May 9, 2023

May 9, 2023

Congress is currently involved in a debt ceiling debate that defies all common sense. While it isn’t reasonable in the first place for Congress to debate whether it will pay the bills it has already incurred, some of the same lawmakers who are holding the economy hostage to exact budget cuts have decided to make the conversation even more irrational by proposing to increase deficits with tax cuts that enrich the already rich.

House Republicans finally unveiled their plan to slow the growth of the national debt. As a condition for allowing the Treasury to avoid creating a global recession, their budget plan demands severe cuts to a wide swath of government programs. Hypocritically, at the same time GOP politicians demand cuts to programs such as Medicaid, veterans’ assistance, and education, they are asking for tax cuts for the wealthy and corporations that would substantially increase the debt.

Extending 2017 Tax Cuts Would Blow Up the Deficit to Benefit the Rich

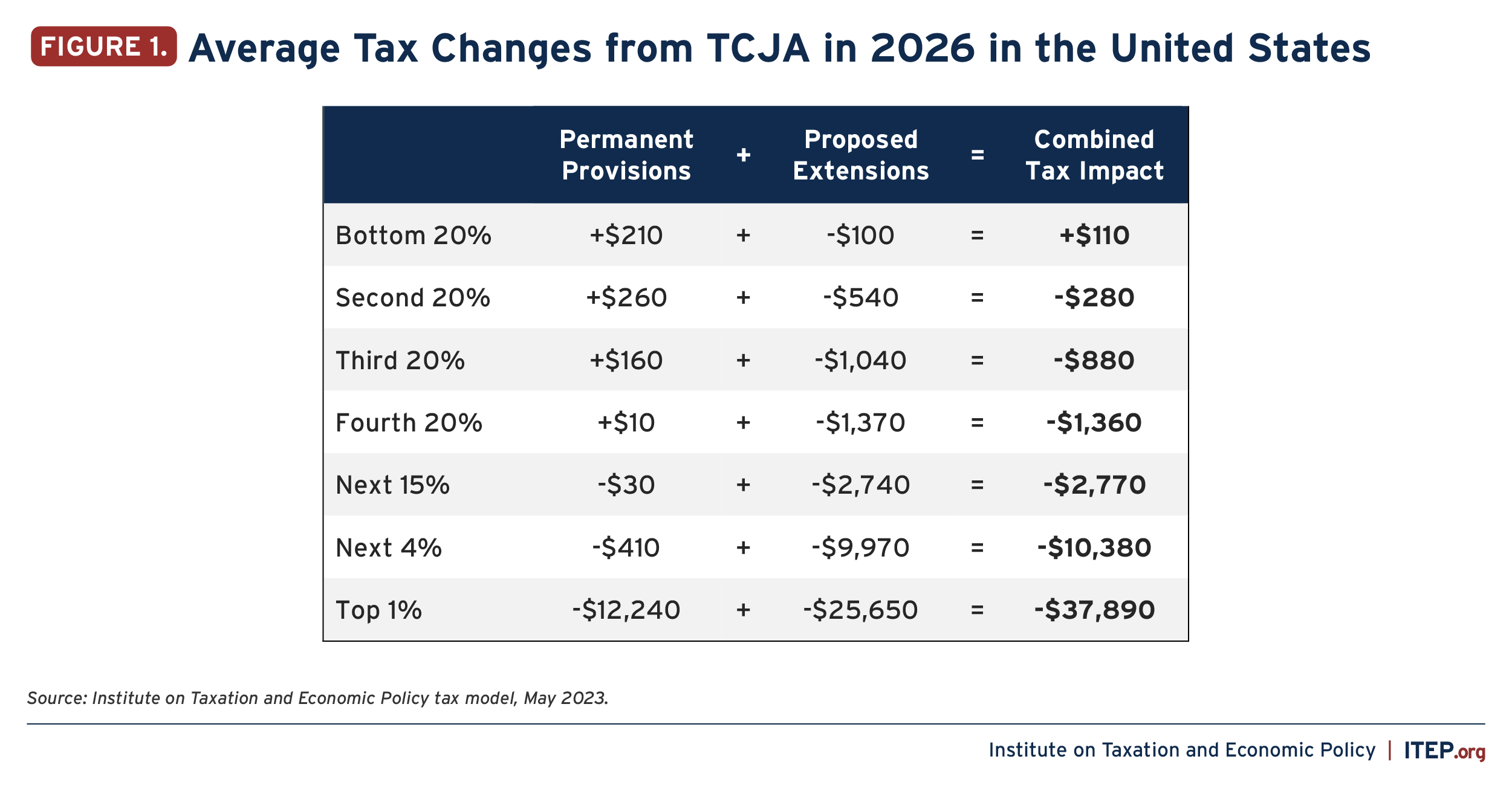

Republicans recently introduced a bill to make permanent the provisions of the Tax Cuts and Jobs Act of 2017 that would otherwise expire at the end of 2025. The bill—introduced by Rep. Vern Buchanan, one of the wealthiest members of Congress—would dramatically increase deficits and would primarily benefit the richest Americans. The top 5 percent would receive $112.6 billion in tax cuts in the first year, more than the entire bottom 80 percent. Under this plan, the richest 1 percent would save nearly $26,000 on their taxes on average.

When Republicans passed the 2017 tax law, many of its provisions were set to expire at the end of 2025. The lawmakers who wrote the bill didn’t actually want those provisions to expire, but they needed to make their bill appear less costly than it actually was so they structured them as temporary measures that they could later extend. (Even as enacted without extension of the temporary provisions, the bill was enormously expensive, increasing deficits by $1.5 trillion.)

When the permanent and temporary provisions of the bill are taken together, its effects are massively tilted toward the rich. The top 1 percent will receive a benefit of more than $37,000 in 2026 while the bottom 20 percent will pay more on average. This is an entirely unreasonable proposal for so-called “budget hawks” to put forth in the middle of a conversation about lowering public debt.

It Gets Worse

Astoundingly, this is not the only wasteful tax cut proposal floating around House GOP chambers.

Republican tax writers are readying a separate package of tax breaks for big businesses. This package looks to be mostly a refurbishment of a plan that failed to pass at the end of last Congress, largely because Democrats would only get on board if it included support for low-income children. Republican leaders decided the provisions for children and families were too costly and that they could get a better deal when they controlled the House. ITEP analyzed the provisions in the Republican package last year and found each to raise its own concerns.

One provision is a tax subsidy for research, which on its face seems like a thing Congress might want to support through the tax code. But the companies lobbying for its passage (like a frozen breakfast maker and a company that makes gambling machines) do not seem to be conducting the type of research a reasonable person would think of as deserving public support.

Another part of that plan would extend a rule called “bonus depreciation,” which has allowed giga-corporations like Google, FedEx, and Walt Disney to write off billions from their income tax bills. Proponents claim the rule encourages investment, but research shows that it is more likely just a windfall for certain industries than an incentive for new factories.

And a third provision would increase the tax advantage that companies who rack up debt have over companies that raise money by selling shares. This provision largely benefits private equity companies that take over corporations and load them with debt. Doing so leaves the corporations more prone to collapse and bankruptcy, and leaves employees and contractors holding the bag. Famously, this practice doomed several well-established companies like Toys “R” Us and Payless.

But Wait, It Gets Worse Still

The one thing you could say for House Republican leaders is at least they didn’t include wasteful tax giveaways to the rich in the same bill that would cut health, childcare, infrastructure, and veterans’ assistance—except that they did.

The debt ceiling bill that House Republicans passed in April would rescind new funding for the IRS that was included in the Inflation Reduction Act (IRA). So far that funding has meant that people have been receiving their tax refunds much more quickly than in recent years. (Ironically, refund checks going out faster means that the Treasury is also approaching the debt ceiling faster).

But about half of the new IRS funding will be used for tax enforcement of big corporations and the wealthy. The Treasury Department estimates that the gap between the taxes people legally owe and the amount they actually pay will amount to around $7 trillion over the next decade. More than half of that gap is just from the top 5 percent of richest taxpayers. The White House, Treasury Department, and IRS Commissioner have all made clear that the IRA funding would be used to step up tax enforcement only for people making more than $400,000 and for corporations.

The Republican scheme to hamper the IRS’ ability to audit wealthy tax dodgers, contained in their debt bill, will actually increase the budget shortfall. The Congressional Budget Office estimates that rescinding IRS funding will increase deficits by about $120 billion over the next decade. To be clear, this isn’t just a tax cut, it’s allowing rich people and big businesses to get away without paying the taxes they legally owe under current tax rules.

None of these tax cut proposals would be a good use of public funds at any moment, but to propose costly tax giveaways to the rich all while demanding cuts for children, retirees, and veterans is disgraceful. If this is what the House GOP’s new top tax writer had in mind when he promised to make the tax code work for the working class, then it seems he had a very strange definition of “working class.” If Republicans are remotely serious about lowering the debt, then they should increase taxes on the rich and corporations, not shower them with more handouts.