Economically and racially equitable tax systems are essential to adequately funding education, health, childcare, affordable housing, and other shared priorities. This is especially true at the local level, where the connection between revenue and the quality of public services is extremely clear. To echo the principles laid out by the National League of Cities and the Local Solutions Support Center, local governments must have enough power and autonomy to raise revenue and manage spending in accordance with local needs and priorities.

While ITEP has occasionally analyzed local tax policy options in places like Maryland, Pennsylvania, Alaska, California and Illinois, we have not had a team dedicated to local issues. Until now.

Our new local tax policy team will explore how to rebalance local taxes, including but not limited to:

- shifting away from fines and fees as revenue-raisers,

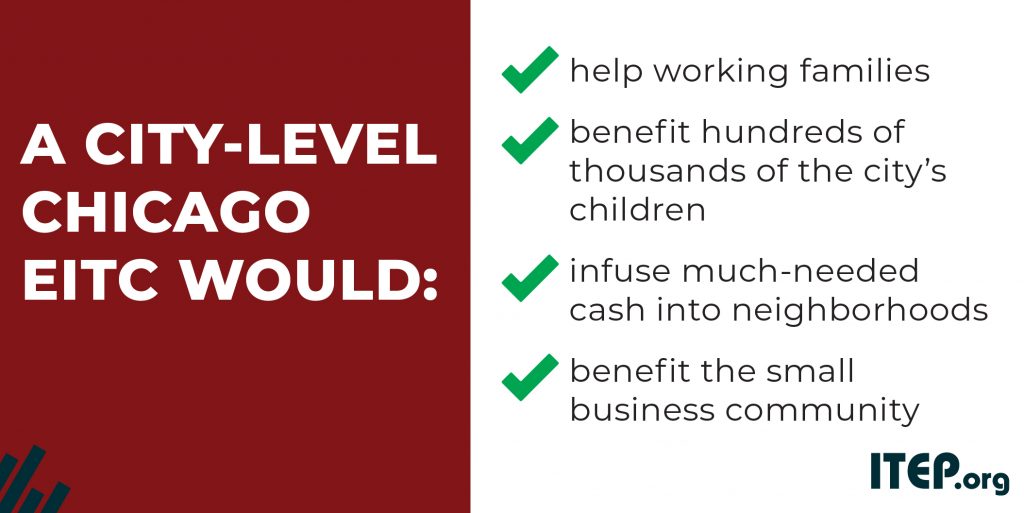

- considering local tax credits to bolster economic security and promote healthy communities,

- removing state legal barriers to equitable local taxes,

- reforming property tax assessments that widen racial and economic disparities,

- and ensuring that localities can raise revenue to tackle urgent challenges in public health, early childhood education, and more.

There is no better time to delve into local taxes. Counties, towns, and municipalities are in flux after a period of relative prosperity. The COVID-19 pandemic ushered in a rise in remote work, which is likely to remain a mainstay of the labor market. While remote work has societal benefits, it is also linked to lower revenues from transit ridership, sales tax, and property tax in densely populated areas. State leaders must grant localities more taxing authorities so that local leaders can find effective, progressive solutions to raise much needed revenue.

Unfortunately, the opposite is happening. The pandemic also highlighted the ways in which local leaders are often hamstrung by state officials in implementing responsible fiscal and public health-related policies. While states have always exercised power over cities and other political subdivisions, there has been a sharp upswing in state interference and preemption laws.

The most common preemption laws limit local efforts to strengthen gun control, paid leave, anti-discriminatory employment laws and affordable housing legislation. During the height of the COVID-19 pandemic, state legislators compromised many localities’ capacity to adopt common-sense response and recovery efforts. But state legislators also use preemption to constrain public revenues. In 2023 alone, there have been multiple bills to curb local revenue including Arkansas’ new law that bars local governments from levying income taxes and an Illinois bill that would cap how much localities can raise their tax levies.

As several scholars have noted, preemption has become a tool of structural racism in that majority-white legislatures often preempt policies that would primarily benefit people of color. Due to historic injustices and current discrimination in the workforce, Black, Latino, and Native families face higher rates of poverty and receive fewer employment-based benefits. Therefore, state interference regarding paid leave, higher minimum wage provisions, and other workplace supports disproportionately hurt communities of color. Barriers to progressive revenue-raising make it impossible to adequately invest in education, health care, and other public goods, also disproportionately harming historically marginalized, under-resourced communities.

To compound the issue, many state lawmakers are senselessly using temporary budget surpluses to justify permanent, regressive tax cuts at the expense of low- and middle-income households. Over half of all states are considering extremely costly cuts that would wreak havoc on state budgets. Not only would state income tax cuts directly endanger crucial services, they would also result in far less revenue to share with local governments.

State aid to municipalities has already declined dramatically over the last few decades. From 1977 to 2017, on average, federal and state government support has declined from 31 to 16 percent of municipal revenue, from 27 percent to 15 percent of township revenue, and from 42 percent to 29 percent of county revenue. At least a dozen states took legislative action to reduce state aid from 2012 to 2017. At the moment, many cities and counties are keeping their budgets in balance by leveraging American Rescue Plan Act dollars to bolster municipal workforces and services but those funds will soon come to an end.

Something needs to change. For too long, there has been a deep disconnect between the expectations thrust on localities and their powers to meet those expectations. As local government law expert Richard Schragger writes in his book City Power, “…scholarship on cities has often vacillated between treating cities as powerless to act and blaming them for their failures.” For example, federal and state policymakers often blame municipal fiscal crises on local corruption and fiscal mismanagement rather than acknowledge the imbalance of power.

This inequity is also at the root of local tax structures. While most states permit regressive local sales taxes, relatively few allow more progressive local income and payroll taxes. States often limit localities’ taxing and spending powers but encourage the use of tax abatements and incentive programs to be economically “competitive” – even though numerous studies have shown these programs often do not spark economic growth. These misguided efforts often result in regressive systems that draw a lower share of income from wealthier households and more from resource-constrained families. In addition to an already-regressive tax system, localities often resort to fines and fees that trap Black, brown and low-income communities with the least political power in a cycle of debt and criminalization.

Local governments are increasingly asked to tackle new challenges like housing shortages, racial and socioeconomic health disparities, and climate-resilient infrastructure. Even responsibilities that seem straightforward, such as administering elections, have become more fraught and costly given unprecedented attacks on the legitimacy of our election systems. These added pressures have created a moment of extraordinary challenge but also enormous opportunity.

Fortunately, localities are hotbeds of creativity, innovation, and resilience. From dedicating new taxes to fund climate action to rethinking real estate transfer taxes to fund low-income housing, many local leaders are already using tax policy to strengthen their communities. ITEP is committed to helping local leaders and advocates make their tax systems more progressive and sustainable. We can collectively work towards a future in which state legislators empower and respect local decision-making and local leaders have the authority and the resources to create vibrant, equitable, thriving communities.