This toolkit accompanies ITEP’s latest research brief, The 5 Biggest State Tax Cuts for Millionaires this Year. It provides ready-to-use social media posts, graphics, and messaging examples to help share ITEPs findings with your networks. Whether you’re communicating with journalists, policymakers, or the public, these materials are designed to make your outreach simple, accurate, and impactful.

Key Talking Points

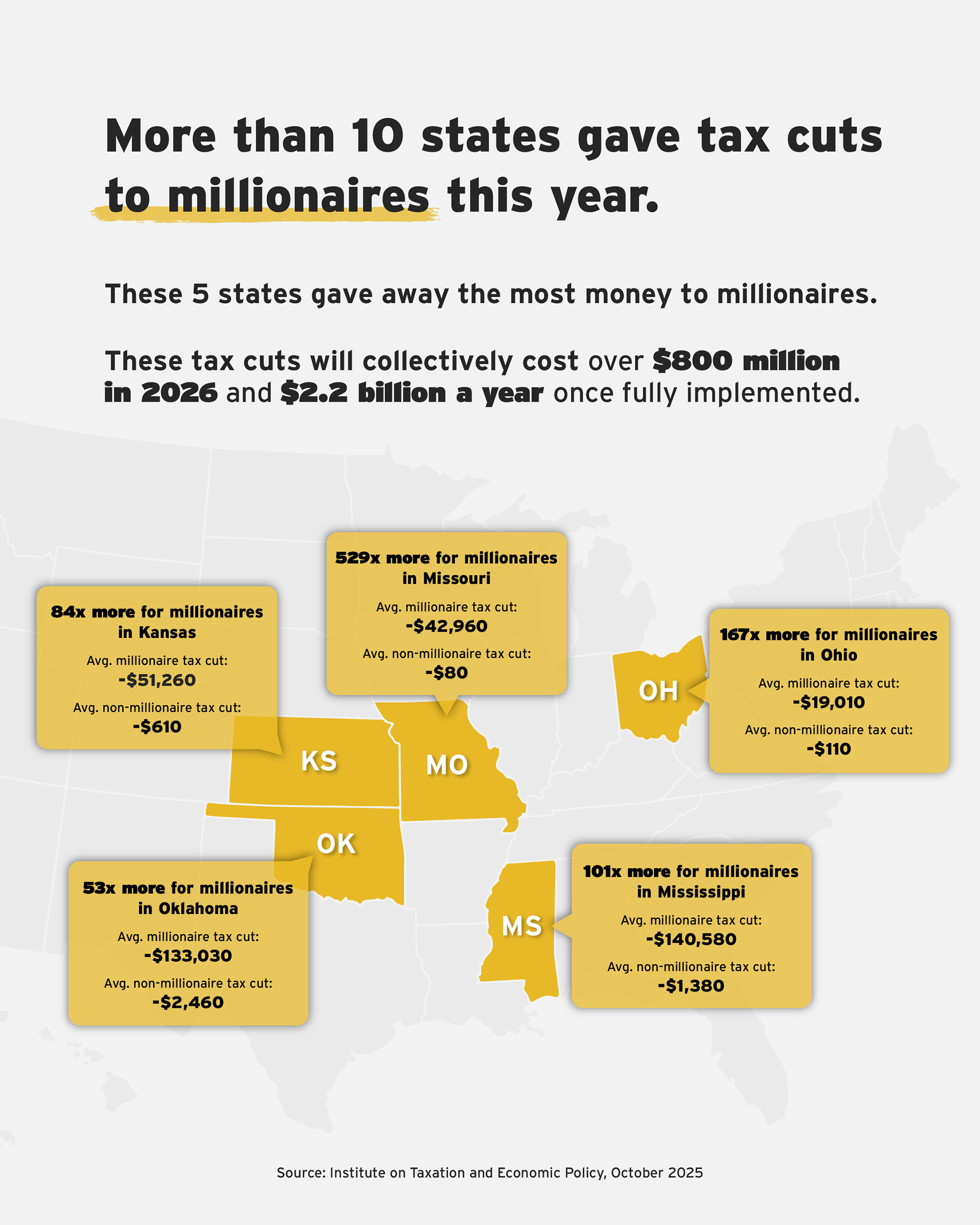

Public opinion polling shows that just 12 percent of the American public thinks that taxes on rich families are too high today. But lawmakers in several states are charging ahead with deep tax cuts for those affluent families anyway. The five states that enacted the largest personal income tax cuts for millionaires in 2025 are Kansas, Mississippi, Missouri, Ohio, and Oklahoma.

Combined, these tax cuts for millionaires—defined here as families with over $1 million of annual income—will cost more than $800 million in 2026 and $2.2 billion a year once fully implemented.

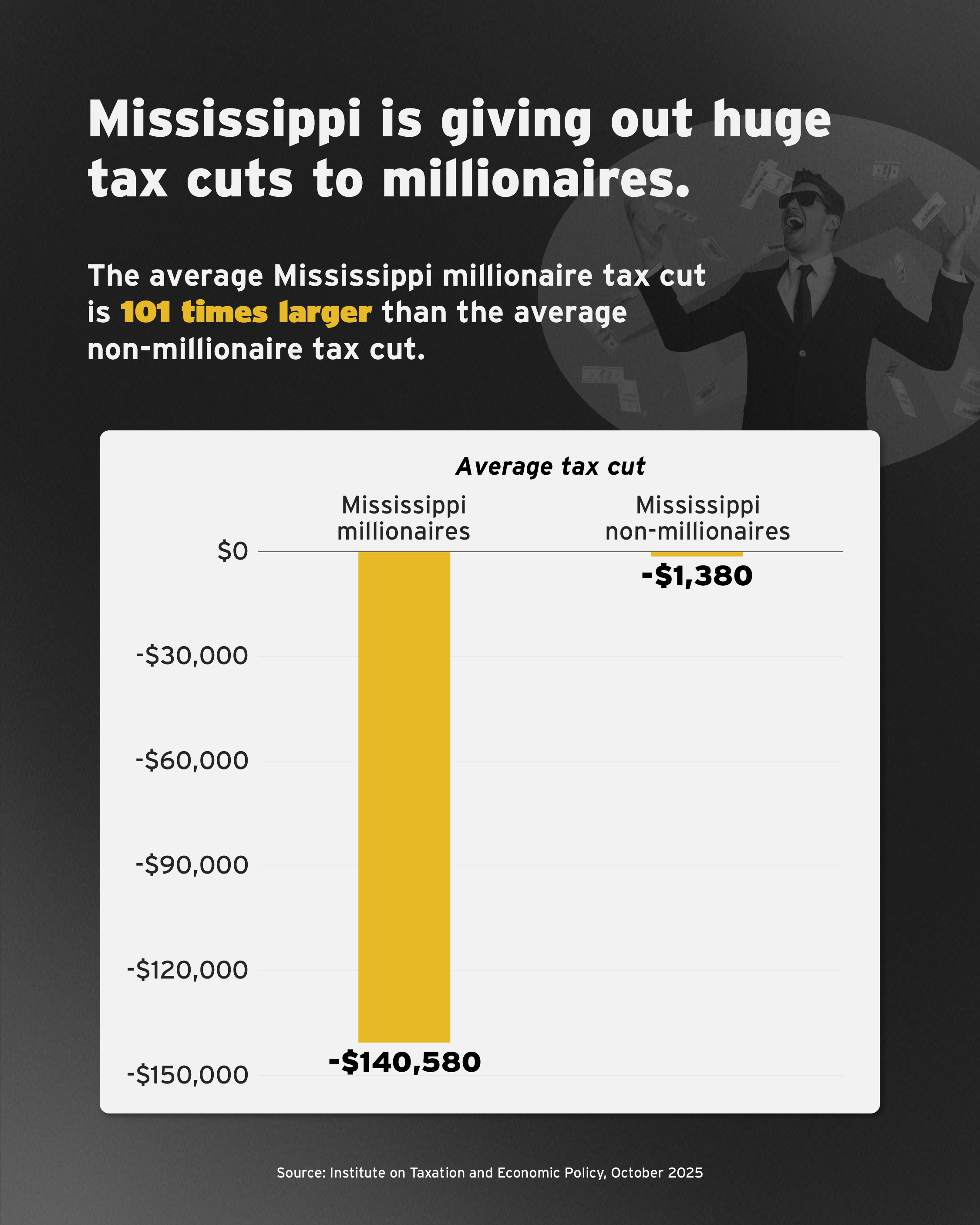

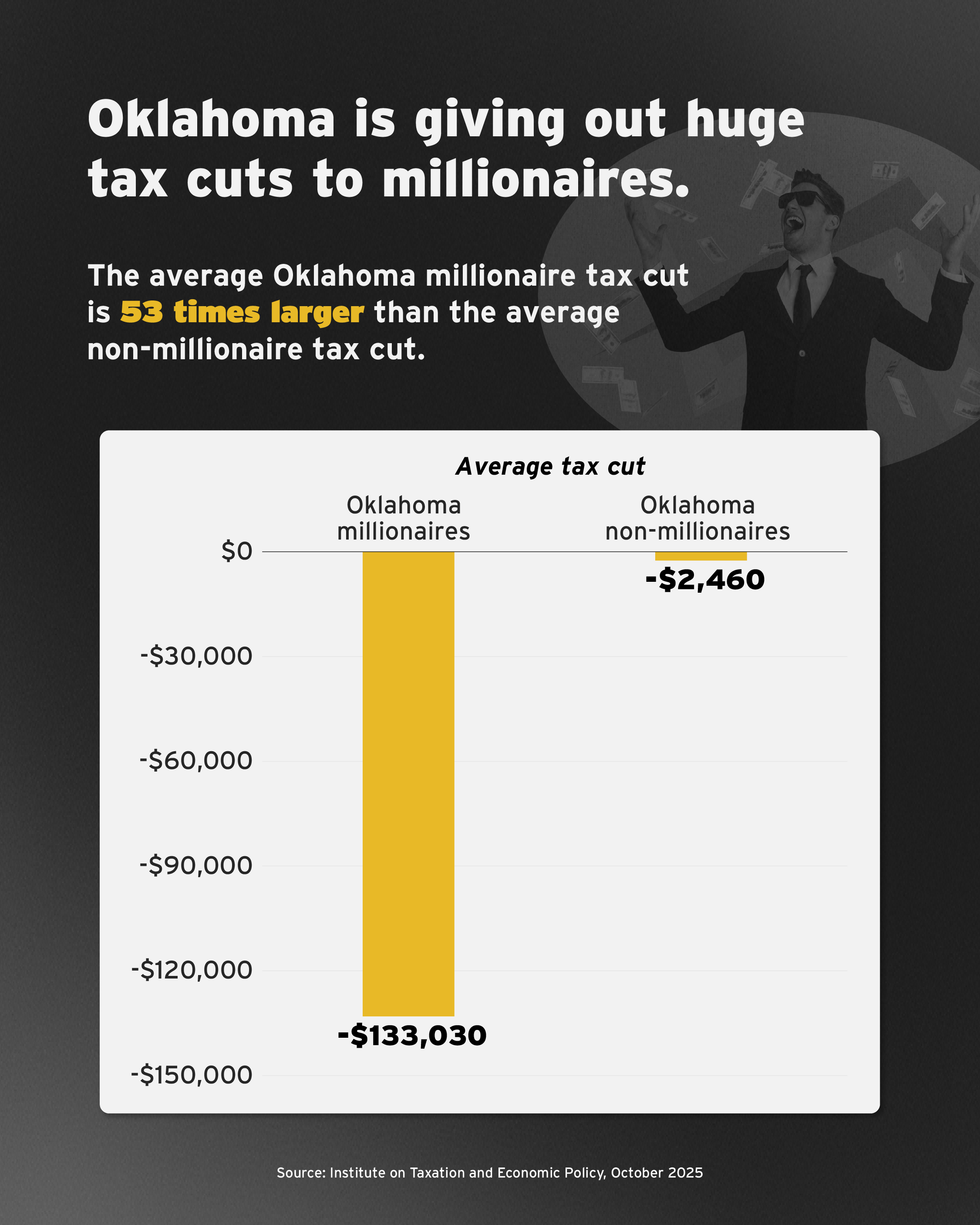

The largest millionaire tax cuts occurred in Mississippi and Oklahoma, where lawmakers voted to eliminate each state’s income tax over a series of years. Once those policies take full effect, millionaires in those two states will get $1.2 billion in tax cuts each year.

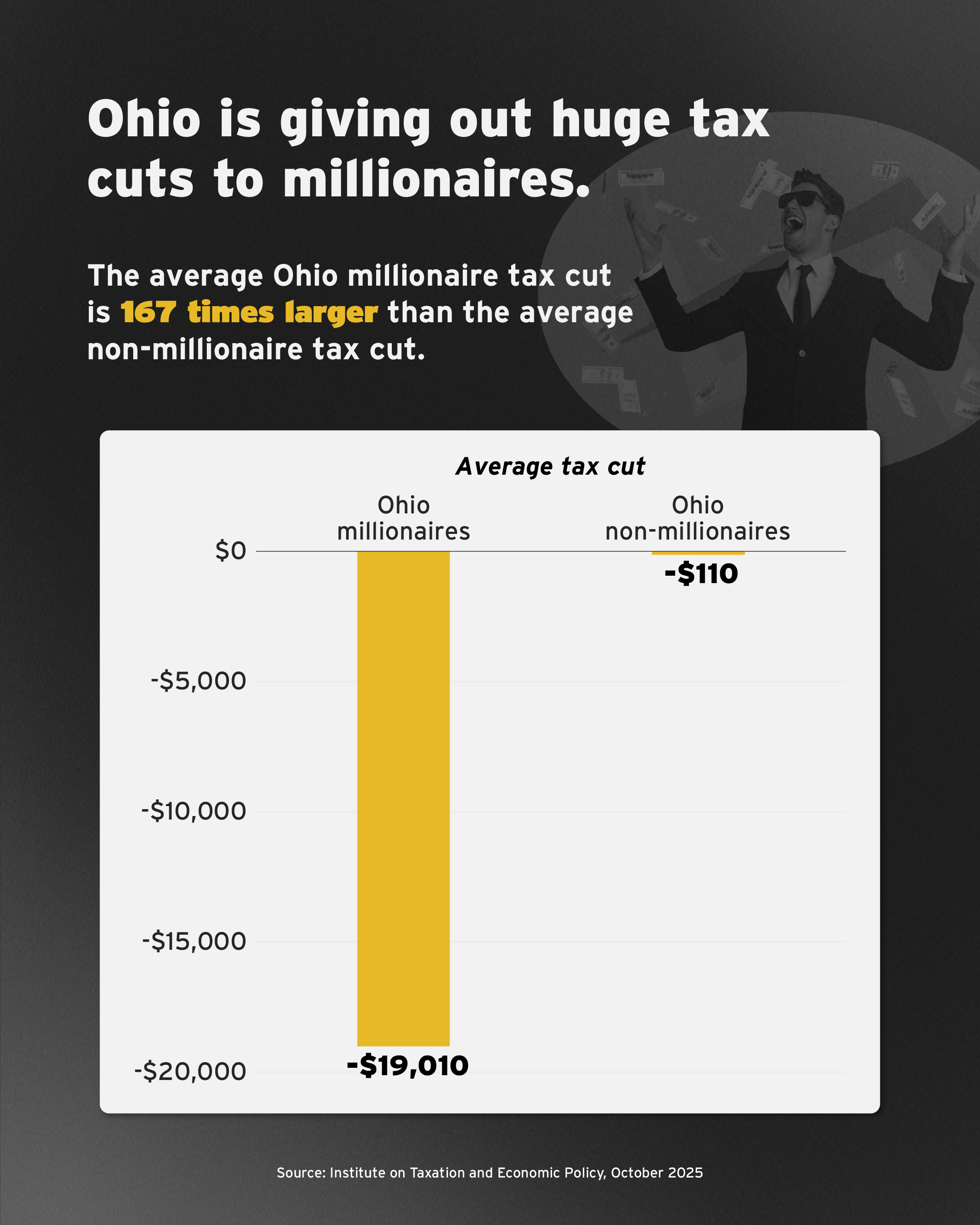

Once fully implemented, the average millionaire tax cut ranges from $19,000 a year in Ohio to more than $130,000 a year in Mississippi and Oklahoma.

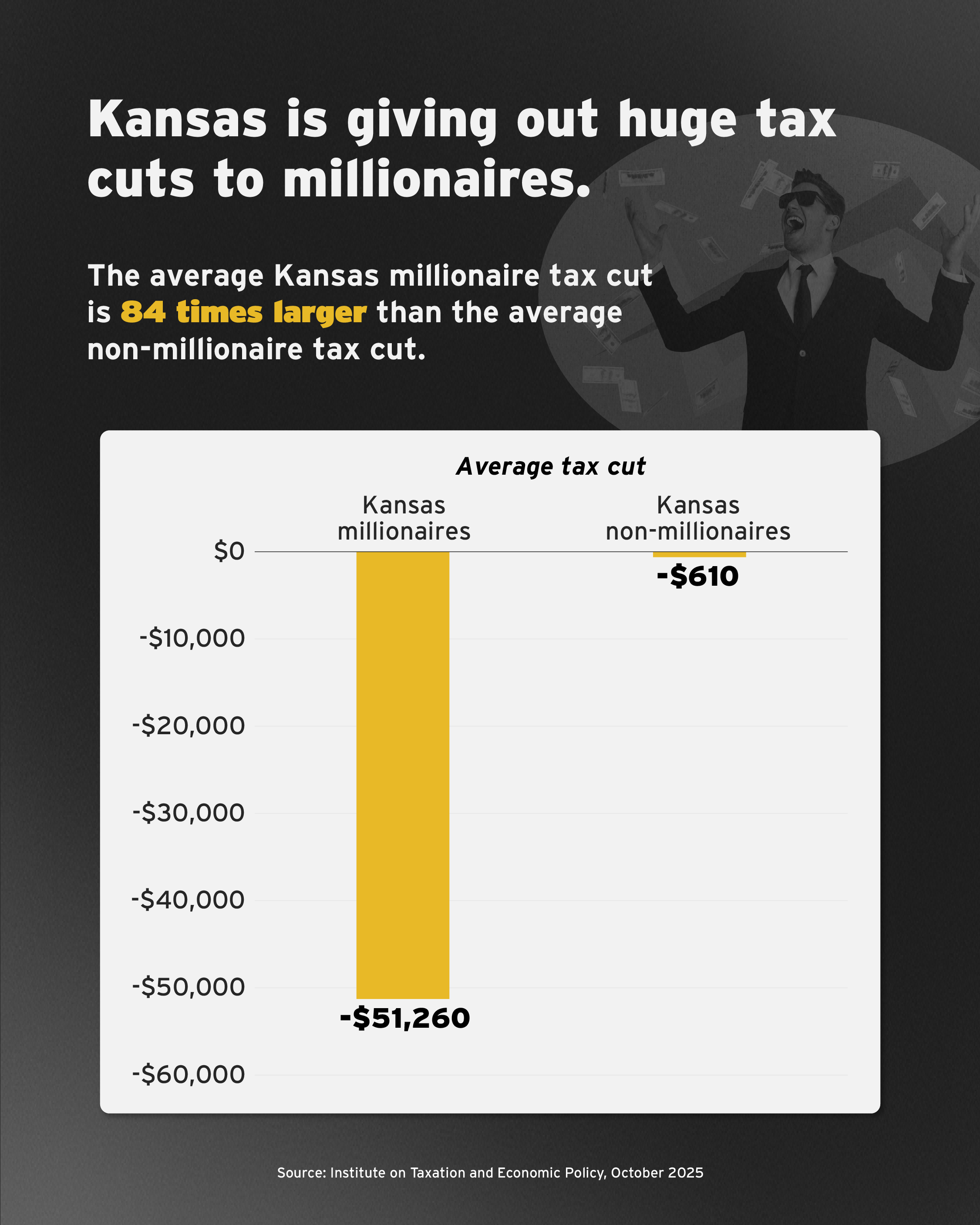

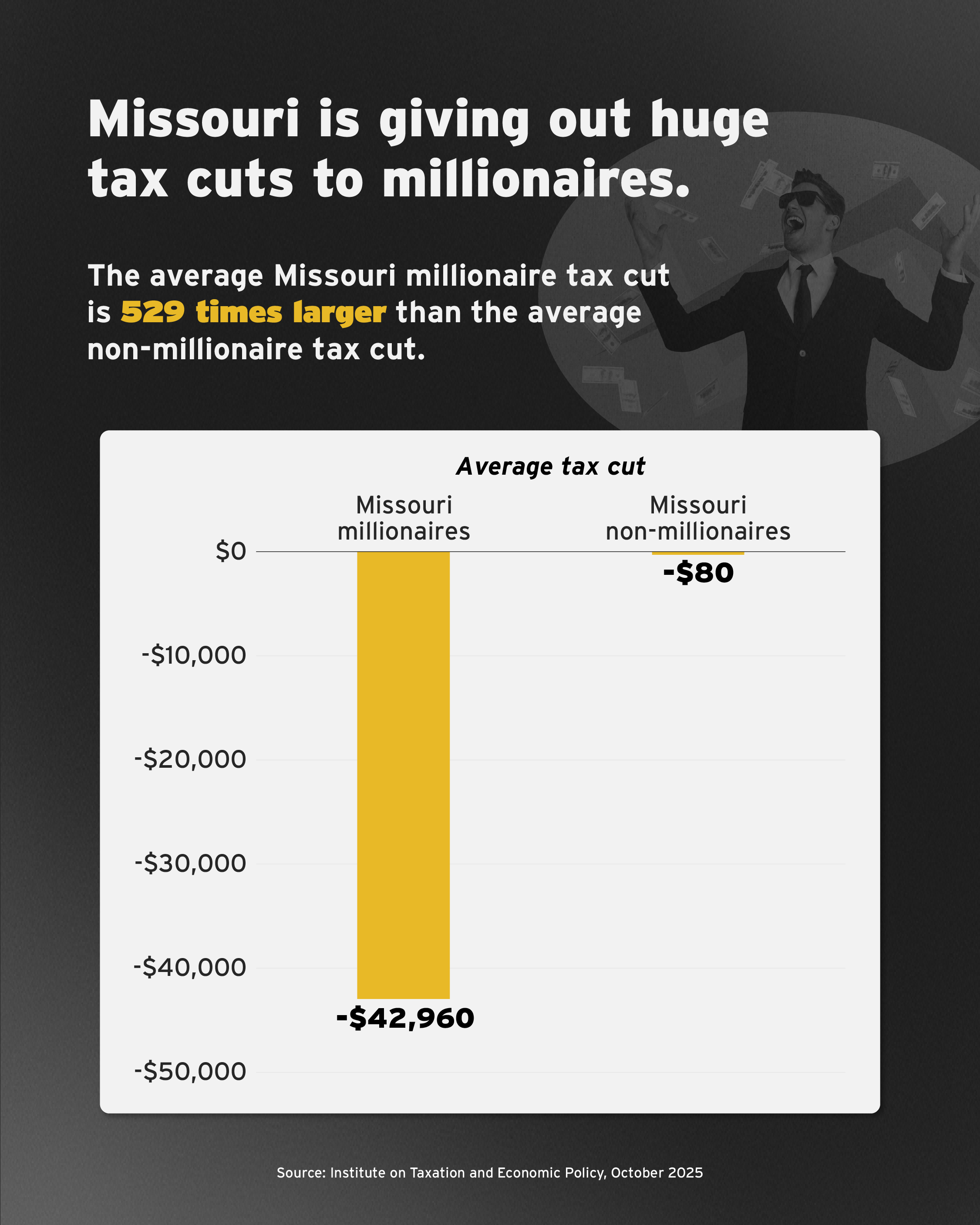

By any measure, all these tax cuts are dramatically skewed in favor of the richest in these states, with the average cuts for millionaires dwarfing those received by everyone else:

- The average millionaire tax cut is more than 50 times the size of the average cut for non-millionaires in each of the five states included in this report. In Mississippi and Ohio the average tax cuts for millionaires are over 100 times the size of those for non-millionaires. And in Missouri, where lawmakers decided to fully exempt a large share of wealthy families’ passive incomes, the millionaire cuts are a whopping 529 times larger than the average non-millionaire cut — almost $43,000 per millionaire compared to a paltry $80 on average for everyone else.

- Even though millionaires make up less than 0.5 percent of the population of these states, they take home over 60 percent of the total tax cut in Missouri, one-third of the cut in Ohio, and 20 percent of the cuts overall across the five states.

- The larger cuts for millionaires are not simply a product of their larger incomes: even when taken as a percentage of income, the cuts are larger for millionaires in every case.