by The Anniston Star Editorial Board

Feb 04, 2013

A nonpartisan research organization in Washington, the Institute on Taxation and Economic Policy, says Alabama’s system of taxation was placed on its list of states with the most regressive tax systems.

Why are we not surprised?

For years, tax experts have told the state’s legislative leaders that over-reliance on sales and unfairly distributed income taxes places the heaviest tax burden on those least able to pay. It also creates an upside-down system that makes budgeting difficult and revenue often inadequate for the needs of a modern state. At the same time, groups and individuals who are concerned with the social consequences of this system have cited Scripture and verse condemning how our state treats the “least of these.”

Thus far, neither the economic nor the ethical argument has moved those who can change the system.

Here, once again, is how the system works.

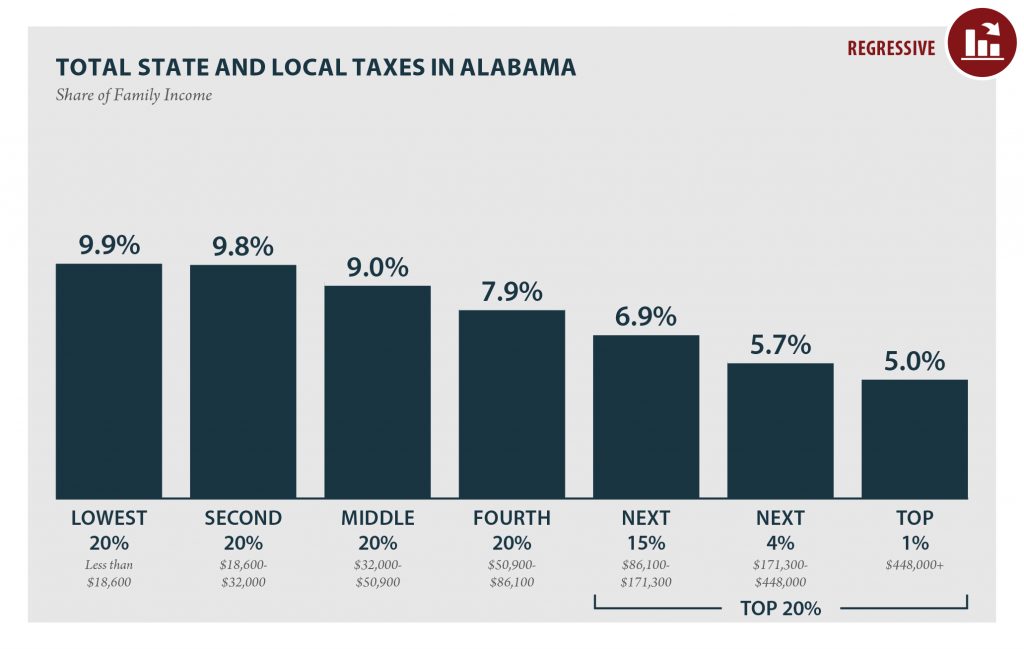

In Alabama, the bottom fifth of earners, those who make less than $16,000 annually, pay an average of 10.2 percent of their incomes in state and local income, property, sales and excise taxes. The middle fifth pays 9.6 percent. And the top 1 percent, those who make an average of $900,000 annually, write off their federal taxes and pay 3.8 percent of their income.

In other words, the overall tax rate for lowest-income Alabamians is 2.5 times higher than the middle fifth and 2.7 times higher than the top 1 percent.

This page has heard all the arguments against reforming this system. Those who benefit under it (and even some who don’t) will tell you that the over-reliance on sales taxes is fair because everyone pays something. Or they will tell you that the system is fair because the poor get more from this system — their taxes pay for services they use and the wealthy don’t. Or they will argue that because the middle- and upper-income earners pay more in dollars, the system is fair.

But what is fair?

Is it fair to tax groceries? Alabama is one of only three states that do that and gives no tax credit so that some of the tax can be recovered by the low-income taxpayer. Is it fair to tax other sales as high as we do? A low-income Alabamian pays seven times as much of their income in sales taxes than those in the top 1 percent. Is it fair that two-thirds of Alabama families pay at the state’s top income tax rate, but because we are one of the few states to allow deductions for federal income taxes, the richest households get the biggest tax cuts?

And is it fair to the people of this state that governors and legislators refuse to do anything about the unfairness of it all?

What is fair and what is unfair to the state of Alabama?

Those are the critical questions.