“Bold progressive victories” is probably not the first phrase that comes to mind when thinking about state laws enacted so far in 2021. Headlines have rightly focused more on the troubling wave of efforts in nearly every state to restrict voting rights and disenfranchise American voters, particularly voters of color. Pushing back against these shameless attempts to further roll back progress made since lawmakers enacted the Voting Rights Act of 1965 is understandably many people’s top priority right now.

But progressive advocates, lawmakers, and voters have won some tremendous victories in states recently. The wins so far in 2021 have occurred all around the country and have featured raising taxes on very rich households, improving income supports for middle- and low-income families, extending those supports to immigrants who were previously excluded, and rejecting costly and regressive tax cuts. These and other reforms help balance upside-down state tax codes that currently exacerbate economic and racial inequities. They can also help ensure that the economic recovery is as broadly shared and lasting as possible. We should celebrate them for the achievements they are—and closely study them for lessons they can teach about how to bring about positive progressive change in these and other states.

Washington State leaders scored a momentous win this weekend by enacting a first-of-its-kind excise tax on extraordinary profits from capital gains exceeding $250,000. New York leaders combined progressive tax increases on incomes over $1 million, $5 million, and $25 million with robust investments in universal pre-kindergarten and supports for essential workers left out of prior pandemic relief due to their immigration status, while also opting out of the federal “opportunity zone” tax break for wealthy developers. Maryland and New Mexico both dramatically enhanced income tax credits for middle- and low-income families and opened them to taxpaying immigrants, and Washington State was able to implement a similar credit for the first time, thus bringing more balance to their tax code from both the bottom and the top. And Mississippi and West Virginia wisely rejected efforts to turn their tax codes even further upside-down by eliminating their income taxes.

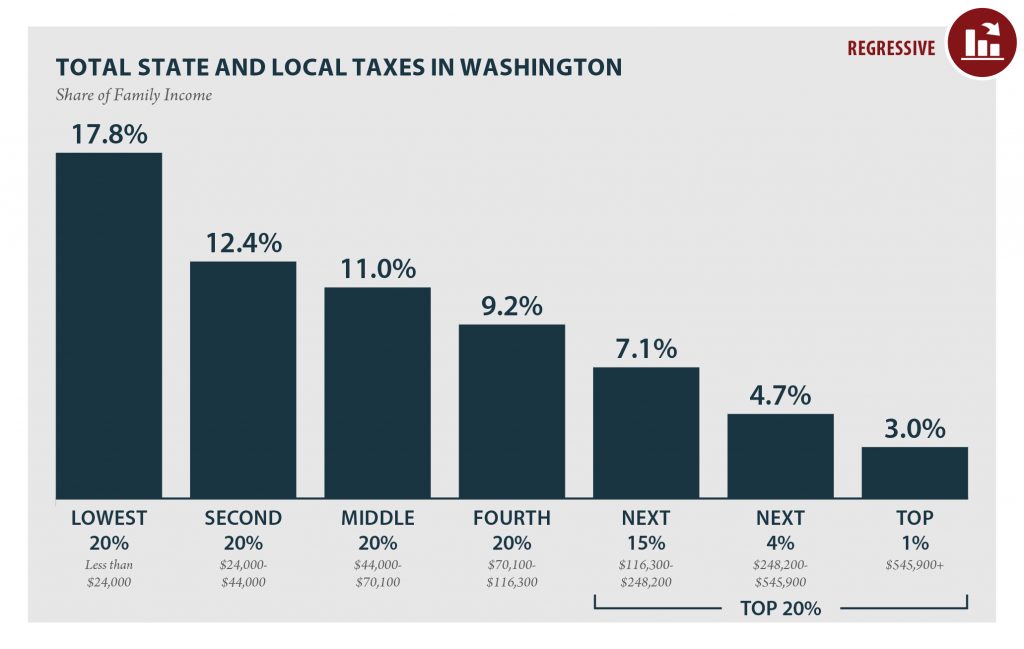

These accomplishments are all the more impressive considering the obstacles and odds they were up against. Well-funded anti-tax interests defending the inequitable and racist status quo have spread so much misinformation about taxes driving away jobs and tax cuts producing economic growth that such myths were readily repeated in these debates, all the way up to West Virginia Gov. Jim Justice and New York Gov. Andrew Cuomo. Advocates in Washington have faced all this and more, as the state currently has the most upside-down tax code in the nation and a prohibition on the personal income tax, the main tool that other states use to advance tax justice.

It is also crucial to also study these hard-fought victories for lessons applicable to other states and other battles. So how did they do it? We see four key factors at play in these and other cases.

First, it sure doesn’t hurt to have facts on your side. Our own research at ITEP shows that state tax codes are badly tilted in favor of rich households, while often worsening racial inequities, and that this regressive arrangement is not helpful to state economies. But we can’t say it any better than Charles Khan of Strong Economy for All:

Studies by leading economists have demonstrated that states that taxed the rich to invest in public goods and public services recovered faster and saw more economic growth after the last recession than those where leaders insisted on budget cuts, pay cuts and service cuts after federal funds ran out. They also have shown that taxes on high incomes, wealth and corporate profits, when matched with investments in Black and Brown communities, prove an effective mechanism to achieve racial equity and address extreme economic inequality.

Second, overwhelming public support is certainly helpful too. As Axios recently reported, “extensive polling and research has found that few issues receive broader support than raising taxes on corporations and people earning more than $400,000 a year… Poll after poll after poll after poll support” the conclusion that people generally understand the value of progressive taxation to fund public investments and reduce the many harms caused by extreme inequality. In a sense, lawmakers enacting these policies are simply catching up with long-standing public support for them.

Third, other states recently embraced changes that helped pave the way for this year’s progress. In 2020, Lawmakers in New Jersey and voters in Arizona helped set an example by taking progressive action, and California and Colorado became the first two states to extend their Earned Income Tax Credits (EITCs) to immigrants who file taxes using Individual Taxpayer Identification Numbers (ITINs), blazing the trail followed this year by leaders in Maryland, New Mexico, Washington.

Finally, these victories were achieved through the energy, resolve, and brilliance of advocates in each of these states. Facts don’t actually speak for themselves, public opinion doesn’t form in a vacuum, examples on their own don’t inspire action, and policymakers don’t necessarily or automatically act on any of these factors. Advocates’ efforts to educate, organize, and persevere are the deciding factors that connect all these dots and turn them into actual policy wins.

New York’s achievements, for example, were the culmination of an extensive campaign of letters, phone calls, texts, lobbying, marches, protests, and even a hunger strike, much of which was led by the Invest in Our New York coalition. The low-income credit in Washington took years of advocacy to put in place—13 years ago—and it has taken those 13 years to finally get the program funded and implemented. And Washington lawmakers’ enactment on Sunday of the extraordinary profits tax brings to life a policy innovation first cooked up a decade ago by local advocates who had the compassion to care about the harms done by the state’s tax code, the creativity to find a solution despite unusual obstacles, and the perseverance to continue working toward their goal for all these years.

So don’t put your hands together for these victories; better to raise a glass with one hand, and take some good notes with the other.