EXECUTIVE SUMMARY

• Alaska faces a budget gap exceeding $4 billion, due largely to the state’s heavy reliance on declining oil tax and royalty revenues. Lawmakers recently enacted large cuts to the state’s budget and are now exploring a variety of revenue-raising measures to help the state regain its fiscal footing.

• Gov. Bill Walker has proposed an ambitious package of reforms in his “New Sustainable Alaska Plan.” Among the proposed changes are scaling back the Permanent Fund dividend distributed to Alaskans each year, reinstating a personal income tax for the first time in 35 years, and increasing existing taxes on various items and industries.

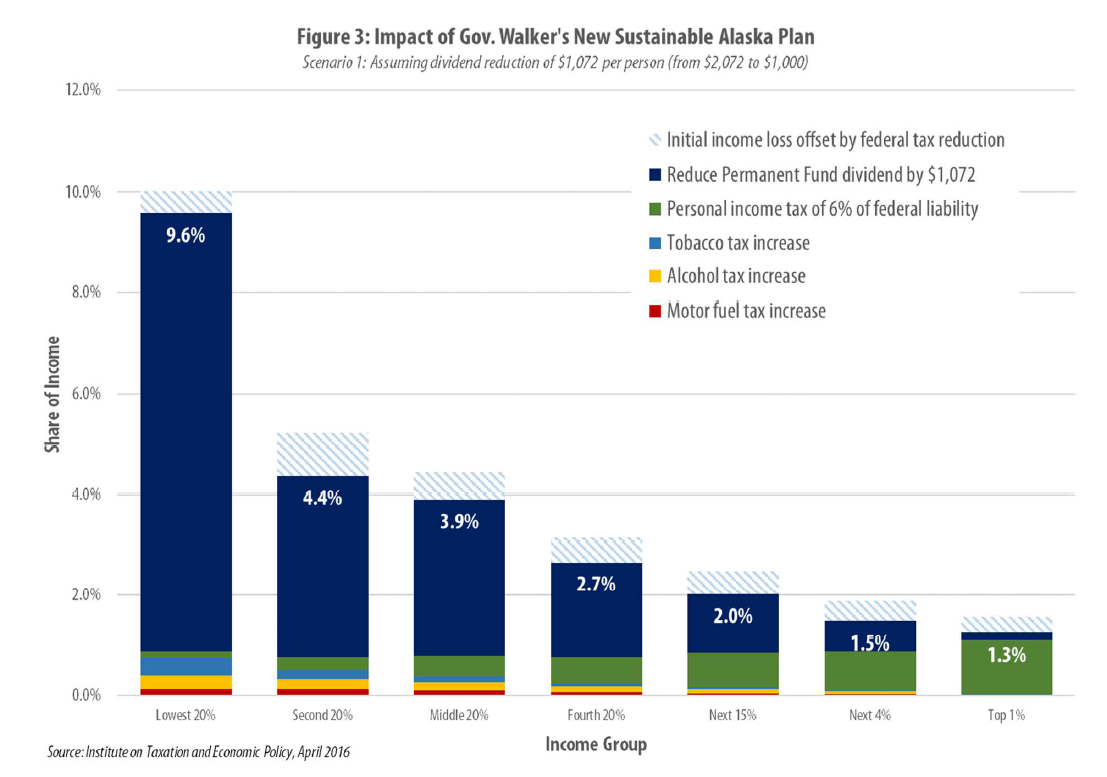

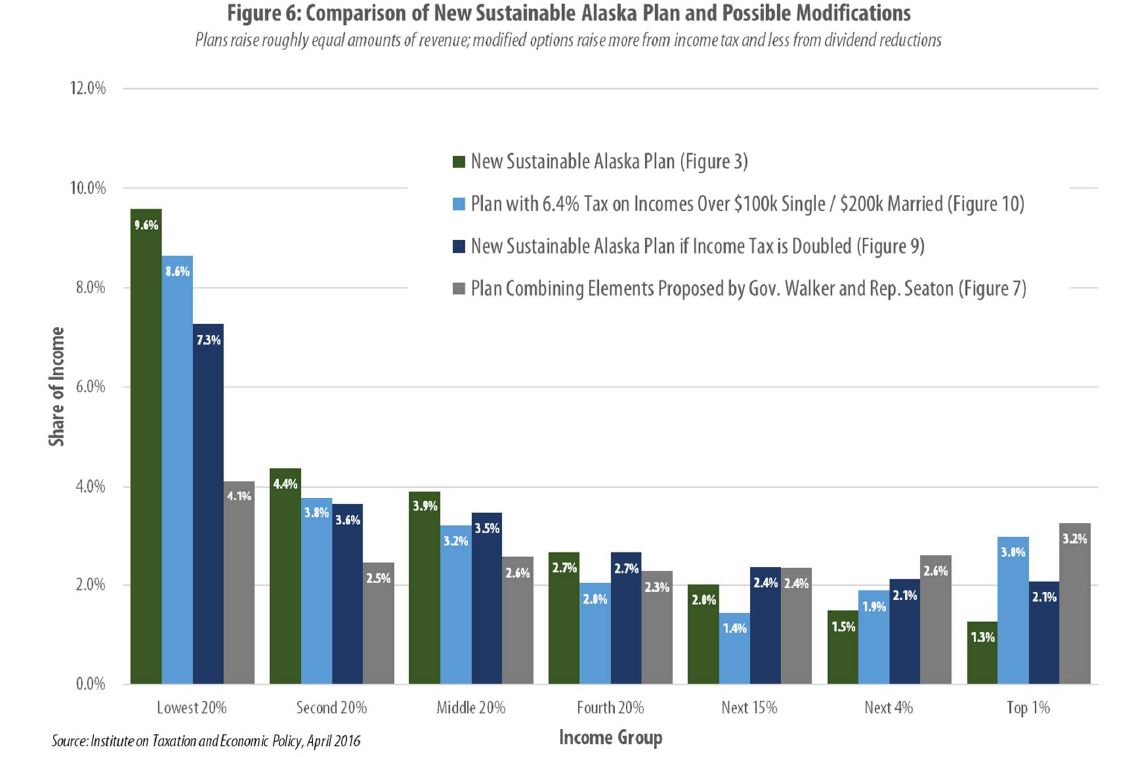

• While each component of the New Sustainable Alaska Plan would have varying implications for Alaskans at different income levels, the overall package would disproportionately impact low-income families and would ask relatively little of high-income Alaskans. If the plan had been in effect in 2015, ITEP estimates that the poorest 20 percent of Alaska households would have seen their incomes decline by 9.6 percent. Middle-income families, by contrast, would have seen their incomes decline by 3.9 percent while the top 20 percent of Alaska households would have seen an average decline ranging from 1.3 to 2.0 percent.

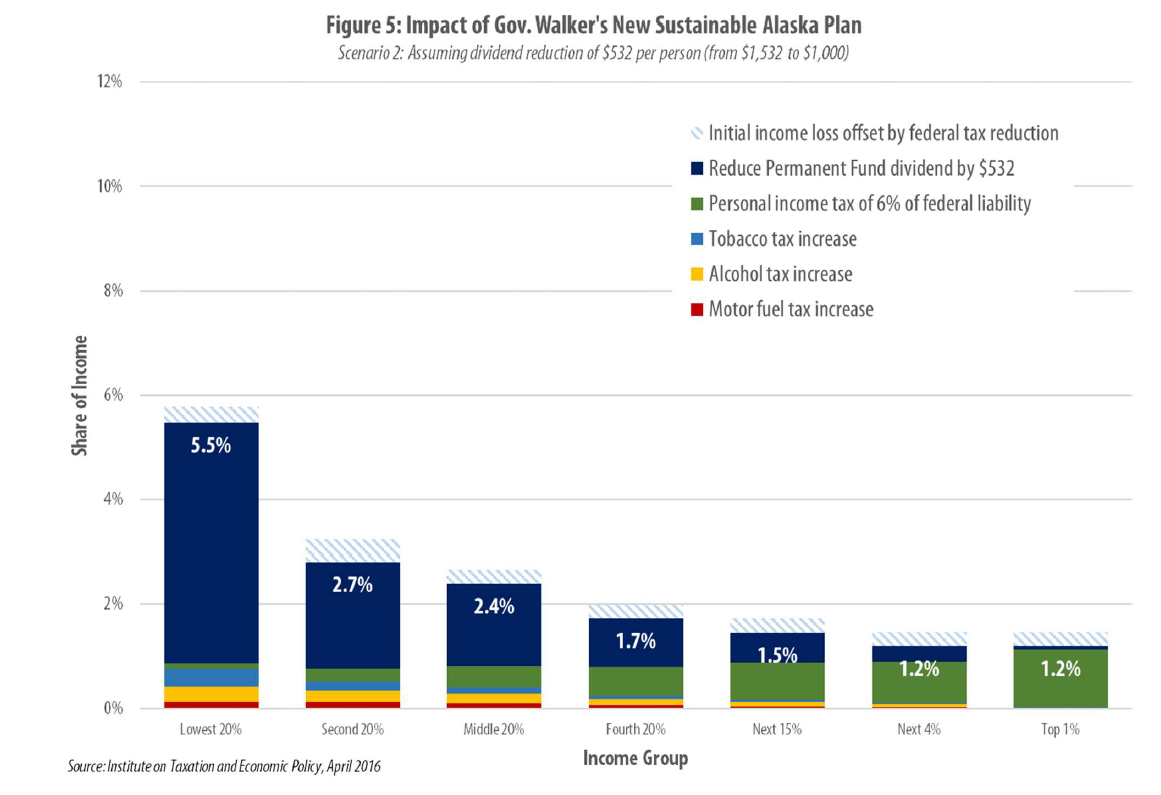

• It is not possible to reliably forecast Alaska’s Permanent Fund dividends, or the precise impact that the governor’s plan would have on those dividends, in the years ahead. If the dividend reduction brought about by the plan is smaller than 2015 data suggest, the impact on Alaskans could decline substantially, though the overall regressivity of the plan would remain intact. Under one such scenario examined in this report, low-income Alaskans could anticipate a decline in their incomes of 5.5 percent while middle-income families would face a 2.4 percent decline and high-income families would face declines ranging from 1.2 to 1.5 percent.

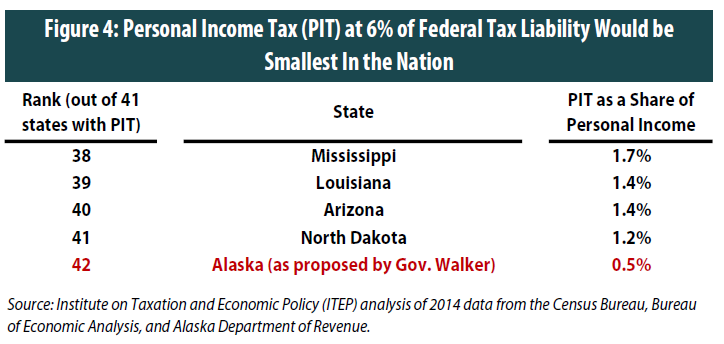

• At its core, the New Sustainable Alaska Plan is regressive because its single largest component is a reduction in the Permanent Fund dividend—a flat dollar payment that most Alaskans receive each year but that, relatively speaking, is a far more important source of income for those families of limited means. At the same time, the progressive personal income tax that Gov. Walker has described as being designed to “offset” this regressivity is extremely modest. If that tax were to take effect, Alaska would have by far the smallest state income tax in the nation—equal to just 0.5 percent of total state personal income. A tax of this size is not capable of counterbalancing the regressive nature of sizeable reductions to the dividend.

• The distributional impact of the New Sustainable Alaska Plan could be significantly improved if it were rebalanced to derive more of its revenue from the personal income tax and less from reductions in the dividend. This report illustrates that point with three alternative personal income tax structures. The first, introduced by Rep. Paul Seaton in 2015, would implement a tax equal to 15 percent of federal liability plus an additional surcharge of 10 percent of long-term capital gains income. The second would simply double the governor’s proposed income tax from 6 percent to 12 percent of federal tax liability. And the third would be levied at a flat rate of 6.4 percent on the portion of income above $100,000 for single taxpayers and above $200,000 for married couples. Any of these options would, at a minimum, reduce the regressivity of the governor’s proposal. In the case of Rep. Seaton’s plan, implementing an income tax of this size and scaling back the governor’s proposed reduction to the dividend would actually result in a roughly proportional impact throughout most of the income distribution.

INTRODUCTION

Alaskans are faced with a stark fiscal reality. Following the discovery of oil in the 1960s and 1970s, state lawmakers repealed their personal income tax and began funding government primarily through oil tax and royalty revenues. For decades, oil revenues filled roughly 90 percent of the state’s general fund. [1]

For years, this allowed Alaska to provide education, infrastructure, and other public services to its citizens at a relatively low direct cost to most taxpayers. More recently, however, declining oil production and the plummeting price of oil have impacted the state’s undiversified revenue structure in a major way. Today the state faces a budget gap exceeding $4 billion and revenues are expected to cover just 25 percent of the state’s costs, despite major cuts in spending enacted last year. [2]

Now lawmakers must decide whether to further cut spending, draw down the state’s reserves, reduce the Permanent Fund dividend, or enact revenue-raising measures to narrow the state’s budget gap. Given the magnitude of the problem, it is unlikely that any one of these options, taken on its own, will be enough to remedy the state’s fiscal situation in the long-run.

Instead, a comprehensive plan will require a combination of policy changes, likely including reforms to the state’s tax structure as well as its system of distributing Permanent Fund dividends. Before undertaking those types of reforms, however, lawmakers should carefully consider the potentially disparate impacts that various tax and dividend changes can have on Alaskans of different income levels. While two potential policy changes may appear similar in terms of their aggregate revenue impact, the reality is that those two options could have very different implications for low- versus middle- versus high-income Alaskans. This report attempts to contribute to a better understanding of these issues by analyzing key components of the revenue options in Gov. Walker’s New Sustainable Alaska Plan, as well as potential modifications to that plan that could improve its distributional impact.

REVENUES IN THE NEW SUSTAINABLE ALASKA PLAN

Gov. Walker and his administration have put forth the ambitious “New Sustainable Alaska Plan” to deal with the state’s fiscal challenges. In addition to cutting state spending, the plan would raise a significant amount of revenue by levying a personal income tax for the first time in 35 years, raising taxes on various products and industries, and reducing and reworking the way in which the Alaska Permanent Fund dividend is structured. Specifically, the plan would:

• Restructure and reduce the Permanent Fund dividend to roughly $1,000 per person (compared to $2,072 in 2015);

• Implement a personal income tax levied at 6 percent of federal tax liability;

• Scale back tax credits for oil and gas companies;

• Increase motor fuel taxes by 8 cents per gallon for highway fuels, 6.8 cents for jet fuel, 5.3 cents for other aviation fuel, and 5 cents for marine fuel;

• Increase taxes on alcoholic beverages by doubling the current per gallon rates for liquor ($12.80 to $25.60), wine ($2.50 to $5.00), and beer, malt beverages and cider ($1.07 to $2.14);

• Increase taxes on cigarettes by $1 per pack and other tobacco products by 25 percent of the wholesale price;

• Increase taxes on the fisheries industry by 1 percentage point;

• Increase the commercial vessel passenger excise tax; and

• Increase the top bracket of the mining license tax by 2 percentage points.

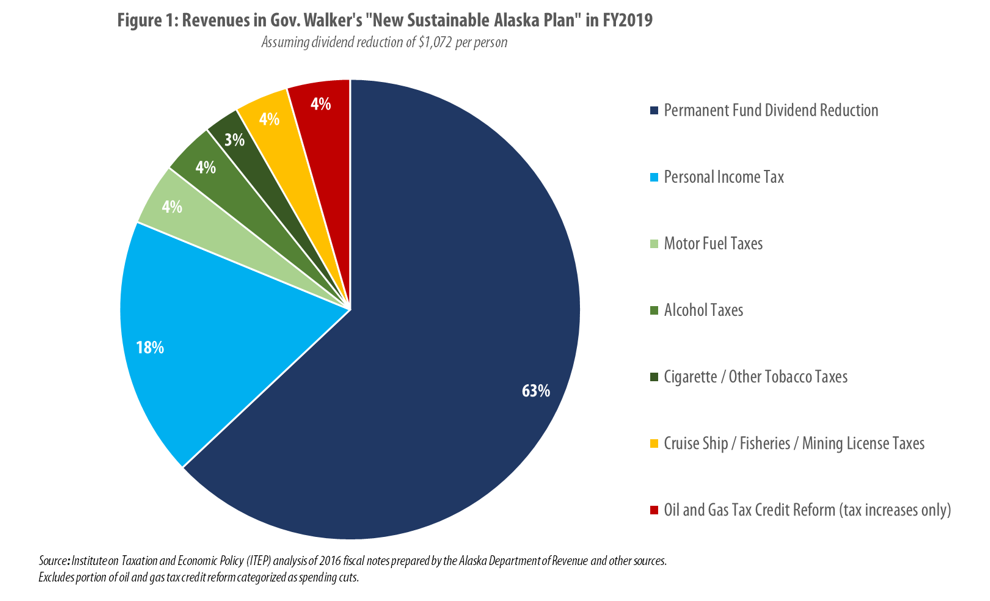

Figure 1 shows the relative importance of the revenue measures listed above in Fiscal Year 2019, under the assumption that the dividend would be reduced by $1,072 per person. [3] The dividend reduction is the largest component of the governor’s proposed new revenues, but the complicated nature of the restructuring also makes it among the most difficult to forecast. [4] A reduction of $1,072 per person is based on the 2015 dividend value of $2,072 and the administration’s explanation that “the proposal sets a 2016 transitional dividend at $1000; but dividends are expected to remain in the $1000 range going forward based on current estimates of future royalty revenues.” [5] Under this assumption, the governor’s plan raises a total of over $1.13 billion in new revenues per year with nearly two-thirds of that, or $700 million, coming from the reduction in the dividend.

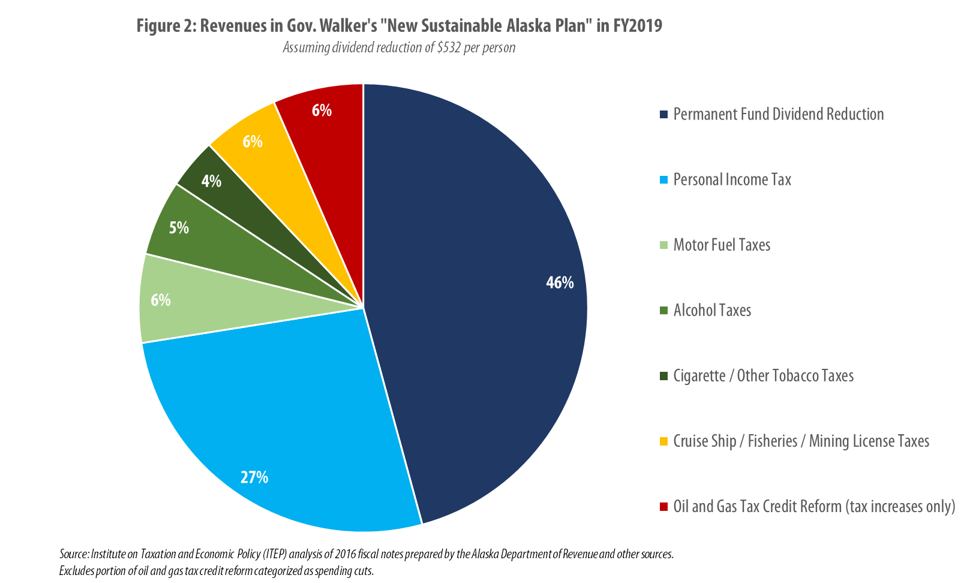

It is unclear, however, whether future dividends would continue to be paid out at the relatively high level of $2,072 per person in the absence of the governor’s proposed reforms. Over the last ten years, dividends have averaged $1,532 per person after adjusting for inflation. If that average holds in the years ahead, then a reduction in the dividend to $1,000 would be roughly half that just described—$532 rather than $1,072 per person. Figure 2 shows how the relative makeup of the governor’s proposed revenues would change under this assumption. Specifically, if the divided reduction to $1,000 per person is calculated against a baseline dividend of $1,532, the revenue raised via the dividend reduction falls from $700 million to $350 million, and from 63 percent to 46 percent of the total package. The overall revenue potential of the package falls as well, from $1.13 billion to $770 million.

Assumptions about the dividend’s size in the years ahead are important in gauging where the New Sustainable Alaska Plan would derive its revenues. But under most reasonable assumptions, it is clear that the dividend reduction would remain the largest revenue component in the package, followed next by the reinstatement of the state’s personal income tax. In order for the dividend reduction to lose its place as the largest revenue source in the package, the annual reduction per person would have to fall below roughly $310 (in 2015, for example, this would have meant reducing the dividend from $2,072 to $1,762). [6]

DISTRIBUTIONAL BREAKDOWN OF THE NEW SUSTAINABLE ALASKA PLAN

In order to fully understand the impact of the revenue options contained in the New Sustainable Alaska Plan, it is important to examine the effects that the plan would have on Alaska residents at different income levels. To accomplish this task ITEP used its microsimulation tax model (described in Appendix E) to analyze most of the tax and dividend changes described in the previous section. Analyses of the mining license tax, fisheries industry taxes, commercial vessels tax, and oil and gas tax credits were not included due either to data limitations or, in the case of the commercial vessels tax, the limited direct impact that this tax would have on Alaska residents. Nonetheless, as is suggested in Figures 1 and 2, the following analyses include roughly 90 percent of the revenues contained in the New Sustainable Alaska Plan.

New Sustainable Alaska Plan, Scenario 1: Assuming a reduction of $1,072 per person in the Permanent Fund dividend

Figure 3 shows that the New Sustainable Alaska Plan, if implemented in 2015, would have a sharply regressive impact overall. In other words, low- and middle-income Alaskans would face a much steeper drop in their incomes than high-income Alaskans. Specifically, the poorest 20 percent of Alaska households would see their after-tax incomes fall by 9.6 percent. Middle-income families, by contrast, would face a decline of 3.9 percent and the wealthiest 20 percent of Alaska households would see declines averaging between 1.3 and 2.0 percent of their incomes. All of these are net of the “federal offset” effect, meaning that they include the federal tax cuts that most Alaska households could expect to receive if their Permanent Fund dividends are reduced, and/or if they begin to deduct Alaska personal income tax payments on their federal tax returns. [7]

This sharply regressive impact is a result of three primary factors: the large magnitude of the reduction to the Permanent Fund dividend, the increases in excise taxes on tobacco, alcohol and motor fuel, and the modest nature of the proposed personal income tax.

As explained above, the single largest component of the New Sustainable Alaska Plan is a reduction in the Permanent Fund dividend. If the plan had been in effect in 2015, the dividend would have been reduced by $1,072 per person (from $2,072 to $1,000). While all eligible Alaskans receive the same flat dollar amount from the dividend, the income that dividend represents is far more important, relatively speaking, for families of limited means. [8]

To its credit, the Walker Administration has acknowledged the potential fairness problems associated with reducing the dividend and has stated that a personal income tax was included in the New Sustainable Alaska Plan in part because “its progressive nature was seen as a way to help offset any regressive effects a potential reduced dividend payout might bring.” [9] Unfortunately, offsetting the regressivity of a dividend reduction of this size is a daunting task that the governor’s modest personal income tax proposal cannot accomplish.

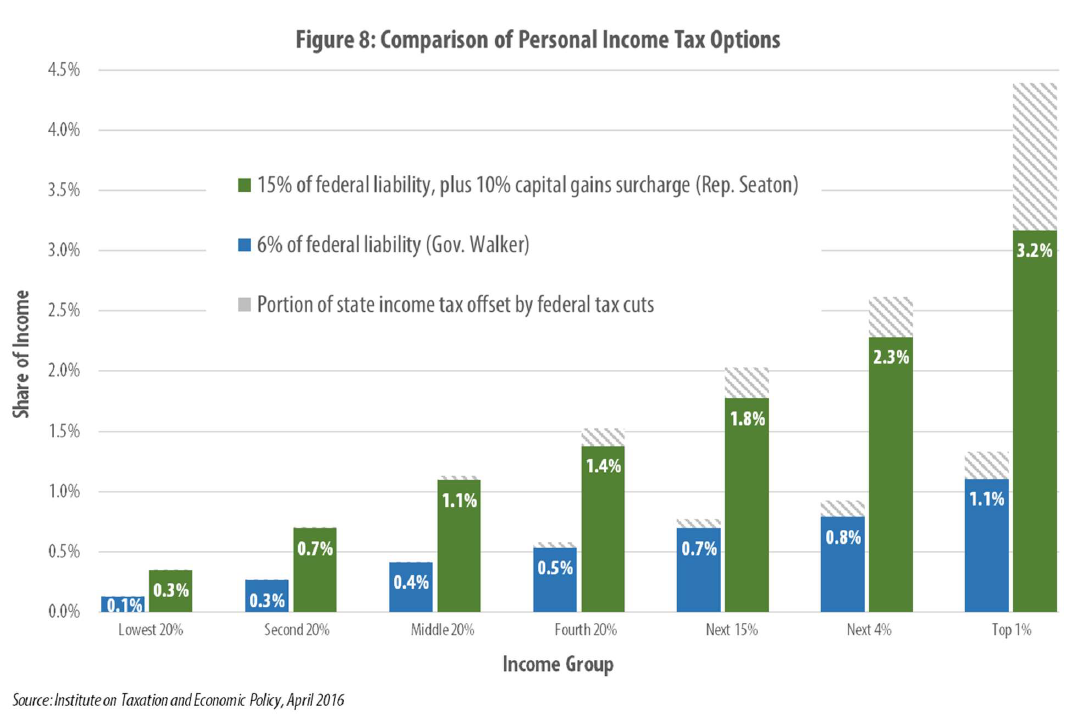

Levying a state income tax equal to 6 percent of federal tax liability would offer Alaska a relatively progressive, and administratively simple, source of revenue. As detailed in Appendix C, such a tax would amount to roughly 1.3 percent of income for high-income families, compared to of just 0.1 to 0.4 percent for low- and middle-income families. [10] But when viewed alongside a dividend reduction that would reduce low-income families’ incomes by 9 percent or more, the effects of this income tax proposal are extremely modest.

Alaska is one of just nine states that lacks a broad-based personal income tax—the most significant progressive revenue option available to the states. [11] While the governor’s plan would change this fact, it would also leave Alaska with, by far, the smallest personal income tax in the country. A tax equal to 6 percent of federal income tax liability would collect an amount equal to just 0.5 percent of personal income—less than half the amount of the smallest state income tax in existence today, in similarly resource-rich North Dakota. [12]

New Sustainable Alaska Plan, Scenario 2: Assuming a reduction of $532 per person in the Permanent Fund dividend

The above analysis was performed in a 2015 model economy, meaning that Alaska residents were assumed to receive an annual dividend of $2,072 per person. That analysis may not be a reliable representation of reality in the years ahead if current law dividend payouts differ significantly from that $2,072 value. In Figure 5, the New Sustainable Alaska Plan is analyzed against a modified baseline where, absent any policy change, Alaska residents could expect to receive a dividend more typical of what they have received over the last decade: approximately $1,532 per person, after adjusting for inflation.

In this second scenario, capping the dividend at $1,000 per person results in a $532 drop, rather than the full $1,072 drop explored in the previous analysis. Even with this more modest dividend reduction, however, the overall package remains regressive. Figure 5 demonstrates that while low-income families would face a 5.5 percent decline in their incomes, middle-income families would face a decline of less than half that amount—or 2.4 percent—while high-income families would face declines ranging from 1.2 to 1.5 percent.

DISTRIBUTIONAL BREAKDOWN OF POSSIBLE MODIFICATIONS TO THE NEW SUSTAINABLE ALASKA PLAN

The New Sustainable Alaska Plan includes a bold package of revenue measures, but the plan has a starkly uneven impact on Alaska households at different income levels. Specifically, the plan asks far more of low- and middle-income families than it does from wealthier families that are better able to absorb a reduction in their incomes.

One way to remedy this shortcoming would be to rebalance the plan so that it generates more of its revenue through progressive personal income taxes, and less of its revenue from regressive cuts to the Permanent Fund dividend. This type of restructuring could pave the way for a fiscal solution that better serves Alaskans of all income levels.

The following discussion outlines three possible approaches along these lines while remaining within the broad framework laid out in the New Sustainable Alaska Plan. By raising, and in some cases restructuring, the income tax contained within the plan, all three options raise roughly the same overall level of revenue as the New Sustainable Alaska Plan while requiring smaller cuts to the Permanent Fund dividend (the dividend would be capped at levels ranging from $1,100 to $1,700 depending on the specific option examined). All three plans also retain the same tobacco, alcohol, and motor fuel tax increases contained in the governor’s plan.

Figure 6 provides a side-by-side comparison of the New Sustainable Alaska Plan and each of the three modified options described in the following sections.

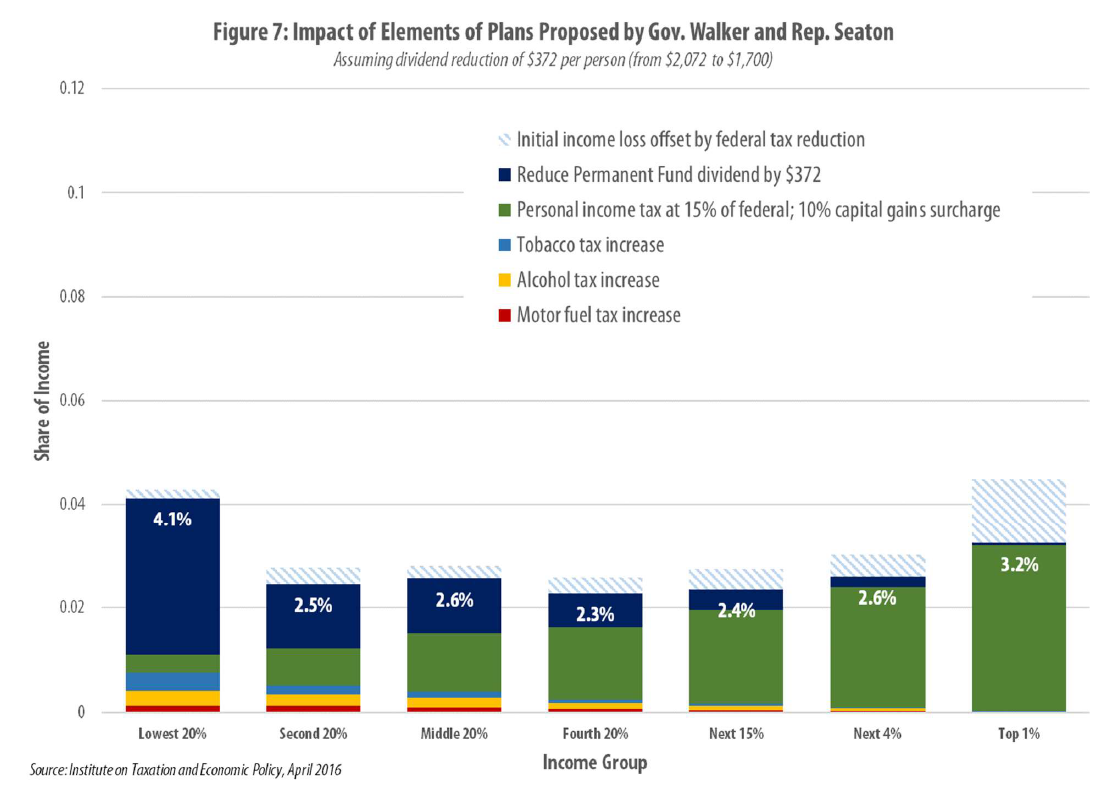

Option 1: Replace Personal Income Tax with Proposal Introduced by Rep. Seaton and Cap Dividend at $1,700 (reduction of $372 in 2015)

In 2015, state Rep. Paul Seaton introduced House Bill 182, which would establish an income tax equal to 15 percent of federal tax liability and would levy an additional 10 percent tax on long-term capital gains income. The portion of HB182 linked to federal tax liability is essentially the same as Gov. Walker’s income tax proposal, except that its rate is 2.5 times higher.

Coupling Alaska’s income tax to federal tax liability would afford the state a progressive and relatively easily to administer source of revenue. But linking the fate of the state’s income tax so closely to federal tax law also has downsides. Perhaps the most notable problem with this approach is that almost any tax break enacted by Congress would effectively be mimicked by Alaska’s tax structure as well.

One such break is the preferential treatment that the federal government affords to capital gains income—profits from the sale of assets such as stocks, bonds, and real estate. The top federal tax rate for capital gains income is currently set at just 20 percent, or roughly half the top rate applied to ordinary earned income. Since most capital gains income is collected by high-income taxpayers, this preferential treatment of investment income is strikingly regressive and grants wealthy investors favorable treatment not afforded to wage earners and those with other sources of income. Rep. Seaton’s proposal attempts to partially negate this regressive impact by levying a 10 percent tax on capital gains income in addition to its broader 15 percent surcharge on federal tax liability.

Retaining Gov. Walker’s proposed excise tax increases while swapping out his income tax for the one proposed by Rep. Seaton would allow for a much more modest reduction in the Permanent Fund dividend while still generating roughly the same level of revenue overall. Figure 7 analyzes a scenario in which these tax changes were paired with a cap on the dividend of $1,700—meaning that the 2015 dividend would have been reduced by $372 from its 2015 level of $2,072.

Under this scenario, the poorest 20 percent of Alaskans would see their after-tax incomes fall by roughly 4.1 percent. Throughout most of the rest of the income distribution, however, the plan ranges from proportional to progressive in nature. Middle-income families could expect an impact equal to 2.6 percent of their income, while the wealthiest twenty percent of taxpayers would see tax and dividend changes between 2.4 and 3.2 percent of their incomes.

Relative to the New Sustainable Alaska Plan, this package of changes would have a smaller impact across the bottom 80 percent of Alaska families and would only have a larger impact on the top 5 percent of earners. For the remaining 15 percent that earn between $133,000 and $235,000 per year, this movement toward a heavier reliance on income taxes and a lower reliance on dividend reductions would leave their net impact essentially unchanged on average.

This dramatic shift in distribution relative to the New Sustainable Alaska Plan hinges on the additional revenue, and progressivity, offered by Rep. Seaton’s proposed income tax. Figure 7 shows that while most Alaskans would face a larger income tax bill under Rep. Seaton’s proposal, the largest increases would be at the top of the income distribution.

More detail on this package of changes, and on a similar package of changes calculated against the same alternative baseline used in Figure 4, are available in Appendices B and C.

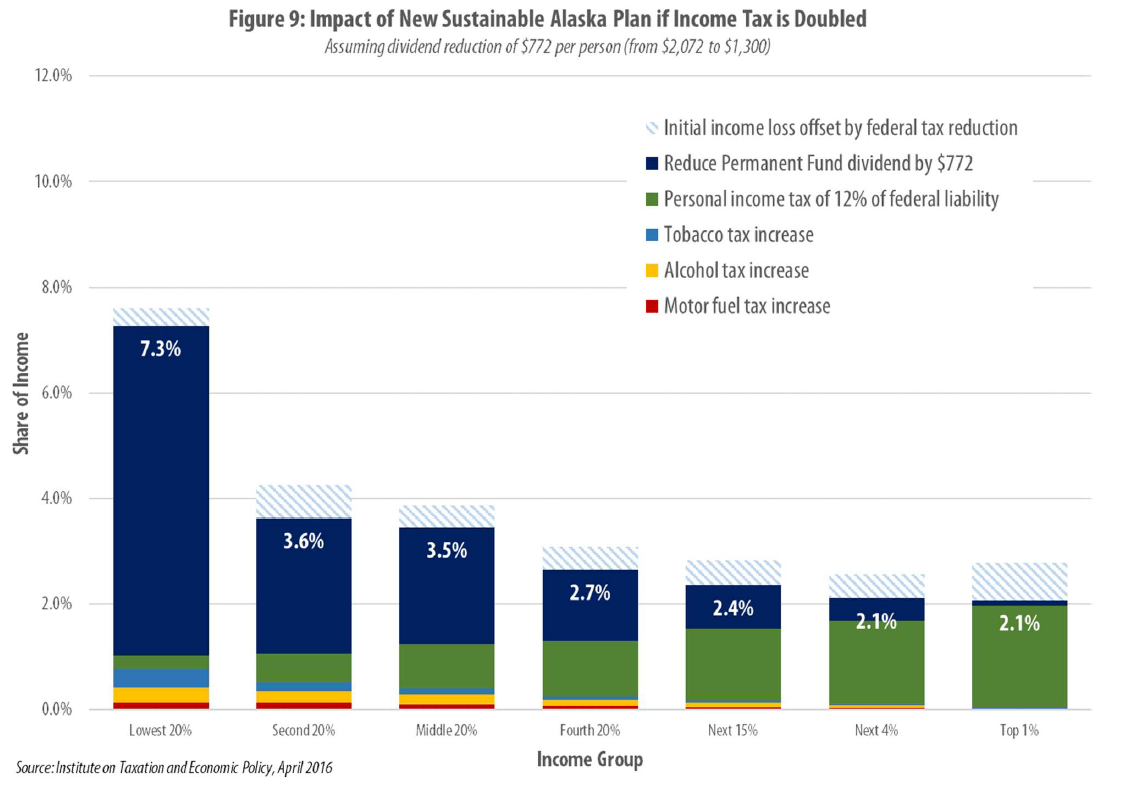

Option 2: Double Gov. Walker’s Personal Income Tax to 12 Percent and Cap Dividend at $1,300 (reduction of $772 in 2015)

Given that much of the regressivity in the New Sustainable Alaska Plan comes from its sparing use of the income tax as a source of revenue, one obvious reform option is to simply increase the tax rate proposed by Gov. Walker and to use the additional revenue to pare back the reduction in the dividend.

Figure 8 examines this type of reform in a situation where the personal income tax rate is doubled to 12 percent of federal liability (instead of 6 percent) and the dividend is capped at $1,300 (instead of $1,000). Under this proposal, Alaska would still have the smallest personal income tax in the nation and the overall distribution of the plan would remain regressive, though somewhat less so than in the original version of the New Sustainable Alaska Plan. Specifically, the poorest 20 percent of Alaskans would see their incomes decline by 7.3 percent (instead of 9.6 percent under the original proposal), while middle-income Alaskans would see a decline of 3.5 percent (instead of 3.9 percent), and the wealthiest 20 percent would face tax increase and dividend reductions ranging from 2.1 to 2.4 percent of their income (as opposed to 1.3 to 2.0 percent).

With this type of restructuring, the bottom 60 percent of Alaska taxpayers would be made better off relative to the New Sustainable Alaska Plan while the top 20 percent would pay slightly more (averaging 0.4 to 0.8 percent of their income). For the fourth quintile, a group earning between $76,000 and $133,000 per year, this movement toward a heavier reliance on income taxes and a lower reliance on dividend reductions would have almost no net impact on average.

More detail on this package of changes, and on a similar package of changes calculated against the same alternative baseline used in Figure 4, are available in Appendices B and C.

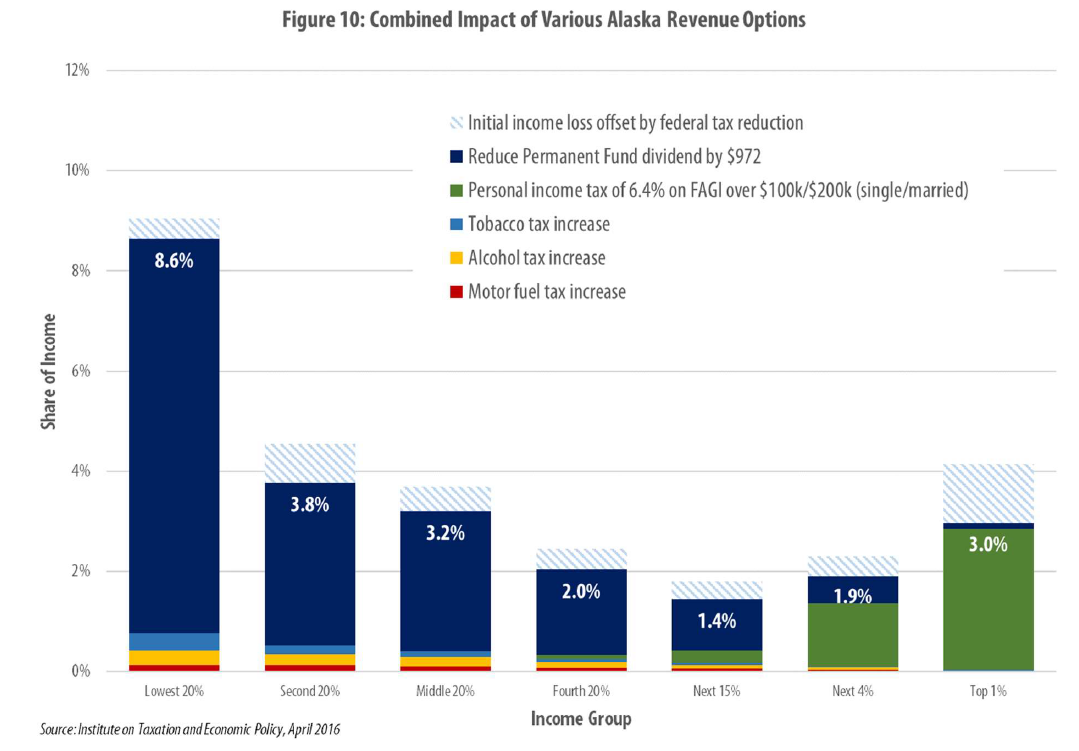

Option 3: Replace Personal Income Tax with a 6.4% Flat Tax on FAGI over $100,000 ($200,000 married) and Cap Dividend at $1,100 (reduction of $972 in 2015)

Rather than coupling Alaska’s income tax to federal tax liability, lawmakers could also consider implementing a state income tax tied to federal adjusted gross income (FAGI). Coupling to FAGI affords some of the same simplicity gains as coupling to federal tax liability, with the added benefit that the state would not be forced to inherit all of the same tax breaks, such as itemized deductions, that are made available at the federal level. This approach involves an additional step, however, in that for such a tax to be progressive, Alaska lawmakers would need to implement exemptions and/or graduated tax brackets that reduce taxes for lower- and middle-income families while raising them for higher-income families.

As a third alternative modification to the New Sustainable Alaska Plan, ITEP explored a scenario in which the state would apply a 6.4 percent tax rate to all FAGI over $100,000 for single childless filers, over $150,000 for heads of household, and over $200,000 for married couples. This 6.4 percent rate is equal to the average state’s top marginal tax rate in 2016. [13] As a result of the large exemptions involved, less than 1 in 10 Alaska households would owe any income tax under this proposal.

This type of income tax would raise slightly more than the Governor’s proposal and would therefore allow for a somewhat scaled back reduction to the dividend (capped at $1,100 instead of $1,000). Under this package of changes, the poorest 20 percent of Alaskans would face a decline in their incomes of 8.6 percent, the middle 20 percent of Alaska families would face a 3.2 percent decline, and the wealthiest 20 percent would face declines ranging from 1.4 and 3.0 percent of their income.

Since only a small fraction of Alaska households would be paying state income taxes under this scenario, the vast majority of Alaska residents would find themselves better off than under the New Sustainable Alaska Plan. In comparing the data presented in Figures 3 and 9, we find that the bottom 95 percent of the income distribution would be better off, while the top 5 percent would pay somewhat more (facing increases of 0.4 to 1.7 percent of their income).

More detail on this package of changes, and on a similar package of changes calculated against the same alternative baseline used in Figure 4, are available in Appendices B and C.

CONCLUSION

Gov. Walker’s New Sustainable Alaska Plan includes a bold package of revenue measures that could significantly improve the state’s fiscal standing. Unfortunately, however, the plan has a starkly uneven impact on Alaska households at different income levels. This is due largely to its heavy reliance on reductions to the Permanent Fund dividend, as well as the fact that the personal income tax designed to offset that regressivity is extremely modest. The distributional impact of the New Sustainable Alaska Plan could be significantly improved if it were rebalanced to derive more of its revenue from the personal income tax and less from reductions in the dividend.

Appendices A through E available here.

[1] Knapp, Gunnar. “Resource Revenues and Fiscal Sustainability,” Economic Development Journal, Spring (2015): Vol. 14, No. 2. http://www.iser.uaa.alaska.edu/Publications/2015-ResourceRevenuesAndFiscalSustainability.pdf

[2] Herz, Nathaniel. “Alaska Budget Deficit Just Jumped $300M Because of Low Oil Prices, Walker Administration Says,” Alaska Dispatch News, March 21, 2016. http://www.adn.com/article/20160321/walker-administration-alaskas-budget-deficit-just-jumped-300-million-because-low State of Alaska, Department of Revenue, Press Release. “Preliminary Spring 2016 Forecast Adjusts Revenue to Reflect Lower Oil Prices,” March 21, 2016, No. 16-002, Juneau, AK. http://dor.alaska.gov/Portals/5/16-002%20Preliminary%20Spring%202016%20Forecast %20Adjusts%20Revenue%20to%20Reflect%20 Lower%20Oil%20Prices.pdf?ver=2016-03-21-090111-370

[3] These revenue figures are based on official fiscal notes prepared by the Alaska Department of Revenue. The plan, as proposed, would initially begin generating revenue in FY17, but the revenue figures presented here are for FY19 because the income tax and oil and gas credit reforms have transitional revenue impacts in the early years that are not representative of their long-term impact.

[4] The single largest infusion of revenue into the state’s general fund would actually come from an annual transfer from the Permanent Fund, but this discussion focuses only on those revenue measures with immediate, direct impacts on Alaska households.

[5] The State of Alaska, Governor Bill Walker. New Sustainable Alaska Plan: Pulling Together to Build Our Future, December 9, 2015. http://gov.alaska.gov/Walker_media/documents/sustainable-alaska/the-new-sustainable-alaska-plan_narrative-overview.pdf

[6] This calculation assumes that there will be 659,895 dividend recipients in FY2019. Reducing the dividend by $310 for each of those recipients would retain $204.6 million in revenue for the state—slightly less than the Alaska Department of Revenue’s $205 million revenue estimate for an income tax equal to six percent of federal tax liability in FY2019.

[7] Further discussion of the federal offset effect is available at: Institute on Taxation and Economic Policy (ITEP). How State Tax Changes Affect Your Federal Taxes: A Primer on the “Federal Offset.” August 1, 2011. https://itep.org/itep_reports/2011/08/how-state-tax-changes-affect-your-federal-taxes-a-primer-on-the-federal-offset.php

[8] Further discussion and analysis of the regressive nature of cuts to the Permanent Fund dividend is available at: Knapp, Gunnar, Mouhcine Guettabi and Matthew Berman. Economic Impacts of Alaska Fiscal Options (Draft Report), University of Alaska Anchorage: Institute of Social and Economic Research, March 11, 2016. http://www.iser.uaa.alaska.edu/Publications/2016_03_30-ShortrunEconomicImpactsOfAlaskaFiscalOptions.pdf (PDF)

[9] The State of Alaska, Governor Bill Walker. The New Sustainable Alaska Plan: Frequently Asked Questions. http://gov.alaska.gov/Walker_media/documents/sustainable-alaska/new-sustainable-alaska-plan-faqs.pdf

[10] Note that these figures actually overstate final tax liability, particularly for high-income families, since many Alaskans would receive federal tax cuts once they begin to deduct state income tax payments on their federal tax returns.

[11] New Hampshire and Tennessee have narrow income taxes on certain types of investment income that are not included in this analysis.

[12] This figure is calculated by comparing state personal income tax revenues (or in Alaska’s case, proposed tax revenues) against the Bureau of Economic Analysis’ (BEA) measure of state personal income. If the calculation was instead based on Federal Adjusted Gross Income as reported by the Internal Revenue Service (IRS), the figure would rise to 0.8 percent. Under either method, Alaska’s proposed income tax would remain the smallest in the nation by far.

[13] ITEP analysis of various sources.

Read the Full Report (PDF)

Read the Full Report (PDF)