Key Findings

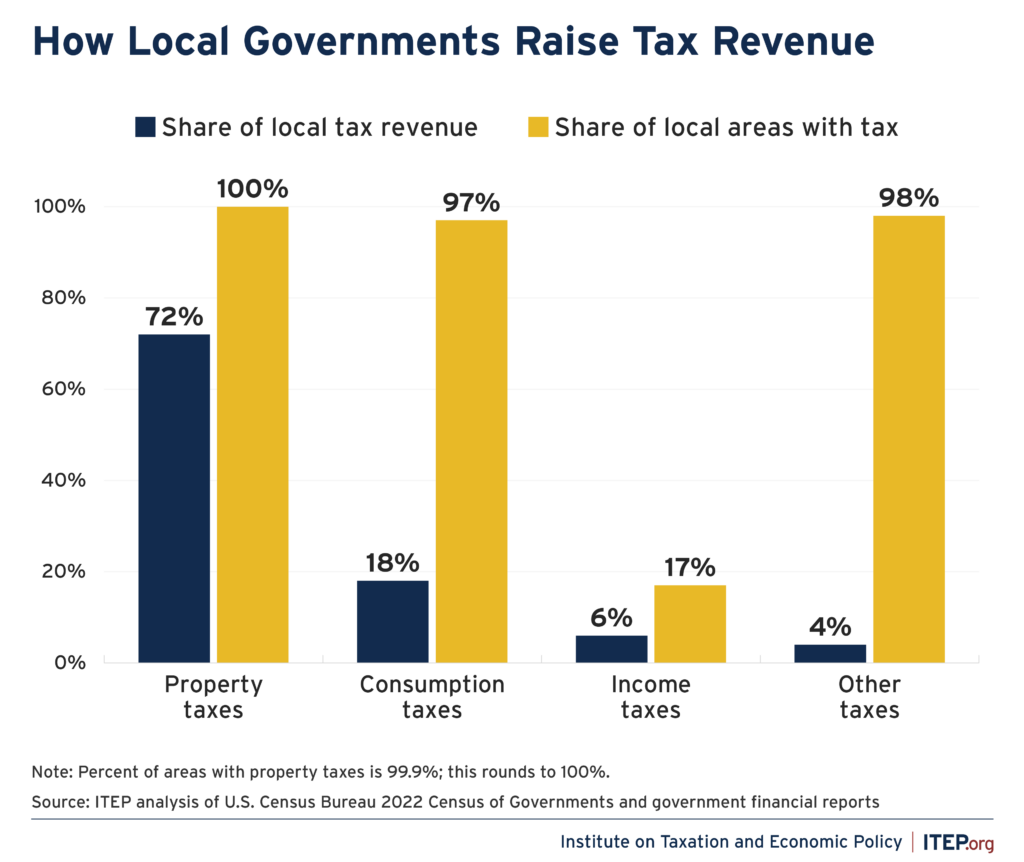

- Local taxes are key to thriving communities. One in seven tax dollars in the U.S.—about $886 billion annually—is levied by local governments in support of education, infrastructure, public health, and other priorities. Three fourths of this funding comes from property taxes, 18 percent comes from sales and excise taxes, and six percent comes from income taxes.

- Property taxes and consumption taxes are common—but often problematic. Property taxes are the dominant local government funding source in nearly all localities, representing the largest tax revenue source in 93 percent of areas. Consumption taxes often play a secondary role, acting as the second largest source in two-thirds of areas.

- Local income taxes are rarer but can be significant where present. One in five localities has an income tax, and in these areas income taxes generate nearly a quarter of local tax revenue. Local income taxes typically apply to people residing or working within a jurisdiction, often calculated as a flat or graduated percentage of income, or are levied on businesses.

- Most local tax systems are falling short of their potential. Well-structured local tax policies support communities by facilitating important investments and advancing fairness. Yet the tax revenue sources most used by local governments tend to disproportionately weigh on households with fewer resources, often because of local policies and state-imposed constraints. Learning from these realities can inform the path to improved tax policies and stronger communities.

Introduction

The tens of thousands of local governments across the United States are frontline providers of the essential services that create thriving communities. Well-structured local tax policies support and strengthen this goal, facilitating important investments while advancing fairness and opportunity.

This resource offers detailed information on how localities raise tax revenue across the U.S., shedding light on the equity and adequacy of these measures at a critical moment for local leaders and the people they serve. We present data for property, sales, income, and other taxes raised in every local jurisdiction—from cities and counties to school districts and tourism districts—with maps disaggregated to the county level for a comprehensive perspective. Each county-level area, which we refer to as a local area, incorporates all tax revenue collected by local governments within its bounds.

Explore below to learn more about how local governments raise revenue.

Local Taxes: A Nationwide View

Cities, counties, towns, and other local governments collect around $886 billion in taxes each year to support vital priorities including education, infrastructure, public health, and public safety. Property taxes account for 72 percent of this revenue. Consumption, income, and other taxes make up the remaining portion.

FIGURE 1

Local taxes altogether provide over two-thirds of local general revenue, making them local governments’ single largest funding source. On top of taxes, transfers from states (which also come from taxes) contribute 28 percent of local revenue, most of it directed to schools. Funding that the federal government gets from federal taxes adds six percent. Another 22 percent comes from charges paid by users of locally run services like water systems, hospitals, and parking facilities.

Local taxes represent one in seven tax dollars collected in the U.S. As detailed below, the tax revenue sources most utilized by local governments tend to disproportionately come from residents with fewer resources, posing a key roadblock to achieving flourishing and equitable communities. Some areas have embraced a better approach, adopting solutions for more balanced revenue systems. Understanding and learning from these realities can inform the path to improved tax policies and stronger communities.

Property Taxes

Property taxes are the dominant tax revenue source for local governments, generating approximately three in four local tax dollars nationwide. Nearly every local area in the U.S. raises revenue through property taxes, and these taxes represent the largest tax revenue source in 93 percent of localities.

Property taxes are commonly based on the value of homes and business real estate. The ultimate incidence of these taxes is shared between property owners, renters, and business owners. Some jurisdictions also tax possessions such as cars, boats, and business equipment, as well as the registration and transfer of property.

A mainstay of local budgets, property taxes have historically been regarded as a relatively stable and broad-based funding source that enables differentiation between households of varying wealth. Yet challenges in policy, implementation, and a changing economy compromise these strengths, leaving localities raising less revenue less equitably. Higher income residents shift the tax responsibility onto lower-income residents as a result. For households and communities of color, biased or otherwise flawed tax administration practices and resource gaps between communities can further inequities.

Many decisions make a locality's property tax system more or less equipped to raise revenue in a balanced and effective manner. These include the tax base, structure of rates, targeted tax breaks and cuts to households and businesses, quality and fairness of implementation, and constraints imposed by states.

Consumption Taxes

Sales, excise, and gross receipts taxes are the second most-frequent local tax revenue source, accounting for 18 percent of taxes collected by local governments. Almost all local areas collect consumption taxes of some kind, though reliance can vary considerably between places. Consumption taxes often supplement property taxes, acting as the second-largest tax revenue source in two-thirds of localities across the U.S. Local reliance on consumption taxes tends to be particularly high in the South, though there are exceptions to this pattern.

Consumption taxes include broad-based sales and gross receipts taxes, which are present in three quarters of local areas and make up a similar share of local consumption tax collections. Narrower taxes on items such as utility services and hotel bookings constitute the remaining portion of revenue raised in this category. Consumption taxes may be paid directly by consumers—both residents and visitors—or paid by sellers and passed onto consumers. State-level rules generally delineate the types of sales, excise, or gross receipts taxes localities are permitted to enact.

Consumption taxes tend to be the most regressive of the three major tax types. Households with fewer resources generally have little choice but to spend a larger share of their incomes on items typically covered by these taxes, resulting in them paying more of their income toward them than households with higher incomes. As a result, greater reliance on revenue from consumption taxes is often associated with a more regressive system.

The magnitude of imbalance in a locality's consumption tax structure is determined in part by the items subject to tax. The most inequitable tax systems rely more on revenue collected from purchases of products that make up a disproportionate share of lower-income families' budgets, such as household essentials, while less regressive systems tend to include items purchased in greater proportion by those with higher incomes, such as personal services. Regardless of the particulars of the tax base, however, broad consumption taxes are usually regressive because higher-income households tend not to consume as much of their income.

Income Taxes

Local income taxes are less common nationwide than property or consumption taxes—but often significant where present. Just 17 percent of localities have income taxes. Among these areas income taxes make up nearly one-fourth of local tax revenue and most often displace consumption taxes to become the second-largest source of tax revenue.

Local income taxes take on a variety of forms. They typically apply to people residing or working within a jurisdiction, often calculated as a flat or graduated percentage of income. A handful of localities tax the payroll expenditures of employers rather than taxing personal income directly, and some areas tax business profits. State laws often outline whether and in what form localities may adopt income taxes.

The relative underutilization of income taxes points to a factor preventing more equitable local tax systems. Income taxes align revenue contribution with ability to pay, and when structured in accordance with best practices, can counterbalance inequities brought about by less-responsive local consumption taxes and property taxes. Key elements influencing effectiveness include the sources of income subject to taxation, the rate structure, and the provision of credits and deductions.

Other Taxes

Four percent of local tax revenue nationwide is generated by sources other than taxes on property, consumption, or income. This includes revenue from business license taxes, license fees, and other taxes, together contributing a small share of local funding.

Areas collecting a greater proportion of taxes in this category frequently raise more than average from license taxes on corporations. Sometimes called franchise taxes, corporate license taxes are annual charges placed on businesses as a condition of operating in a jurisdiction. They are often applied as a flat dollar amount or scaled in proportion to company size.

About the Data

Data used in this resource are from ITEP analysis of the Census Bureau's 2022 Census of Governments survey, the most recent year with published results from the full survey. Where appropriate and necessary to improve accuracy, ITEP augmented Census data with information from financial reports of local and state governments. We aggregated tax revenue for each local taxing jurisdiction, inclusive of counties, cities, townships, school districts, and special districts, into its respective county to better enable nationwide comparison. We refer to the county-level aggregates as "local areas" in this brief.

Property taxes are defined to include ad valorem real estate and intangible property taxes; documentary and transfer taxes; estate, inheritance, and gift taxes; and motor vehicle license taxes. Consumption taxes include general sales and gross receipts taxes and selective sales and excise taxes. Income taxes are defined to include personal income taxes, payroll taxes, and business net income taxes. Licenses and other taxes include corporation and occupation license taxes; resource severance taxes; and other taxes.