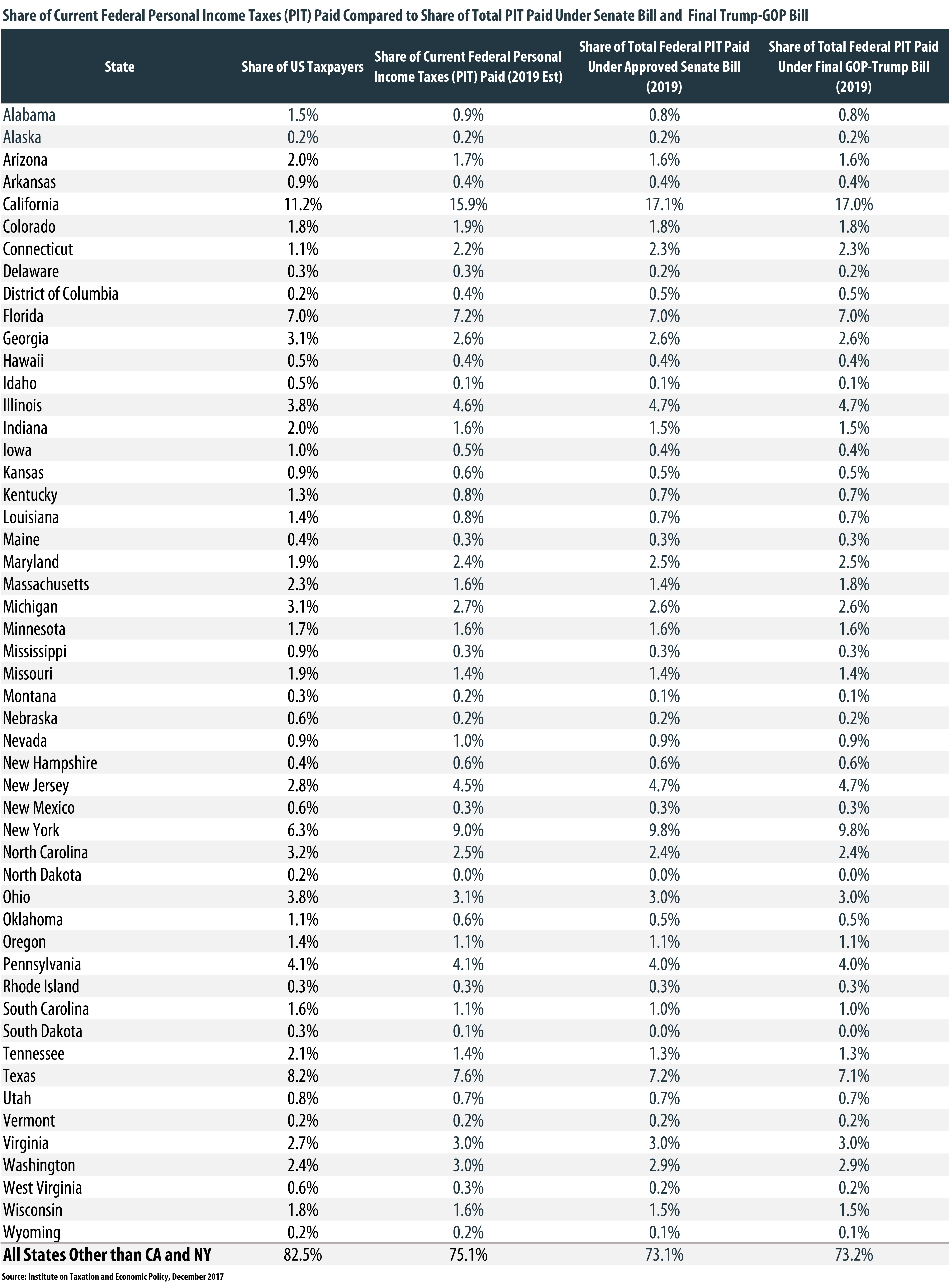

Residents of California and New York pay a large amount of the nation’s federal personal income taxes relative to their share of the population. As illustrated by the table below, the final GOP-Trump tax bill expected to be approved this week would substantially increase the share of total federal personal income taxes (PIT) paid by both states. Connecticut, Maryland, Massachusetts, and New Jersey would also see their share of federal PIT increase.

At the same time, it would reduce total federal personal income taxes paid by Florida and Texas (and most other states), which would receive a larger share of the tax cuts relative to what they pay to the federal government today.

The final GOP-Trump tax bill will cut taxes for some households and raise taxes for others. Residents of states with higher state and local taxes, such as California and New York, are more likely to face tax increases than residents of other states in large part because the bill severely restricts the ability of taxpayers to deduct state and local taxes on their federal tax returns. The inclusion of a last-minute compromise to allow taxpayers to deduct a combination of state and local income taxes and property taxes capped at $10,000 was not enough to prevent this tax shift.

Californians will make up 11.2 percent of U.S. taxpayers in 2019, but its residents would pay 15.9 percent of the federal personal income taxes that year under current law. In 2019, California residents see their share of federal income taxes paid increase to 17 percent under the final GOP-Trump tax bill (Table 1).

New Yorkers will make up 6.3 percent of U.S. taxpayers in 2019 but would pay 9 percent of the federal personal income taxes that year under current law. In 2019 residents of New York would see their share of total federal personal income taxes paid climb to 9.8 percent under the final GOP-Trump tax bill.

However, some lower-taxed states would be treated much better. Florida makes up 7 percent of the nation’s taxpayers, and its residents pay 7.2 percent of federal personal income taxes under current law. But its residents would see their total share of federal income taxes paid decline to 7 percent under the final GOP-Trump tax bill.

Texas is treated even better. It will account for 8.2 percent of the nation’s taxpayers in 2019, but its residents will pay just 7.6 percent of federal personal income taxes that year under current law. Texas residents will see their share of federal personal income taxes paid decline to just 7.1 percent under the final GOP-Trump tax bill.

It is unsurprising that the last-minute state and local tax (SALT) deduction compromise to allow both state and local income (or sales) and property taxes capped at $10,000 did little to move the needle in California, New York, and other high tax states given that the average SALT taken in those states by itemizers far exceeds the cap. In California, for example, the average SALT deducted by itemizers under current law is $23,000 and in New York the amount is $26,000.

This finding should provide cold comfort to lawmakers representing California, New York, New Jersey, and Maryland who were told the SALT compromise would address their concerns.