A new ITEP report estimates the impacts in every state of the much-discussed idea of extending the temporary provisions in the Tax Cuts and Jobs Act, which will expire after 2025 without further action from Congress. The report concludes that extending or making permanent these provisions would be just as skewed to the wealthy as the original law.

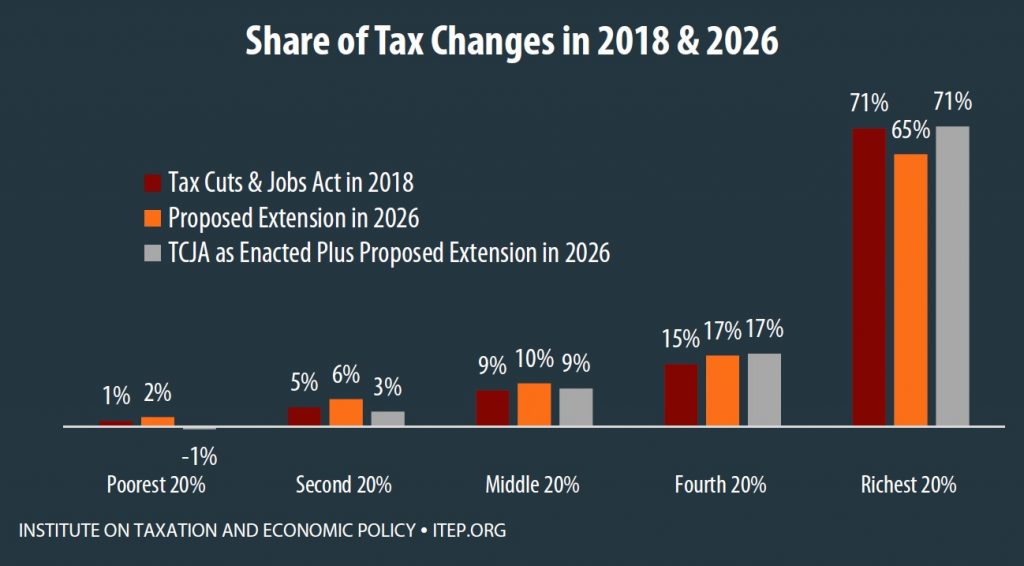

- In 2018, 71 percent of the benefits of the Tax Cuts and Jobs Act (TCJA) go to the richest fifth of Americans.

- In 2026, 65 percent of the benefits of extending TCJA’s temporary provisions would go to the richest fifth of Americans.

- If one considers the combined effect of the permanent provisions of TCJA (which would still be in effect in 2026) plus an extension of TCJA’s temporary provisions, 71 percent of the benefits in 2026 would go to the richest fifth of Americans.

The permanent provisions in the law include a steep cut in the corporate tax rate (which mostly helps the wealthy) and a less generous inflation adjustment and changes to the Affordable Care Act, which increase taxes overall for some low- and middle-income households.

Some lawmakers could make the mistake of thinking that the temporary provisions, which expire after 2025, are “middle-class” tax cuts. While the temporary provisions do include some changes that benefit low- and middle-income households, they also include changes that mainly help the well-off, like a cut in the estate tax and a tax cut for “pass-through” businesses that are mostly owned by the rich.

Extending TCJA’s temporary provisions would add more tax cuts for the richest households in 2026, but for some lower- and middle-income households, such an extension would only partly offset the tax hike they will receive from TCJA’s permanent provisions that year.

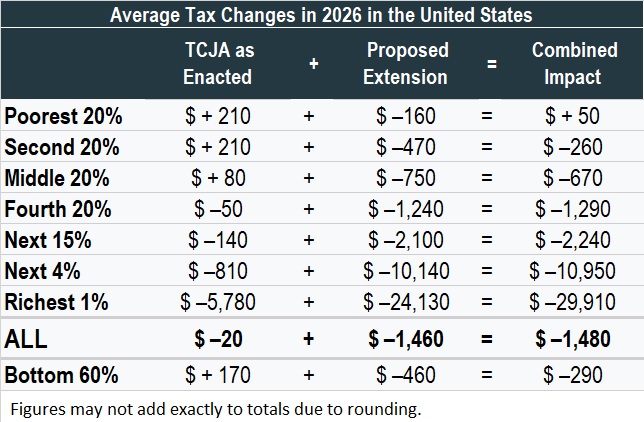

- For the richest one percent of Americans, the permanent provisions of TCJA will reduce taxes by $5,780 on average in 2026, while an extension of the temporary provisions would provide another $24,130 in tax cuts on average. The combined effect of TCJA as enacted plus an extension would be an average tax cut of $29,910 in 2026 for this group.

- For the middle fifth of Americans, the permanent provisions of TCJA will hike taxes by an average of $80 in 2026, while an extension of the temporary provisions would cut taxes by an average of $750 that year. The combined effect of TCJA as enacted plus an extension would be an average tax cut of $670.

- For the poorest fifth of Americans, an extension of the temporary provisions does not provide enough tax cuts to offset the tax hikes that result from TCJA’s permanent provisions, which will raise their taxes by an average of $210 in 2026. Extending TCJA’s temporary provisions would cut their taxes by an average $160 that year. The combined effect of TCJA as enacted plus an extension would be an average tax hike of $50 in 2026 for this group. This is not to say that the majority of this group will see a tax hike. But some families in this group who do face a tax increase (particularly one resulting from TCJA’s repeal of the health insurance mandate under the Affordable Care Act) face a particularly large tax hike, and, as a consequence, the average tax change for this group is a tax hike rather than a tax cut in 2026.

Of course, we need an actual bill to analyze to know for sure what the impacts might be, and no bill has been released yet. But that bill, when we see it, is likely to be even more skewed towards the rich than what we estimate here.

That’s because this analysis assumes no change in a business tax break (called “full expensing”) that phases out under TCJA as enacted. If lawmakers choose to include this among the temporary provisions to be extended, the tax cuts for the richest households would be even larger because most of the benefits of full expensing would go to those who own corporate stocks and other business assets.

The bottom line is that lawmakers who truly want a tax policy that works for the middle-class will never accomplish that goal by simply extending parts of TCJA. The only real answer is to start over from scratch with a real tax reform.

Read the full report for more details.