May 16, 2024

May 16, 2024

Do you want teachers to be paid well? Access to quality education is a core value in every state, and the educators providing that service deserve satisfactory wages. Supporting progressive taxes in your state could make that happen.

Some states sensibly ask more of those who are able to pay more. It’s no surprise that these states with more progressive tax systems are succeeding in paying higher wages to educators.

Last week the National Education Association (NEA) released a new report that shows average teacher pay in every state. NEA found the national average public school teacher salary for 2022-23 was $69,544.

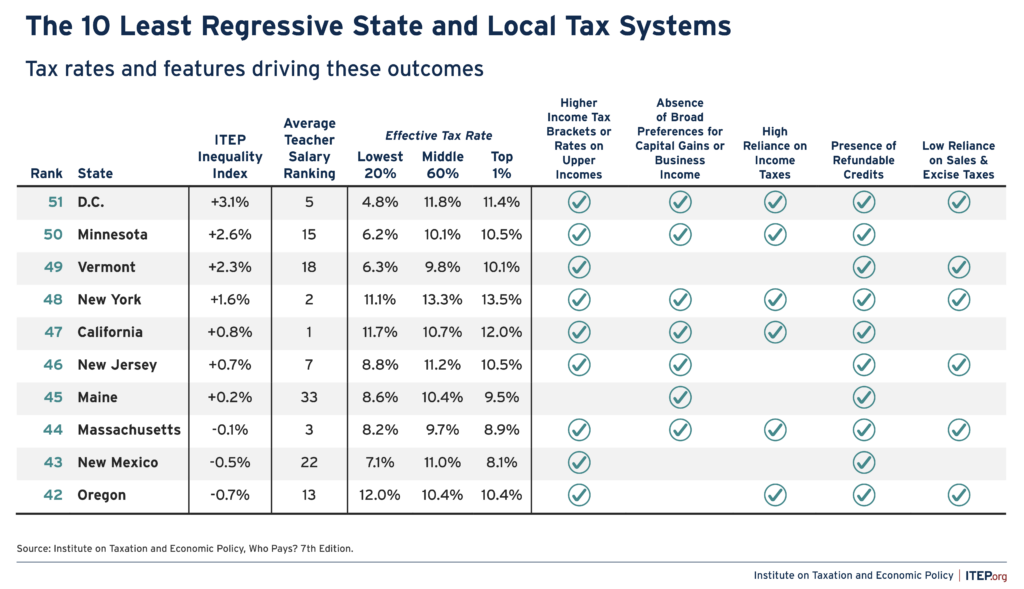

Our signature report Who Pays?, which assesses the progressivity and regressivity of state tax systems, offers some connections with NEA’s findings. As we note in Who Pays?, progressive taxation often delivers higher overall tax revenue, relative to the size of each state’s economy. This revenue helps ensure states and localities can pay teachers and other public servants well. Most of the states that pay teachers better also have less regressive state and local tax systems.

California provides the highest average teacher salary at $95,160 and ranks as the fifth-least regressive tax system in the country. New York comes in second at $92,696 while ranking one spot ahead of California in our Tax Inequality Index. The District of Columbia, Massachusetts, New Jersey, Oregon, and Minnesota also pay some of the highest teacher salaries and are among our 10 least regressive states.

At the bottom of the teacher salary rankings, we predictably find some of the most regressive states. Florida, Tennessee, South Dakota, Arkansas, and Louisiana are all in the lowest 10 for teacher pay and rank among our top 10 most regressive tax systems.

Floridians must be questioning some of the policy choices made in Tallahassee. The third-largest state in the nation pays teachers the second-lowest average salary of $53,098. Advocates pushed for higher base salaries this year, but that bill failed. Florida also ranks 42nd in per student spending. Florida Policy Institute reports the state’s investment per pupil is 13.6 percent lower than pre-recession levels.

The average teacher in Florida pays an effective rate of 9.5 percent on all taxes. That’s well above the 2.7 percent rate for the richest 1 percent of Floridians, who have average annual earnings of $3.3 million.

Meanwhile, New Mexico is showing what’s possible by building a more progressive tax system. New Mexico jumped 18 spots in our Tax Inequality Index since 2018 thanks to policy changes like expanding low-income credits, creating a Child Tax Credit, and increasing taxes on investment income and high-earning residents. That progress translated to deeper investments in education as well, as the state experienced the largest increase in average teacher salary from the 2021-2022 to 2022-2023 school years.

There are a variety of factors that affect teacher pay. For example, NEA finds that teachers earn 26 percent more on average in states with unions. But one often overlooked factor is progressive tax policies that allow states to raise and provide the funding educators and their students deserve.