Tax Day is a reminder of all the things our collective tax dollars provide to make our communities stronger.

Envision all that we’ve achieved through collective resources – our education systems, our infrastructure networks, health coverage to low-income families and their children, pension and health benefits for public employees, care for people with mental illness and developmental disabilities, public safety, parks, recreation and countless other services that have improved lives and positioned others for success. And I envision what’s possible with deeper public investment. The ways in which revenue can improve our society, lift up marginalized communities, and make everyone’s lives better.

When state budgets are strong, lawmakers should put those revenues toward building a stronger and more inclusive society for the long haul. Yet, many state lawmakers have made clear that their top priority is repeatedly cutting taxes for the wealthy.

So far this year, major tax plans have been passed by lawmakers in eight states and debates on major tax changes continue in more than half of the remaining states. To date, seven states have cut income taxes, two provided tax subsidies for seniors, four provided one-time rebates, and another five increased existing state tax credits. While the credit enhancements we’ve seen so far this session are a welcome development, many of the proposals being debated and passed by state legislatures are expensive and permanent tax cuts that provide an outsized benefit to the rich and do relatively little for low- and middle-income families.

Details of tax action in each state are available via ITEP’s State Tax Watch tracker.

2023 State Tax Policy Landscape

Note: this map is a snapshot of tax policy action as of April 12, 2023

A Familiar Mantra: “Cut Now, Reckon Later”

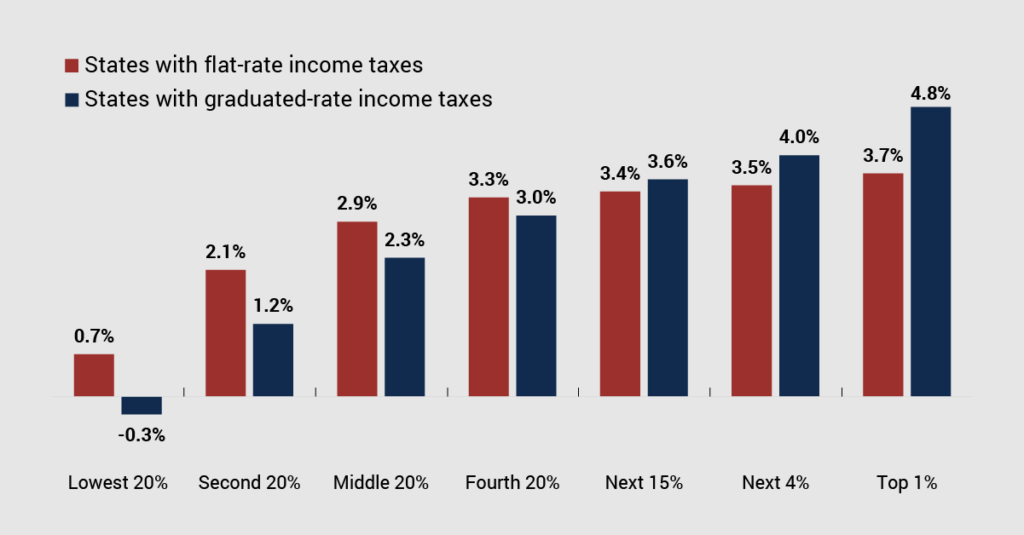

The most prominent trend we’re seeing is the push to cut state income taxes. This includes rate cuts, the acceleration of existing cuts that were already on the books, sizable subsidies for seniors, and efforts to move from graduated income tax structures to flat rates – a move that would limit those states' ability to raise progressive revenue, even with an income tax in place.

State lawmakers also continue to push for full income tax elimination. This has already played out this year in West Virginia where lawmakers coupled a deep income tax cut with a trigger that is intended to ultimately, over time, eliminate the state’s income tax.

So whether it be through triggers, flat taxes with an eye on elimination, or a relentless chipping away of existing income taxes, there is a concerted effort by anti-tax lawmakers to create a path for income tax elimination in many states. And in those that fall short of that, there is a focus not just on cutting state income taxes, but on restructuring them to make them fundamentally less fair and less effective at raising the revenue we need to fund vital public resources and to create a robust public sector working to make our society more equitable and inclusive.

Far too many of these tax cuts are being enacted and debated with little to no acknowledgment of what we’re going to give up by choosing to collect fewer tax dollars. The recent trend toward gimmicky tax triggers and phased-in cuts is designed to dodge those hard discussions and make it appear – falsely – that tax cutting has no downside.

But budgeting decisions always involve tradeoffs. And when tax cutting gets out of hand and those primarily benefiting are wealthy individuals and companies advocating for themselves, we lose our ability to fund what makes our society great. And we move further and further away from that positive vision for meaningful public investment.

Rather than prioritizing cuts, we should be talking about the revenue needed to fund universal preschool, options for college education that do not send families deep into debt, and infrastructure that is safe, efficient, and doesn’t hurtle us into a climate crisis. That’s why most people-oriented policymakers are putting forth more forward-thinking solutions. For instance: the governors of Minnesota and Wisconsin have proposed raising taxes on wealthy families profiting from their investments by charging higher rates on realized capital gains income; governors in New York and Connecticut are pushing to extend temporary surcharges applied to their state corporate income taxes; and Minnesota’s Gov. Tim Walz has proposed creating a state-administered system of paid family leave, funded through a payroll tax. These governors, along with lawmakers across the country, are promoting bold policies to ensure their states raise equitable, sustainable revenue.

Let’s shift the conversation to celebrate all that our collective revenues provide. And let’s move from the current “tax cuts first” mentality to one in which we protect and raise revenue to meet our needs and exceed our expectations.