Following is a statement from Alan Essig, executive director of the Institute on Taxation and Economic Policy, regarding President Trump’s FY2020 budget proposal released today. The proposal reinforces the Trump Administration’s commitment to tax cuts for the rich and deep cuts to domestic programs under the guise of fiscal responsibility.

“The White House’s fiscal year 2020 budget proposal demonstrates that for some elected officials, deficits don’t matter when it comes to tax cuts but are a matter of urgent concern when it comes to programs and services that benefit ordinary people.

“Despite proposing cuts of nearly $2 trillion from programs including Medicare and Medicaid and others, President Trump’s fiscal year 2020 budget includes deficits of more than $1 trillion for four years straight. One reason is that the president’s tax cuts are so expensive that even the most draconian spending cuts cannot achieve his unrealistic promises to balance the budget.

“The budget proposal again assumes that Congress will make permanent his 2017 tax cuts, which are already set to cost $1.9 trillion according to the Congressional Budget Office. Many of the tax cuts expire at the end of 2025 and CBO has estimated that making them permanent, as the president proposes, would add more than a $1 trillion to the national debt between now and 2030, and the cost in the years beyond that would be in the trillions. An ITEP analysis has demonstrated that extending these temporary provisions would simply provide more tax cuts to the households who need help the least.

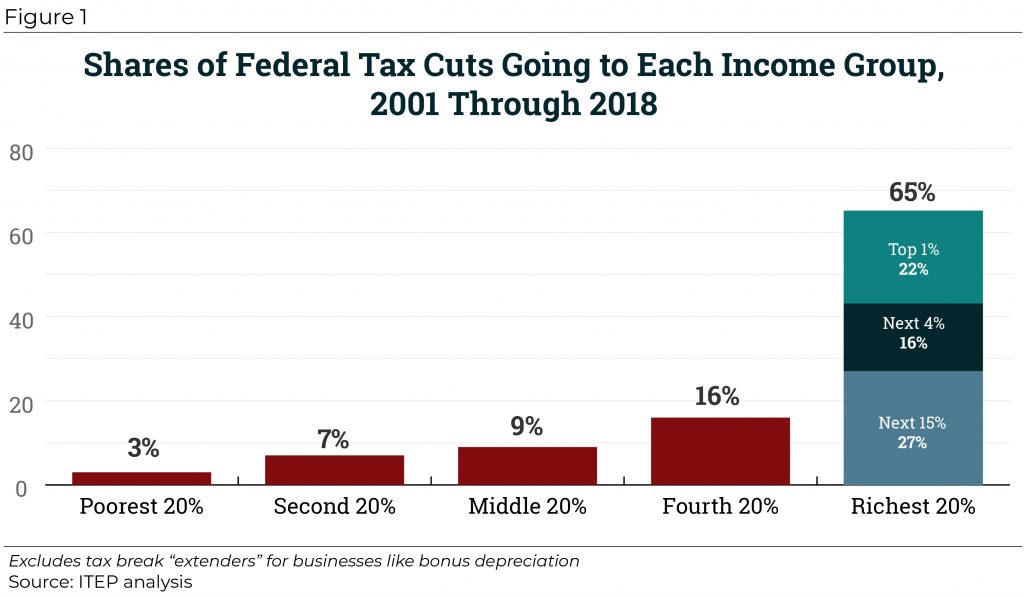

“Americans have long wanted higher taxes on the wealthy and on corporations, but elected officials have continually cut taxes for the nation’s highest-income households. From 2001 through 2018, significant federal tax changes have reduced revenue by $5.1 trillion, with nearly two-thirds of that flowing to the richest fifth of Americans. By the end of 2025, the tally of tax cuts will grow to $10.6 trillion. Nearly $2 trillion of this amount will have gone to the richest 1 percent.

“As expected, the president’s budget would enshrine top-heavy tax cuts into law and finance them by slashing domestic programs. It is time for a course correction.”