Watch the video recording below for discussion on how ITEP’s distributional data can be part of an advocacy and communications strategy for securing state tax policies that raise enough revenue to fund various priorities. Outline includes a brief overview of findings from the sixth edition of Who Pays? A Distributional Analysis of the Tax Systems in All 50 States as well as insight from state advocates who use Who Pays? and other tax policy analyses research to pursue their legislative agendas.

Every budget and tax debate should be informed by who pays taxes and how much. Forty-five out of 50 states capture a greater share of income from their lowest-income residents than the top 1 percent. And every state fails the test of true progressivity. This webinar highlights how to use Who Pays? data to steer your state’s tax and budget policy debate and provide valuable tools for you to advance progressive tax policy discussion in your state.

Speakers

• Aidan Davis, ITEP Senior Policy Analyst

• Dylan Grundman, ITEP Senior Policy Analyst

• Ted Boettner, West Virginia Center on Budget and Policy Executive Director

• Misha Werschkul, Washington State Budget & Policy Center Executive Director

Audience

This webinar is designed for policy professionals, leaders of advocacy and grassroots groups and new policy staff with a professional interest in equitable tax structures.

Additional Resources

Who Pays? A Distributional Analysis of the Tax Systems in All 50 States

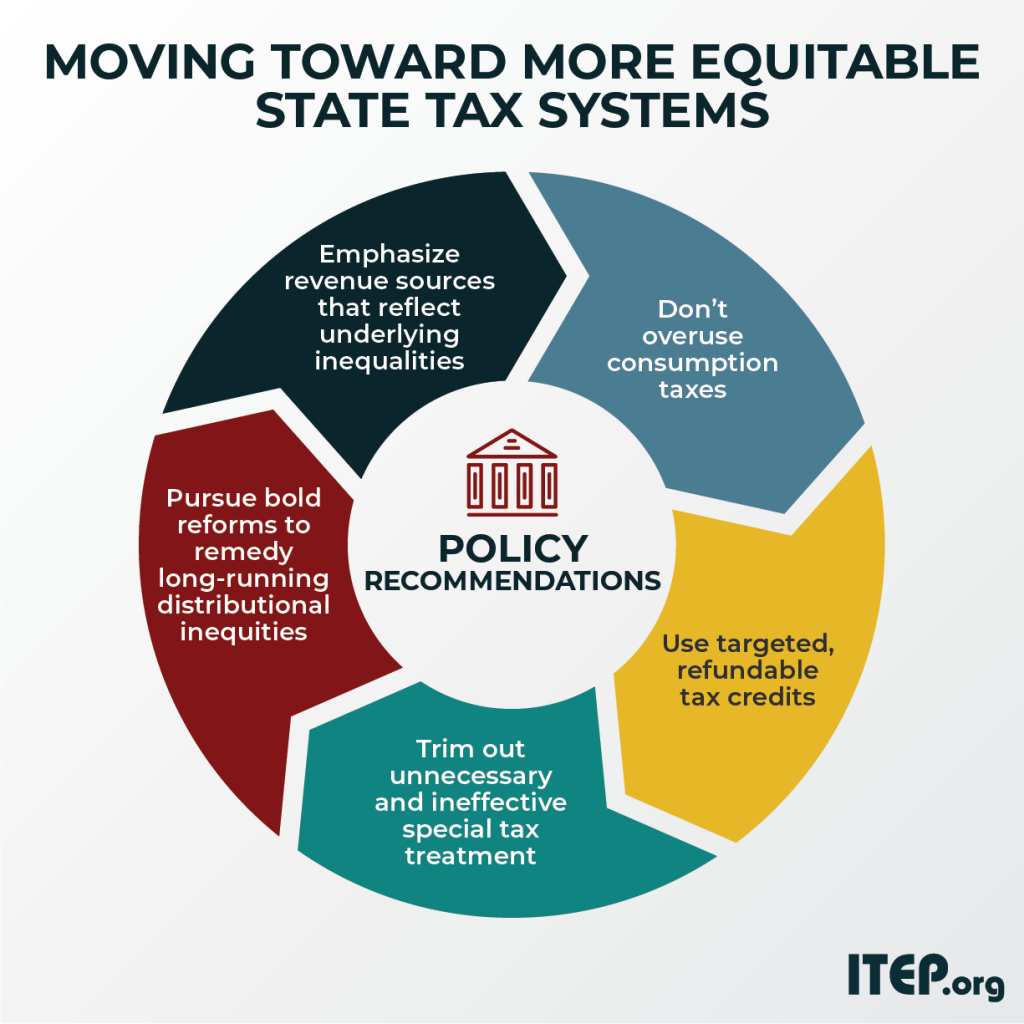

Moving Toward More Equitable State Tax Systems

Research Shows Millionaires Less Mobile than the Rest of Us

Millionaire Migration and Taxation of the Elite: Evidence from Administrative Data