See ITEP’s estimates of the cash payments and tax changes in Biden’s American Rescue Plan.

After a solid year of federal policy doing too little to combat staggering job loss, spiking poverty, a raging pandemic and nearly 400,000 COVID deaths, we are ready for a leader who wants to hunker down and get to work on behalf of the people. So we did a happy double take when President-elect Joe Biden outlined his economic plan last night.

The plan will help state and local governments pay for essentials; expand a child tax credit to lift all kids in a way that also dramatically reduces child poverty; increase the recent payments from $600 to $2,000 for all but the wealthiest people; extend and increase unemployment insurance extensions; fund the desperately needed health infrastructure to improve vaccine roll-out–he vowed 100 million shots in 100 days; and soon begin making the kind of climate investments that could get a handle on carbon emissions.

It is a bold plan, at the scale needed for now, when the biggest danger is that we will do too little.

Biden has gotten the memo on the tough situation for state and local government budgets as they face reduced receipts and increased costs. With predicted state shortfalls in the hundreds of billions of dollars even as COVID creates new imperatives, federal help is overdue. The President-elect vowed to deliver $350 billion for states and cities.

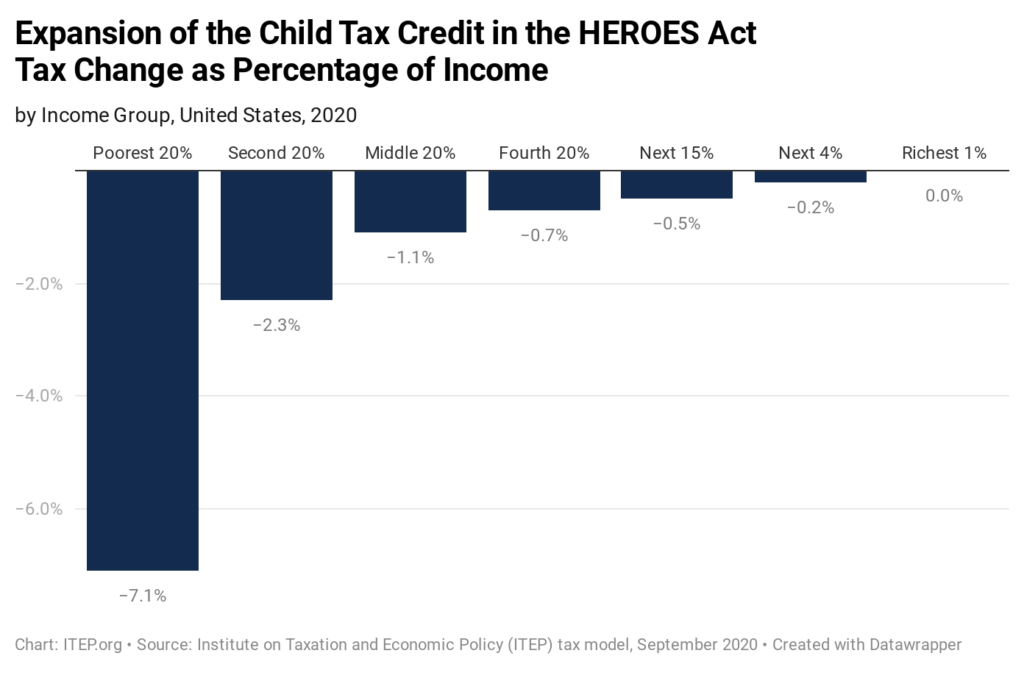

Biden’s ideas also include a major expansion of the child tax credit, which would dramatically reduce poverty in the United States. Stay tuned for details from ITEP about exactly how many children this will help. Meanwhile, we can tell you that previous similar proposals would have eased life for the families of more than 83 million children, with the biggest boost going to those who struggle most. The Center on Poverty and Social Policy at Columbia University found that a similar proposal that was part of the House-passed HEROES Act would have cut the poverty rate in half for Black children and by at least 41 percent for Hispanic children.

We’re in a recession, so it’s appropriate that the first economic bill of the new administration be financed through borrowing. The President-elect’s language on this was particularly strong. But as he should, Biden proposes to eventually raise revenue from the wealthiest and corporations. These proposals don’t go as far as we at ITEP might, but they would be leaps ahead of current policy.

Federal tax policy in recent years has been marked by slashing taxes for the top 1 percent by $50,000 apiece on average, knee-capping corporate taxes, and allowing 91 profitable Fortune 500 companies to pay absolutely nothing in federal income taxes (when we last counted). The result has been insufficient federal money for large, ongoing investments in health infrastructure, helping children thrive, and taking on our climate catastrophe.

The tax law shoved through by outgoing President Trump and Republicans in 2017 created substantial advantages for profits earned overseas compared to profits earned domestically. President-elect Biden seeks not to get rid of that disparity, as we recommend, but to substantially reduce it.

The United States has long taxed earnings on work at a higher rate than earnings from wealth. We can fix that by raising tax rates on earnings from capital gains. At ITEP, we’d like to make the two rates equal for everyone. The President-elect proposes a solid start on doing so, by raising taxes on capital gains for those earning more than $1 million a year.

Currently, very wealthy people can pass income generated by their wealth on to their heirs and the family avoids paying income taxes on it. This is part of what leads to the intractable economic and racial wealth divide in America–if your father was born with a silver spoon, you can inherit a table of silverware. Biden’s plan lets you inherit that silver, but ensures you pay something so the nation creates opportunity for others to at least buy a stainless-steel place-setting.

A number of bills in Congress would go further than President-elect Biden proposes to–they’d raise more from the very wealthiest, from financial transactions, from stock earnings, and from corporations; and do more to tax gargantuan inheritances to combat inequality that begins at birth. We think all of these deserve a look.

But for now, it’s affirming to know we will soon have a president who is interested in tax reforms–like fixing inheritances, repealing the Millionaires Giveaway, improving tax enforcement so that plutocrats like Donald Trump can’t evade all taxes–that could collectively raise trillions to fund the America we were meant to be. In a country where people are dying and falling into poverty every day, those investments can’t come soon enough.