech companies’ growing dominance. A look at the online retail giant’s new quarterly report and past tax avoidance reveals why lawmakers should be equally concerned about how the tax system allows dominant, profitable corporations to avoid most or all federal tax on their profits.

Amazon, yet again, is poised to pay little or no federal income tax on its record profits, and it appears likely to do so using entirely legal tax breaks for stock options and research and development.

The company’s pretax earnings for the quarter were a staggering $6.2 billion, more than double what it reported for the same three-month period in 2019. The company’s cumulative pretax income of $9.6 billion for the first half of 2020 puts it on a path to exceed its record $13.9 billion of pretax income in 2019.

Earnings reports typically don’t include separate estimates of current federal income tax liabilities, so we can’t yet know whether the company will continue its streak of paying little or no federal income taxes. But the company’s income tax note sends a clear signal that, tax-wise, we should expect more of the same.

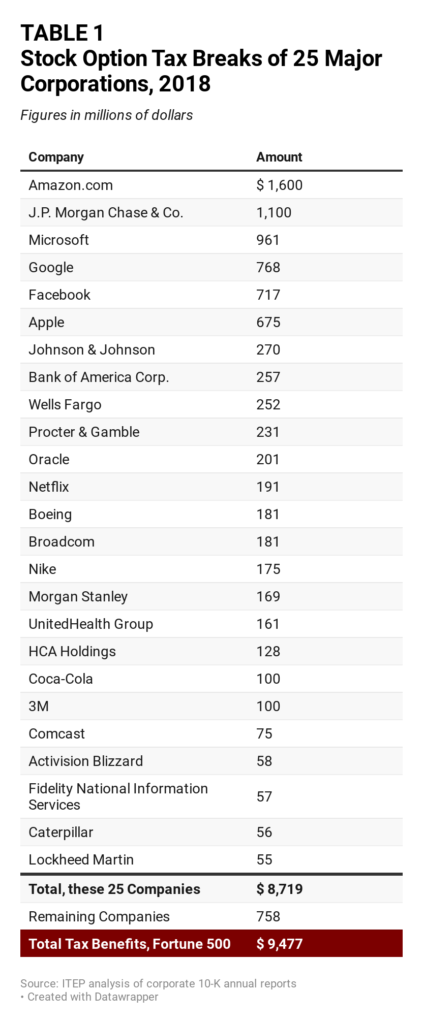

“For 2020, we estimate that our effective tax rate will be favorably affected by the impact of excess tax benefits from stock-based compensation and the U.S. federal research and development credit,” its earnings report stated. This is notable because stock options and the R&D tax credit appear to be among the main tools used by Amazon to avoid virtually all federal income taxes over the past three years. ITEP argues for repealing the stock option tax break here.

This disclosure is also notable because it’s a reminder that the mechanisms Amazon has used to reduce its three-year federal income tax rate to zero between 2017 and 2019 are legal. Congress created them, Congress chose in the most recent round of “tax reform” to leave them in place, and Congress currently appears to be entirely cool with these tax breaks remaining in place. If Amazon’s income tax avoidance is viewed as a bad thing (as, in the eyes of most Americans, it almost certainly is), Congress has the power to bring it to an end.

Lawmakers who enacted the 2017 tax law, in particular, have shown little interest in requiring large companies like Amazon to pay federal income taxes. If, at the end of this year, Amazon once again reveals its ability to keep the tax system from laying a glove on it, Jeff Bezos will certainly be entitled to tell Congress, “we warned you.” The blueprints for the company’s tax avoidance are available to see for any policymakers choosing to take loophole-closing tax reform seriously.