Alaska Gov. Bill Walker recently proposed tripling the gasoline and diesel tax rates paid by Alaska motorists to generate funding for the state’s infrastructure. In a different state, tripling the motor fuel tax might be a radical policy change. But Alaska’s tax has not been updated since 1970 and because of those 47 years of procrastination, it now lags far behind the taxes levied in most other states. In fact, as ITEP explains in a new brief, Alaska’s motor fuel tax would remain below average even if Gov. Walker’s proposal to raise the base rate from 8 to 24 cents per gallon were enacted.

ITEP’s brief discusses four ways in which Alaska’s fuel tax is an outlier both compared to the taxes levied in other states, and compared to Alaska’s own history. Specifically, it finds that:

- Alaska’s tax rate on highway fuel (gasoline and diesel) is the lowest in the nation.

- Alaska has waited longer than any state since last updating its highway fuel tax rate.

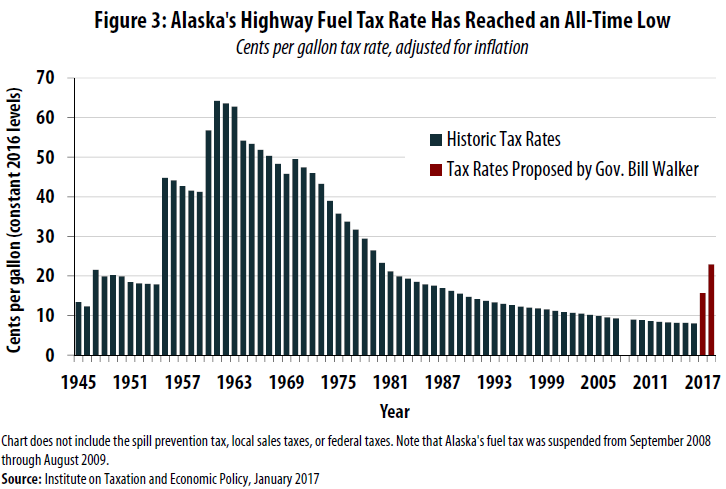

- Adjusted for inflation, Alaska’s tax rate on gasoline and diesel fuel has reached its lowest level in history.

- Alaska households are spending a smaller share of their earnings on state highway fuel taxes than at almost any time since Alaska became a state.