Mississippi policymakers this year took a big step to worsen the state’s racial income and wealth divides by passing a radical plan to eventually eliminate the state’s income tax.

In March, Mississippi enacted legislation to phase down its individual income tax rate from 4 percent to 3 percent by 2030, with further annual reductions triggered by certain criteria until the tax is fully eliminated.

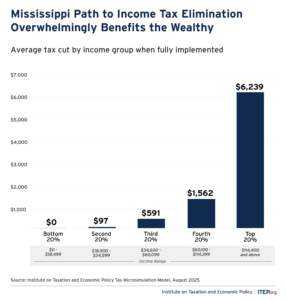

While individual households in Mississippi will see some tax savings, the benefits are not evenly distributed. High-income Mississippi residents will disproportionately benefit from this change, with the top 20 percent receiving an average tax cut of $6,239 and the lowest 20 percent getting virtually nothing.

Meanwhile, the state will lose about $2.5 billion a year in revenue once this plan is fully implemented, which will lead to significant budget instability and place public services at risk. Eliminating the income tax is also likely to increase Mississippi’s reliance on other taxes, with a high likelihood of relying on regressive consumption taxes.

Inequality is not just found between income brackets, but between racial and ethnic groups as well. Mississippi’s deep legacy of anti-Black policies, from slavery and Jim Crow to the enactment of the first modern sales tax in 1932 – a policy that disproportionately harms lower-income consumers by shifting who pays taxes away from primarily white, wealthy landowners – has led to deep inequities.

About 37 percent of the state’s population is Black or African American, one of the highest rates in the country. The poverty rate among this population is 27 percent, significantly higher than the still-high 11.6 percent rate for the white population. Income disparities are also stark: the median household income for white Mississippians is about $67,000, compared to about $38,500 for Black or African American households.

The gap between Black and white residents and between low-income and high-income residents will grow under this new tax policy. The tax cut is not evenly distributed, with Black households getting less than their share.

Black-led households will receive about 26 percent of the total tax cut, even though they account for about 40 percent of all tax returns, according to our analysis. In contrast, white households will receive about 71 percent of the tax cut—well above their 55 percent share of tax returns. Of the $2.5 billion in tax cuts, about $1.8 billion is going to white households and only around $650 million to Black or African American households. The reason for this is that white households are far more heavily represented among the wealthiest 20 percent of Mississippi households, who will receive the bulk of the benefits of this tax cut. White households make up 15 percent of all tax returns in the top 20 percent, while Black or African Americans only comprise 4.2 percent.

But the distribution of the tax cut isn’t the only part of this plan that will expand racial inequities; the billions in lost revenue will also harm modest-income Mississippians of all races, while disproportionately harming Black or African American Mississippians.

The largest share of Mississippi’s state funding, 38 percent in 2024, comes from sales taxes, followed by income taxes. As Mississippi reduces and eventually eliminates the income tax, it will become even more reliant on sales and excise taxes, just like other states with no state income tax. Consumption taxes take a larger share of income from the state’s middle-income and poorer residents than from its wealthier residents. Because Black households are overrepresented in Mississippi’s lower- and middle-income populations, they will be disproportionately responsible for funding the government and services that all Mississippians utilize.

Lastly, taxes primarily exist to fund public investments. The loss of tax revenue will impact Mississippi’s ability to pay for good schools, health care, affordable housing, and other services for all Mississippi communities, including its Black communities that have long suffered from underinvestment.

The changes in Mississippi stand in stark contrast to Maryland’s recent changes.

This year Maryland increased taxes on the wealthy by creating two new high-income tax brackets, a new capital gains surcharge, and by limiting itemized deductions for high-income earners. They also provided tax cuts by establishing a higher standard deduction and expanding the child tax credit. These progressive tax changes will not only raise revenue for the state but also advance racial equity.

Conversely, Mississippi’s move to ultimately eliminate its personal income tax is a regressive and costly policy that undermines racial equity. A small, disproportionately white and wealthy segment of households will receive the bulk of the tax cuts, while most residents—especially those in the lowest 20 percent, who are disproportionately Black—will see little or no benefit. This change poses serious concerns for Mississippi’s future, threatening to deepen inequality while stripping critical funding from public services.