Taxes save lives. Babies’ lives to be precise.

A compelling new examination over multiple years and multiple states found that infants are more likely to survive to age one in states that raise more revenue and raise it from those most able to pay. Generating taxes from rich people and corporations can help babies make it to their first birthday.

Publishing in the Journal of the American Medical Association (JAMA), authors Jean A. Junior, Lois Lee, and Eric Fleegler found that every $1,000 increase in tax revenue per capita was associated with a 2.6 percent decrease in infant mortality. They also found that each 0.10 increase in tax progressivity – the degree to which taxes were higher on higher levels of income – was associated with a 4.6 percent reduction in infant mortality.

The authors use ITEP data from our Who Pays? report, noting that it is “the only source of state-level effective tax rates combining personal income, property, and sales taxes.” They assess progressivity using the Suits Index, a widely used approach.

More progressive taxes slightly reduce inequality on their own (by raising more from those who have more) and generate revenue that can be spent on basics that help children and families. The authors name targeted refundable tax credits, health care spending, home visiting, and food aid as spending priorities proven to reduce poverty and help babies thrive. They also cite reforms outside of fiscal policy, like higher minimum wages and paid leave requirements, that can improve babies’ health and lives.

Infants in the United States are less likely to survive than babies in any other wealthy nation. In 2019, for every 1,000 live births in the U.S., 5.7 babies died before their first birthday, compared to 1.9 in Japan, 2.1 in Sweden, and 3.2 in Germany. And, as with so many tragic, preventable American failings, the numbers are bad for babies of all races and even worse for Black babies, who are more than twice as likely to die before age one than white, Asian-American, or Hispanic babies of any race.

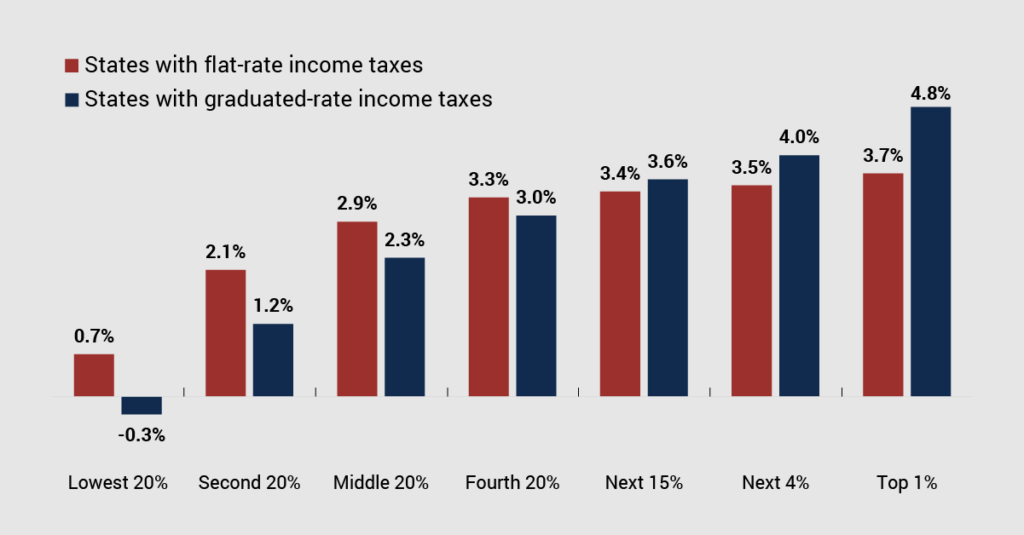

The study examined the data in every state for every year that ITEP has produced its Who Pays? report. This added up to 300 state-years (50 states and six different years). Tax policy was regressive in almost all these state-years.

The authors argue that meaningful reductions in infant mortality require both more revenue and increased tax progressivity, and that doing one without doing the other will be insufficient. Fortunately ITEP has an extensive toolkit describing how to raise more state tax revenue, raise more of it from wealthy people, raise more of it from businesses, and do so in a way that improves the economy.

Policy matters. We know this intuitively. This simple, elegant study connects the dots in an understated way. The authors conclude that taxes are an “important, modifiable social determinant of health that deserves greater attention from researchers, advocates, and policymakers.” Understated, but also mind-boggling and heart-tugging if you stop to think about it.

This is a tough country with sharp divisions on too many things. But regardless of where we are on the political spectrum, it seems the bare minimum to say everyone wants babies to make it to toddlerhood. Jean Junior and her coauthors have given us a rare roadmap that we should all agree on. If we want to see more first birthday parties, we should raise more revenue and we should do it from those most able to pay.

Update May 3, 2023: This post has been edited to remove an erroneous claim that infant mortality for non-Hispanic Black babies declined when more revenue was raised.