As Tax Day approaches, it’s worth thinking about not only the taxes that we individually pay but the overall condition of our tax code as well. State tax codes, while perhaps less discussed than the federal system, are critically important. Depending on how they are designed, state taxes can improve or worsen economic and racial inequities; make states better or worse places to live, work, and play; and lead to robust or scant public services like education, health care, and environmental protection. Here are eight things to know about state taxes.

1) State and local tax systems are regressive

The vast majority of state tax systems are regressive, meaning lower-income people are taxed at higher rates than top-earning taxpayers. Further, those in the highest-income quintile pay a smaller share of all state and local taxes than their share of all income while the bottom 80 percent pay more. In other words, the rich pay a lower effective state and local tax rate than lower-income people and, as a result, collectively contribute a smaller share of state and local taxes than their share of all income. This is because of policymaker choices: different choices can raise more revenue and do so from those most able to pay.

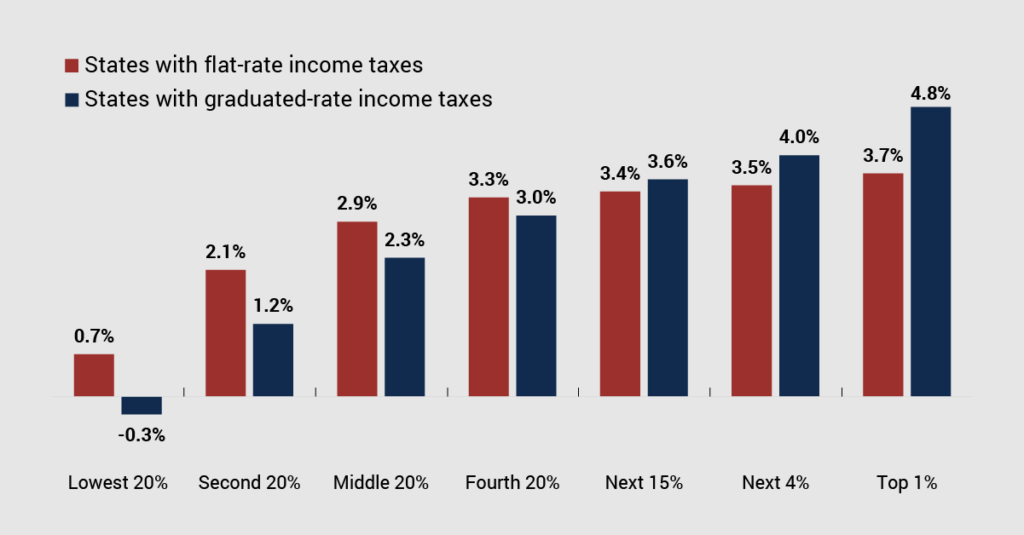

2) Flat income taxes lead to higher taxes on families with modest incomes

Some states have recently become enamored with the idea of flat taxes, but these taxes come with significant drawbacks compared to graduated rates. A flat income tax guarantees that wealthy families’ total state and local tax bill will be a lower share of their income than that paid by families of more modest means. These taxes also tend to produce less revenue than graduated taxes during times of rising inequality. And for most families, there is nothing inherently “low tax” about flat taxes. In fact, flat taxes often actually result in higher income tax bills than graduated rate taxes.

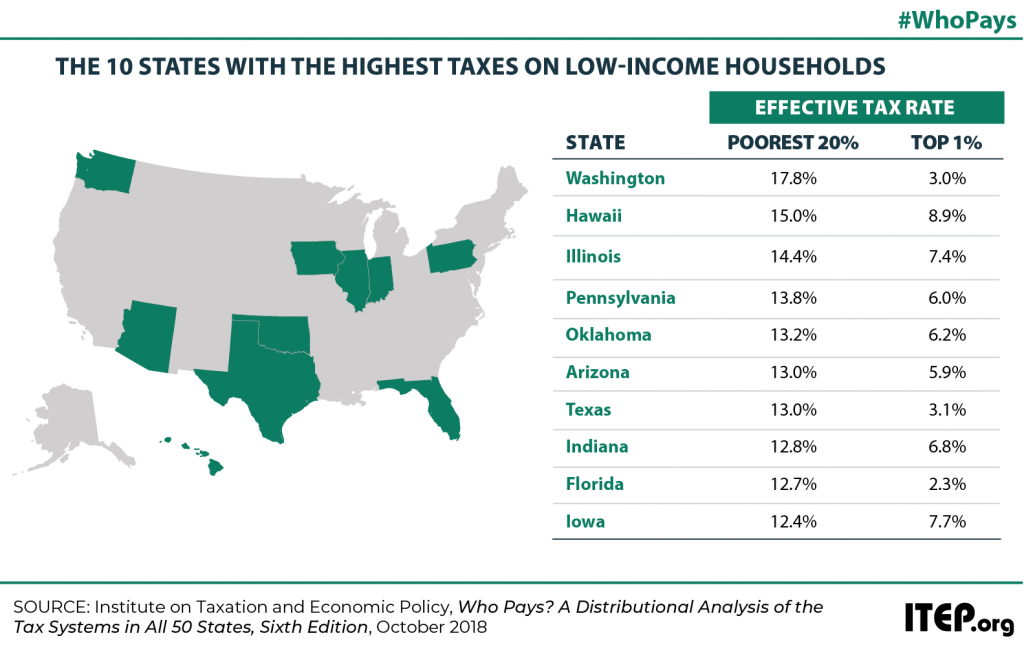

3) States without income taxes are especially regressive

It is a common misconception that states without personal income taxes are “low tax.” In reality, to compensate for lack of income tax revenues these states often rely more heavily on sales and excise taxes that disproportionately impact lower-income families. As a result, while the nine states without broad-based personal income taxes are universally “low tax” for households earning large incomes, these states tend to be higher tax for the poor. (Note: The nine states without broad-based personal income taxes are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.)

4) Income taxes on wealthy families improve economic and racial equity

On the other hand, taxes on top earners are a powerful tool for building economic equity. They are also a powerful tool for advancing racial equity both because an outsized share of top earners’ income flows to white families - and because taxing those most able to pay can raise substantial revenue with which to fund public investments that directly combat inequality. That's why almost all states have an income tax and the vast majority of those income taxes have graduated structures, where rates are higher for higher levels of earnings.

5) Subsidies for corporations and private businesses exacerbate racial inequities

Many state and local governments offer extravagant business tax subsidies and loopholes under the guise of luring a business to, or keeping a business in, their states or localities. These carveouts are a huge drain on revenues, which leaves individuals and families picking up the slack and which makes it harder for governments to provide the public goods – like quality schools, efficient infrastructure, and safe communities – that businesses and families alike both need and want. And they also exacerbate racial inequities -- and economic inequities – since the overwhelming majority of corporate shareholders and private business owners are wealthy and white.

6) At the state level, sales and excise taxes are the biggest part of most families’ tax bills

On Tax Day, all eyes are understandably on the income tax. But when it comes to state and local tax codes, most families ultimately pay more tax on the things they buy—through broad sales taxes and selective excise taxes—than on the income they earn. These taxes tend to be less noticed, as they’re made in tiny increments across numerous purchases throughout each year. But they have a big impact on tax fairness and are the primary reason that low- and moderate-income families tend to face higher overall tax rates than the rich at the state and local levels.

7) Child poverty is a policy choice and tax policy can help alleviate it

There is increasing momentum in the states toward adopting and expanding Child Tax Credits (CTCs). Ten states currently have some form of a CTC and many others are considering one. These credits are especially effective tools to reduce the number of kids and families facing economic hardship. Seven states could cut their child poverty rates in half with a base state Child Tax Credit of less than $3,000, while the majority of states would require a base credit between $3,000 and $4,500 per child (with a 20 percent benefit boost for young children) to do so.

8) State Earned Income Tax Credits help low-paid workers and improve state tax codes

Nearly two-thirds of states have an Earned Income Tax Credit (EITC), which helps working families afford childcare, health care, housing, food and other necessities while improving the equity of upside-down state and local tax systems. The EITC benefits low-income people of all races and ethnicities and is particularly beneficial in historically excluded Black and Hispanic communities, where discrimination in the labor market, inequitable educational systems, and countless other inequities have relegated a disproportionate share of people to low-paid jobs.