House Tax Bill Enlists the Wealthy to Spread Private School Vouchers

briefKey Findings

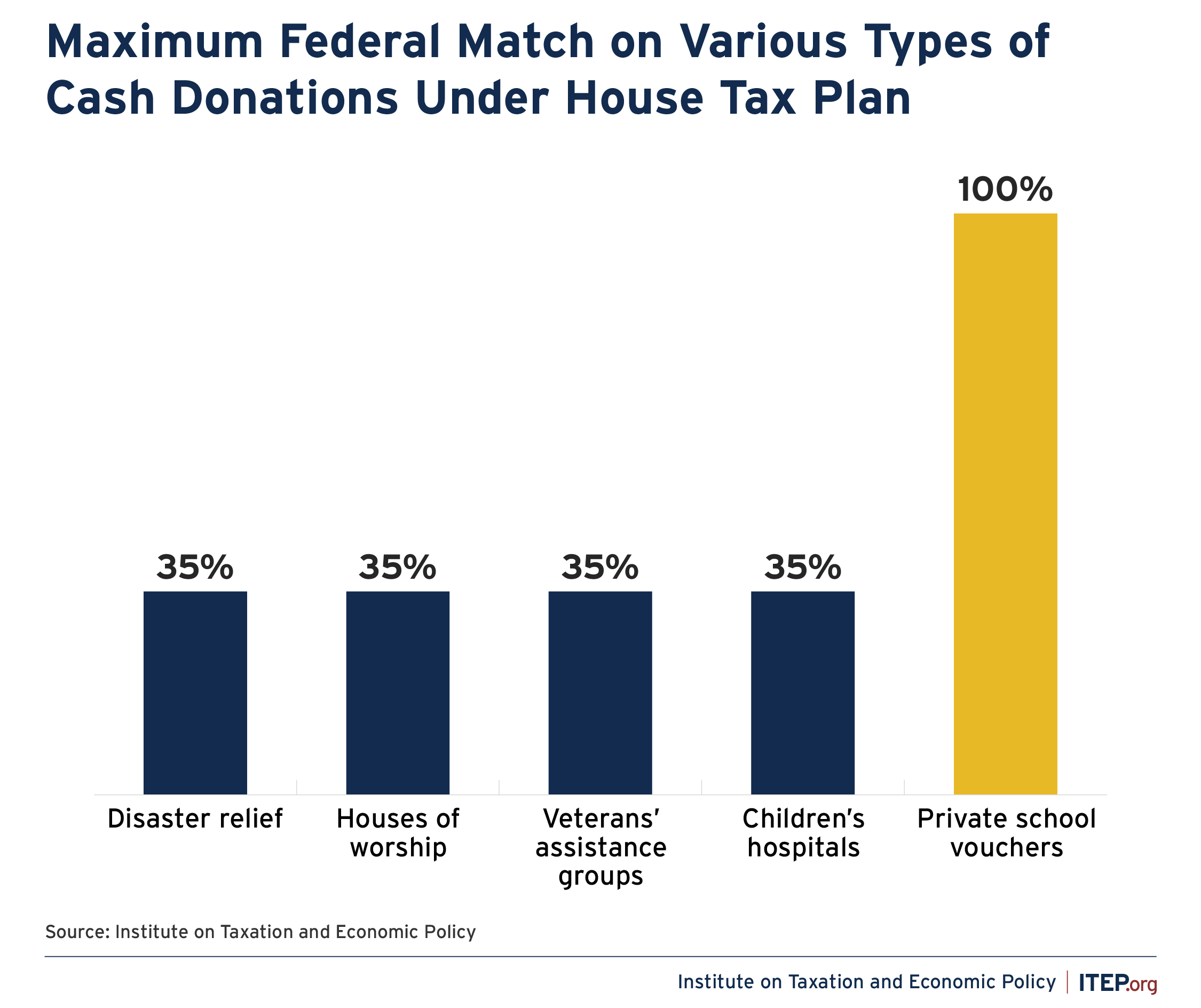

- The House tax plan cuts charitable giving tax incentives for donors to most nonprofit groups while roughly tripling the incentive available to donors to groups that fund private K-12 school vouchers.

- Donors to children’s hospitals, veterans’ assistance groups, and other charities would receive no more than 35 cents in tax savings for each dollar donated, while donors to private K-12 school voucher groups would receive a full reimbursement of their donations, valued at 100 cents on the dollar.

- The bill would also allow private school voucher donors to avoid capital gains tax on their gifts of corporate stock. The effect would be a profitable tax shelter for wealthy people who agree to help funnel public funds into private schools.

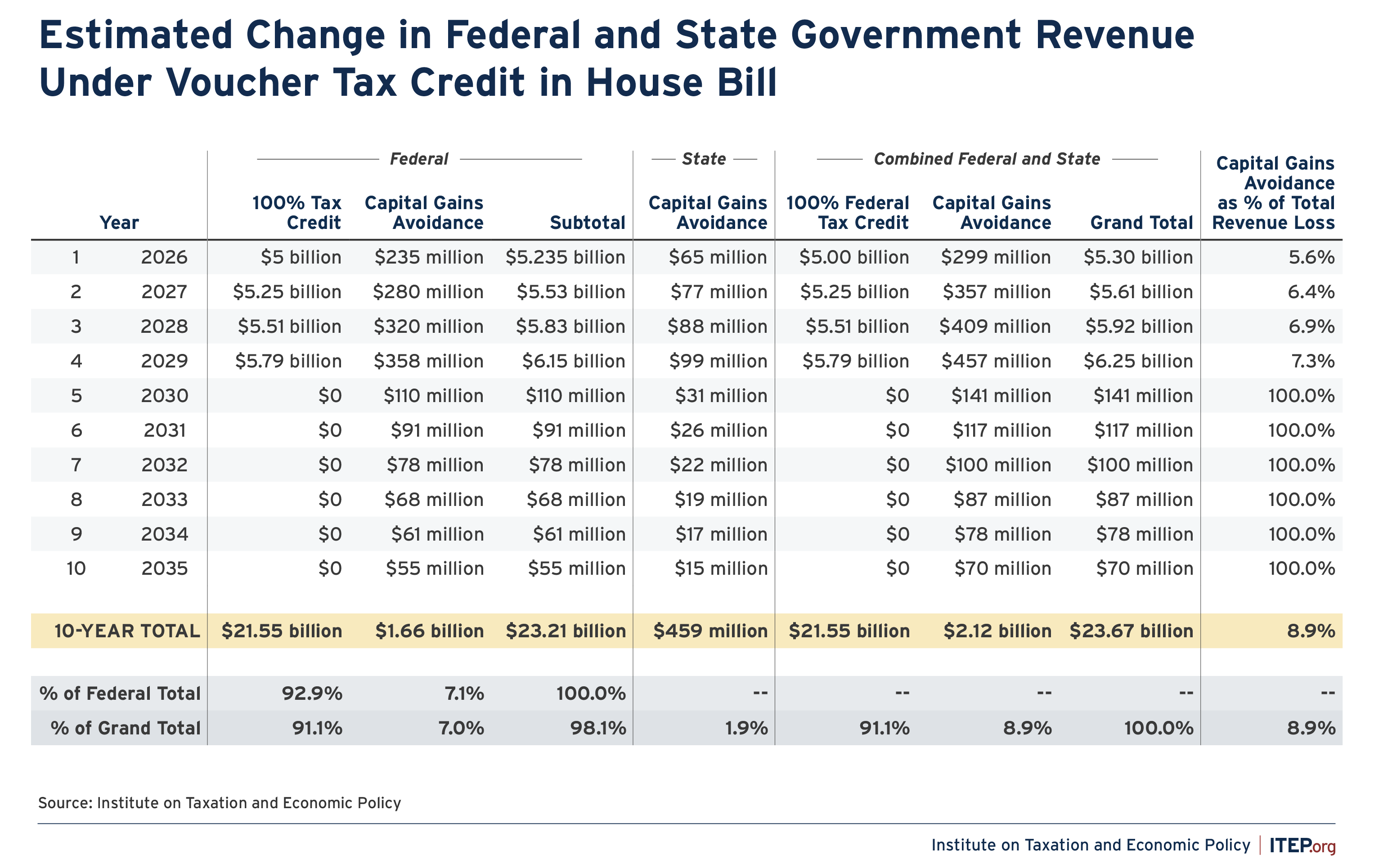

- We estimate the bill would reduce federal tax revenue by $23.2 billion over the next 10 years as currently drafted, or by $67 billion over the next 10 years if it is extended beyond its four-year expiration date.

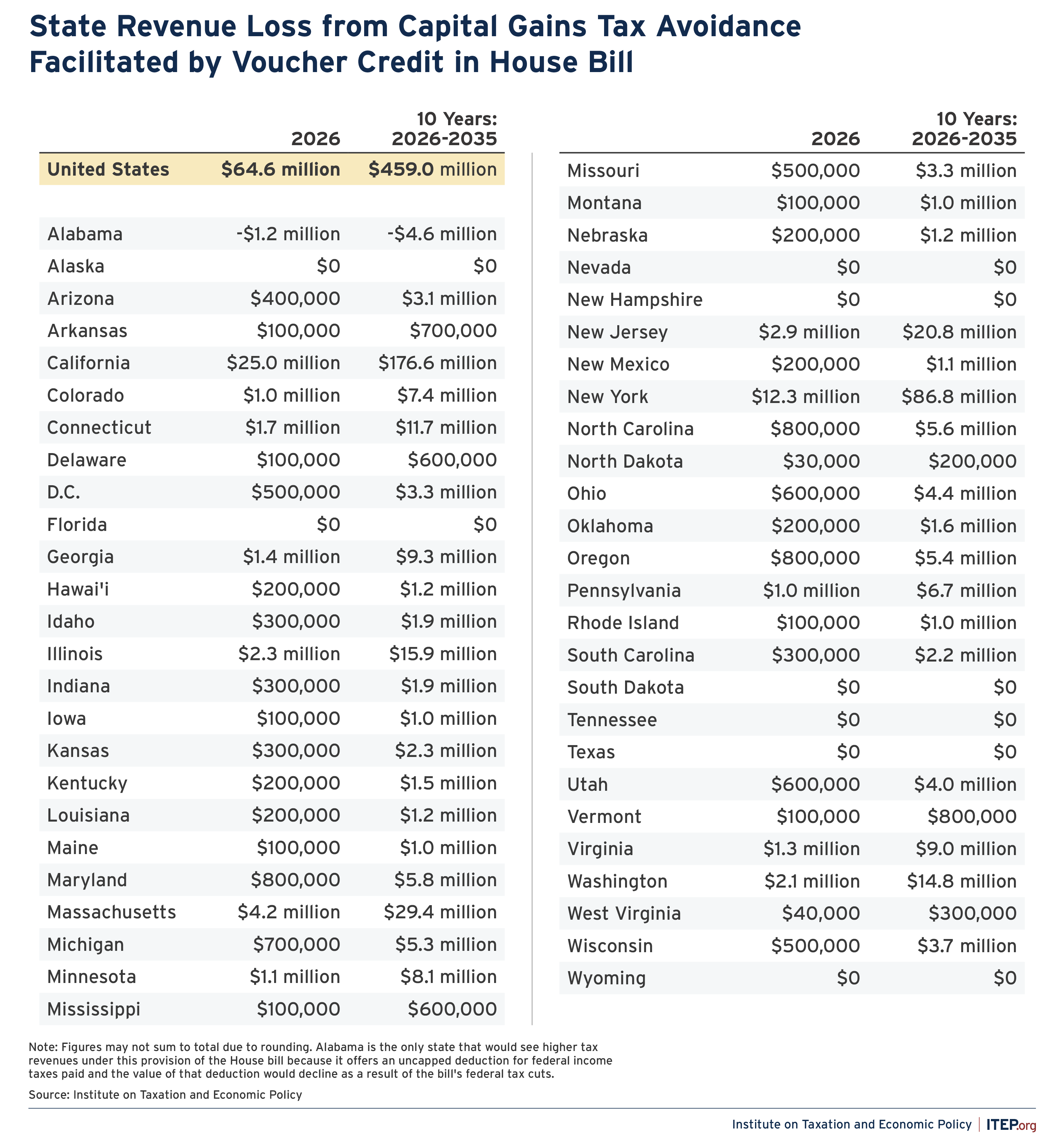

- Because state income taxes largely piggyback on federal law, the bill would also reduce state tax revenue by $459 million over the next 10 years as currently drafted, or by $1.1 billion over the next 10 years if it is extended beyond its four-year expiration date.

- As currently drafted, the bill would facilitate $2.2 billion in federal and state capital gains tax avoidance over the next 10 years. If the bill is extended beyond its four-year expiration date that figure would rise to $5.2 billion.

Overview

The tax plan moving through the U.S. House of Representatives includes a provision granting extraordinarily generous treatment to nonprofits that give out vouchers for free or reduced tuition at private K-12 schools.[1] While the bill significantly cuts charitable giving incentives overall, nonprofits that commit to focusing solely on supporting private K-12 schools would be spared from those cuts and see their donors’ tax incentive almost triple relative to what they receive today. On top of that, the bill goes out of its way to provide school voucher donors who contribute corporate stock with an extra layer of tax subsidy that works as a lucrative tax shelter. Essentially, the bill allows wealthy individuals to avoid paying capital gains tax as a reward for funneling public funds into private schools.

The provision in question is a modified version of the Educational Choice for Children Act, which ITEP analyzed in-depth earlier this year.[2] At its core, the plan relies on paying out 100 percent, dollar-for-dollar tax credits to people who “donate” to private school voucher groups. “Donors” would be reimbursed in full for their donations, up to a maximum reimbursement of $5 billion nationwide, per year.[3] A 100 percent donation tax credit is unprecedented at the federal level.

At the same time, other provisions in the bill actually cut the largest charitable giving tax incentive on the books used by people who give to other nonprofit groups. This cut occurs through two broad channels. First, through extending and making permanent a complex slate of temporary tax changes enacted in 2017 that, taken together, reduced the average benefit of itemized deductions for charitable giving by more than a quarter overall.[4] And second, through adding brand new limitations on the charitable deduction, such as capping the maximum tax benefit for high-income taxpayers at 35 cents on the dollar rather than 37 cents.[5]

The House tax plan would create a system that treats people supporting private K-12 vouchers far more generously than donors to children’s hospitals, veterans’ groups, and every other cause imaginable. While people making cash contributions to most causes would be barred from receiving more than 35 cents back for every dollar donated, cash contributors to private school voucher groups would be credited 100 cents on the dollar.

FIGURE 1

In practice, however, the typical tax benefit from giving to school voucher groups would far exceed 100 cents. The bill goes out of its way to make clear that the 100 percent tax credit is available not just on cash donations, but on donations of marketable securities, such as corporate stock, as well. People contributing corporate stock would find that “donating” would yield a personal profit for themselves. That is, the financial return from “donating” stock to a voucher group would be larger than the financial return of selling the stock for cash.

To illustrate this, imagine an individual who initially purchased stock for $6 million and has seen it grow in value to $10 million, resulting in $4 million of profit.[6] This $4 million return would ordinarily be considered long-term capital gains and subject to a federal income tax rate of 23.8 percent upon sale, resulting in a federal tax bill of $952,000. State taxes could add another $188,000 to that total, depending on the taxpayer’s state of residence.[7] The total federal and state tax bill on this sale would therefore be $1.14 million.

Under this proposal, a taxpayer in this situation would likely be advised by their accountant to forgo selling this stock in favor of contributing it to a voucher group instead. Claiming a 100 percent tax credit would result in the same pre-tax return as selling the stock (receipt of a $10 million tax credit rather than a $10 million cash payout). But it would not incur the $1.14 million income tax bill described above. This taxpayer would therefore see a higher after-tax return, or profit, from giving away their stock to a voucher group instead of selling it.

Revenue Estimates

As seen in Figure 2, we estimate that this tax avoidance maneuver would deprive the federal government and state governments of more than $2 billion in capital gains tax revenue over the next decade.[8] This would come on top of the roughly $21.5 billion cost of the tax credit itself, bringing the net total revenue loss to over $23.6 billion.

FIGURE 2

Estimates of lost state tax revenue are disaggregated by state in Figure 2, with the largest losses generally confined to states that do not offer private K-12 school vouchers today. These state revenue losses would be triggered by a reduction in reported capital gains income among donors to private school voucher groups.

FIGURE 3

These calculations assume the voucher tax credit would expire after four years, as scheduled under the House bill, though it is widely understood that proponents would like it to remain on the books permanently. Extending the credit for the duration of the 10-year budget window would raise its overall federal and state price tag to more than $68.1 billion. Of that amount, $67 billion would represent foregone federal revenue with the other $1.1 billion coming out of state coffers. Taken together, federal and state capital gains tax revenue would decline by $5.2 billion over the next 10 years, with $4.1 billion of that coming from federal coffers and the remaining $1.1 billion occurring at the state level.

Conclusion

At its core, the House plan seeks to dangle capital gains tax avoidance in front of wealthy taxpayers to convince them to funnel public dollars into private schools.

For wealthy individuals who support private K-12 school vouchers, like Elon Musk, participating in the shelter would be an easy decision. We previously estimated that Musk could have cut his federal capital gains tax bill by $690 million in 2021 if this policy had been in effect then.[9]

But even wealthy individuals who have never given more than a passing thought to private school vouchers are likely to sign up on the advice of their accountants. This is the quintessential definition of a tax shelter: a transaction that people would not ordinarily choose to undertake, except for the tax savings.

While Congress does create tax shelters from time to time, that result is often accidental, arising out of the complexity of the tax code and the creativity of tax accountants and lawyers. In this case, however, the shelter appears to be intentional.[10] By putting this arrangement on the books, the bill’s proponents have ensured that there will be an eager pool of wealthy donors lined up to help move public funds into private schools, and to collect their capital gains tax cuts as a reward.

Endnotes

[1] While the contributions can also be used to fund homeschooling and educational expenses other than private school tuition, in practice the vast majority of these contributions will be steered toward paying for private school tuition.

[2] Davis, Carl. “Shelter Skelter: How the Educational Choice for Children Act Would Use Tax Avoidance to Fuel School Privatization.” Institute on Taxation and Economic Policy. March 2025.

[3] These nonrefundable tax credits are also limited, at the taxpayer level, to the greater of $5,000 or 10 percent of adjusted gross income (AGI). For the vast majority of donors, the 10 percent limit will be the relevant restriction.

[4] Tax Policy Center. “How did the TCJA affect incentives for charitable giving?” Accessed May 2025.

[5] The House bill would also reduce the charitable deduction claimed by corporations by applying a floor that denies the deduction on gifts valued at less than 1 percent of taxable income. On the other hand, the bill would also revive an above-the-line charitable deduction for individuals who claim the standard deduction, though the extremely low cap on deductions per taxpayer ($150 for singles and $300 for married couples) significantly blunts the extent to which it offers a genuine incentive to make additional donations beyond those that would have occurred in the absence of the deduction.

[6] This example is discussed in more detail in the report cited in note 2.

[7] This calculation was performed assuming a 4.7 percent tax rate, which is the median state tax rate applied to long-term capital gains income, as calculated by ITEP using a combination of data from NBER’s TAXSIM and information from state revenue agencies.

[8] The methodology underlying these calculations is described in: Davis, Carl. “A Revenue Impact Analysis of the Educational Choice for Children Act of 2025.” Institute on Taxation and Economic Policy. March 2025.

[9] See note 2.

[10] Davis, Carl. “Voucher Boondoggle: House Advances Plan to Give the Wealthy $1.20 for Every $1 They Steer to Private K-12 Schools.” Institute on Taxation and Economic Policy. September 2024.