This November, Illinoisans will decide whether to amend the state constitution to allow a graduated income tax. A “yes” vote on the Illinois Fair Tax constitutional amendment will make effective legislation that will replace the current flat tax rate of 4.95 percent with graduated rates that cut taxes for those with taxable income less than $250,000 and institute higher marginal rates on taxable incomes greater than $250,000 (Figure 1).

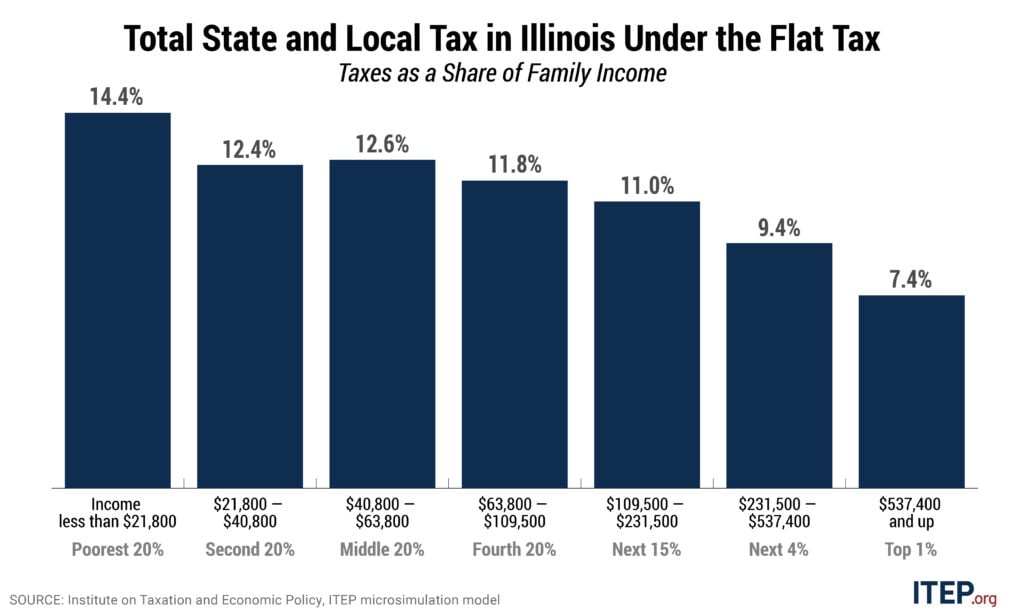

Under the Fair Tax, 97 percent of taxpayers with income tax liability would receive a tax cut and only the wealthiest 3 percent would pay more. The Fair Tax would improve the fairness of Illinois’s combined state and local taxes (Figure 2). Currently Illinoisans in the bottom 20 percent of income—less than $21,800 in income—pay 14.4 percent of their incomes in combined state and local taxes, while the top 1 percent—$537,400 and higher in income—pay only 7.4 percent.[1] In contrast, the Fair Tax would increase effective tax rates by 2.4 percent for the top 1 percent while cutting taxes for taxpayers whose incomes fall in the bottom 95 percent, improving Illinois’s tax system from the 8th most regressive in the nation to the 20th.

The choice between maintaining the flat tax status quo or adopting the Fair Tax extends beyond questions of individual income tax liability and improved tax equity. Less appreciated is how the tax structure in place affects income and wealth inequality.

Tax laws that collect higher shares of taxpayer income from those with lower incomes exacerbate income inequality. In Illinois today, after state and local taxes, a family making less than $21,800 has 85.3 percent of their income remaining post-taxes while a family with more than $537,400 has 92.6 percent of theirs. At a minimum, Illinois’s tax laws should be reformed to require the wealthy to pay more and reduce taxes for low- and moderate-income Illinoisans to ensure that incomes aren’t more unequal after state and local taxes than they were before.

In comparison, what difference would the Fair Tax have on income inequality in Illinois? To quantify it, ITEP examined tax responsibilities under Illinois’s historic flat income tax structure compared to the proposed Fair Tax over a 20-year period[2] for taxpayers with over and under $250,000 in taxable income, and here’s what we learned:

- Under Illinois’s flat income tax, the wealthiest don’t contribute as much as they would under a graduated income tax like the Fair Tax—both in terms of absolute tax dollars paid and the share of total taxes paid.

- In 2019, Illinoisans with more than $250,000 in taxable income paid 38 percent of all personal income taxes under the flat 4.95 percent rate, but under the Fair Tax they would pay 47 percent of total income taxes—an increase of 9 percentage points.

- In contrast, those with less than $250,000 in taxable income currently pay 62 percent of all personal income taxes but would pay 53 percent under the Fair Tax—a decrease of 9 percentage points.

- By taxing higher incomes at higher rates and lower incomes at lower rates, more total tax dollars are paid by those with greater ability to pay, shifting more of the responsibility for the tax from those with low- and moderate-wages to the wealthiest.

- Under the same distribution of the Fair Tax, the wealthiest 3 percent of Illinoisans would have paid an additional 8 percent of total income taxes or $27 billion from 1999-2019. Under the flat tax, that $27 billion was instead paid by Illinoisans making under $250,000 in taxable income.

- Owing $27 billion less in taxes under the flat tax structure is equivalent to a wealth gain of almost $50.2 billion for the richest Illinoisans over this 20-year period, assuming the money was invested in the stock market.

- Illinois has had a flat income tax since its adoption in 1969, so cumulative tax subsidies from low- and moderate-income families to the highest-income Illinoisans and the wealth equivalent of those subsidies compared to the Fair Tax are far greater over the entire duration of the tax’s history.

While Illinois’s tax structure didn’t independently create income and wealth gaps, it certainly has perpetuated inequities year after year that have made it even harder for families already struggling to get by with low, stagnating wages, while enabling the wealthy to become even wealthier. This is a desirable outcome only in the short-term and only for the minority of Illinoisans who benefit from the status quo. Illinois can do better. Voters can choose to do so this November.

[1] Meg Wiehe, Aidan Davis, Carl Davis, Matt Gardner, Lisa Christensen Gee and Dylan Grundman. “Who Pays? A Distributional Analysis of the Tax System in all 50 States (Sixth ed.),” Institute on Taxation and Economic Policy, October 2018. Online at https://itep.org/whopays/.

[2] ITEP conducted a multi-year analysis comparing tax liabilities under Illinois’ flat tax compared to the Fair Tax for taxpayers with less than and greater than $250,000 in taxable income. Due to difficulties forecasting income and economic conditions 20 years in the future, this is a retrospective analysis, using data on historic flat tax rates and actual personal income tax collections from 1999-2019. For each year, ITEP determined tax liabilities for taxpayers under the actual flat tax in effect that year compared to what tax liabilities would have been had each group paid the same share of taxes as they would under the Fair Tax (tax collections held constant).