Key Takeaways

- Public opinion polling shows that just 12 percent of the American public thinks that taxes on rich families are too high today. But lawmakers in several states are charging ahead with deep tax cuts for those affluent families anyway. The five states that enacted the largest personal income tax cuts for millionaires in 2025 are Kansas, Mississippi, Missouri, Ohio, and Oklahoma.

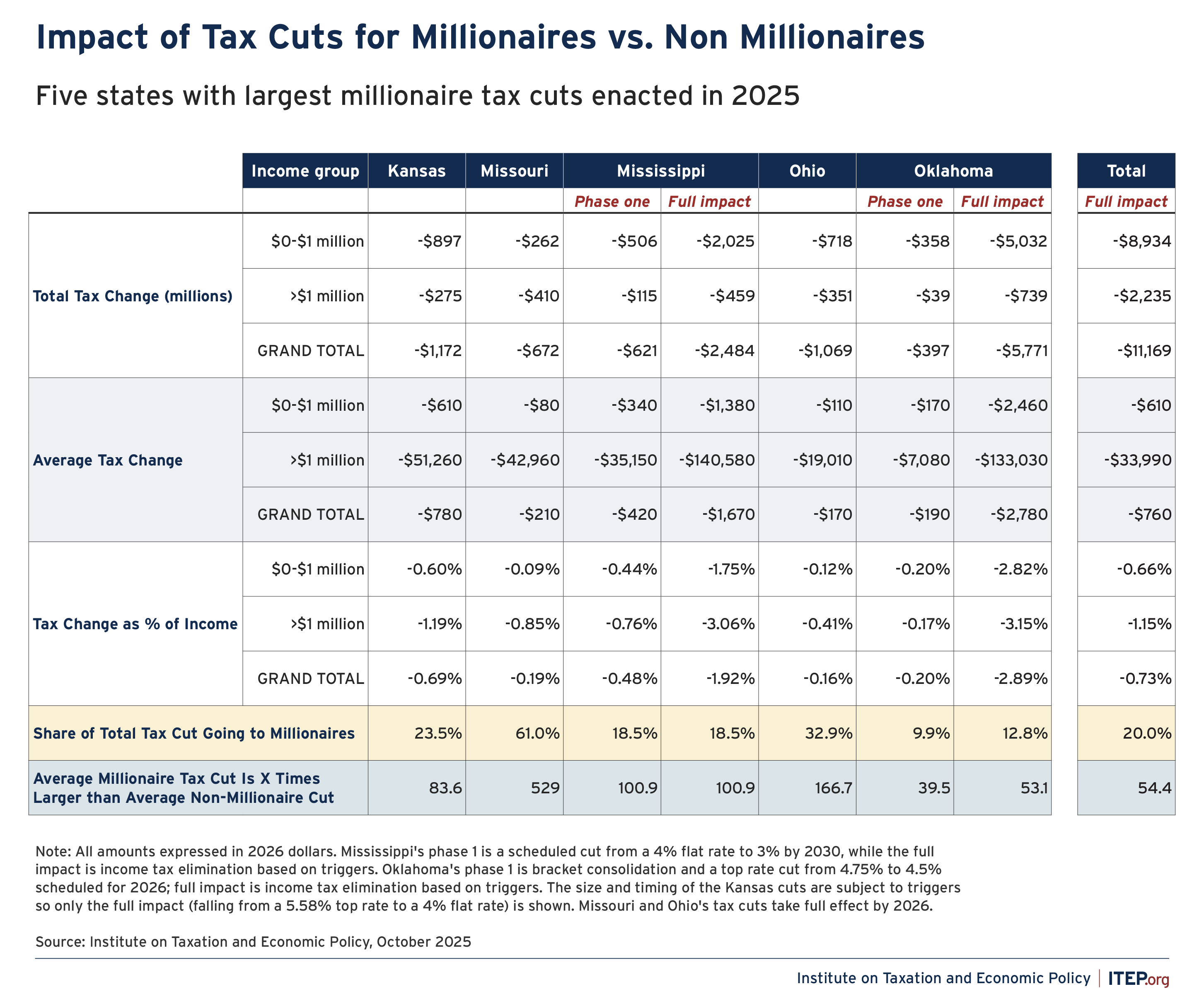

- Combined, these tax cuts for millionaires—defined here as families with over $1 million of annual income—will cost more than $800 million in 2026 and $2.2 billion a year once fully implemented.

- The largest millionaire tax cuts occurred in Mississippi and Oklahoma, where lawmakers voted to eliminate each state’s income tax over a series of years. Once those policies take full effect, millionaires in those two states will get $1.2 billion in tax cuts each year.

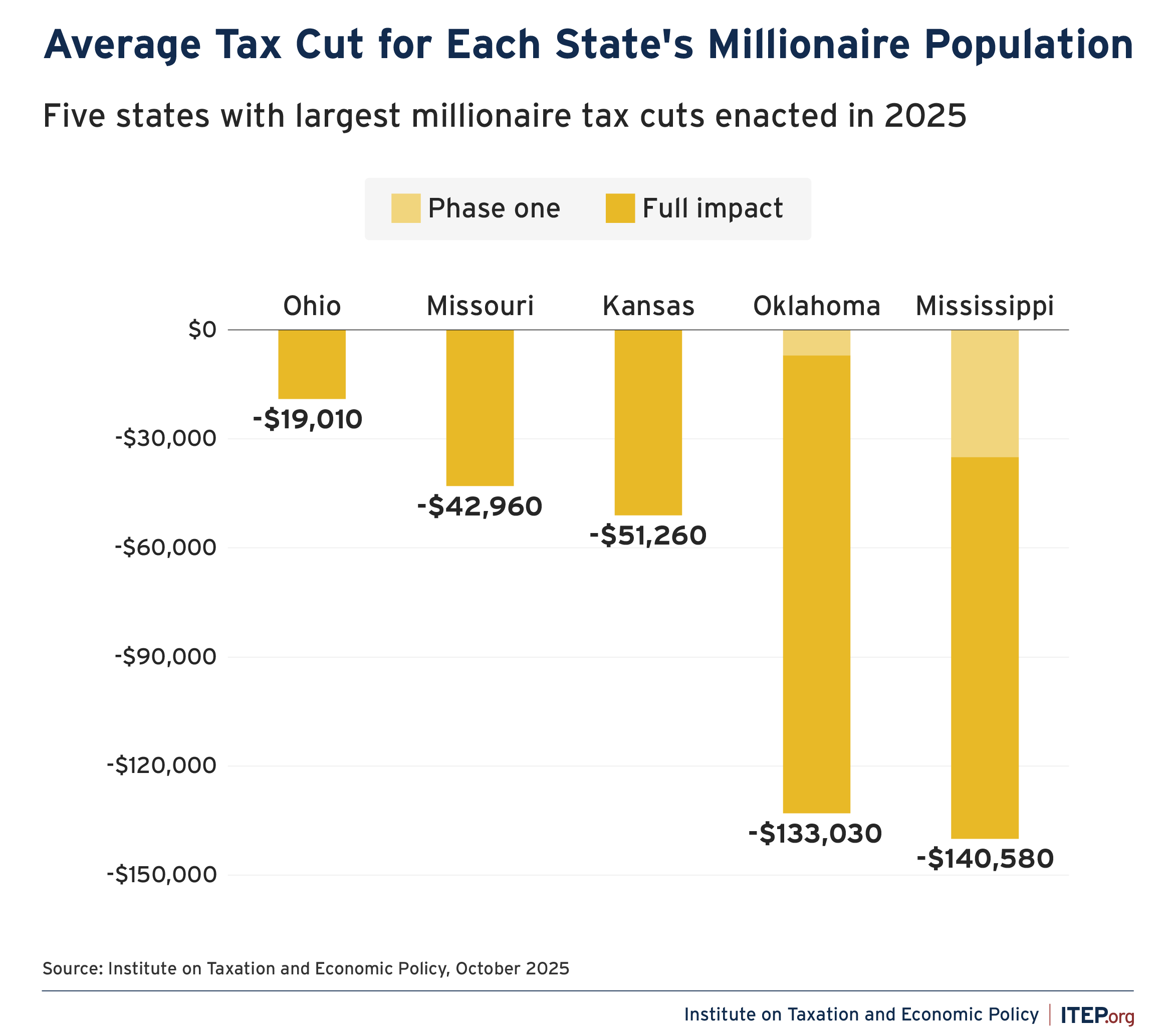

- Once fully implemented, the average millionaire tax cut ranges from $19,000 a year in Ohio to more than $130,000 a year in Mississippi and Oklahoma.

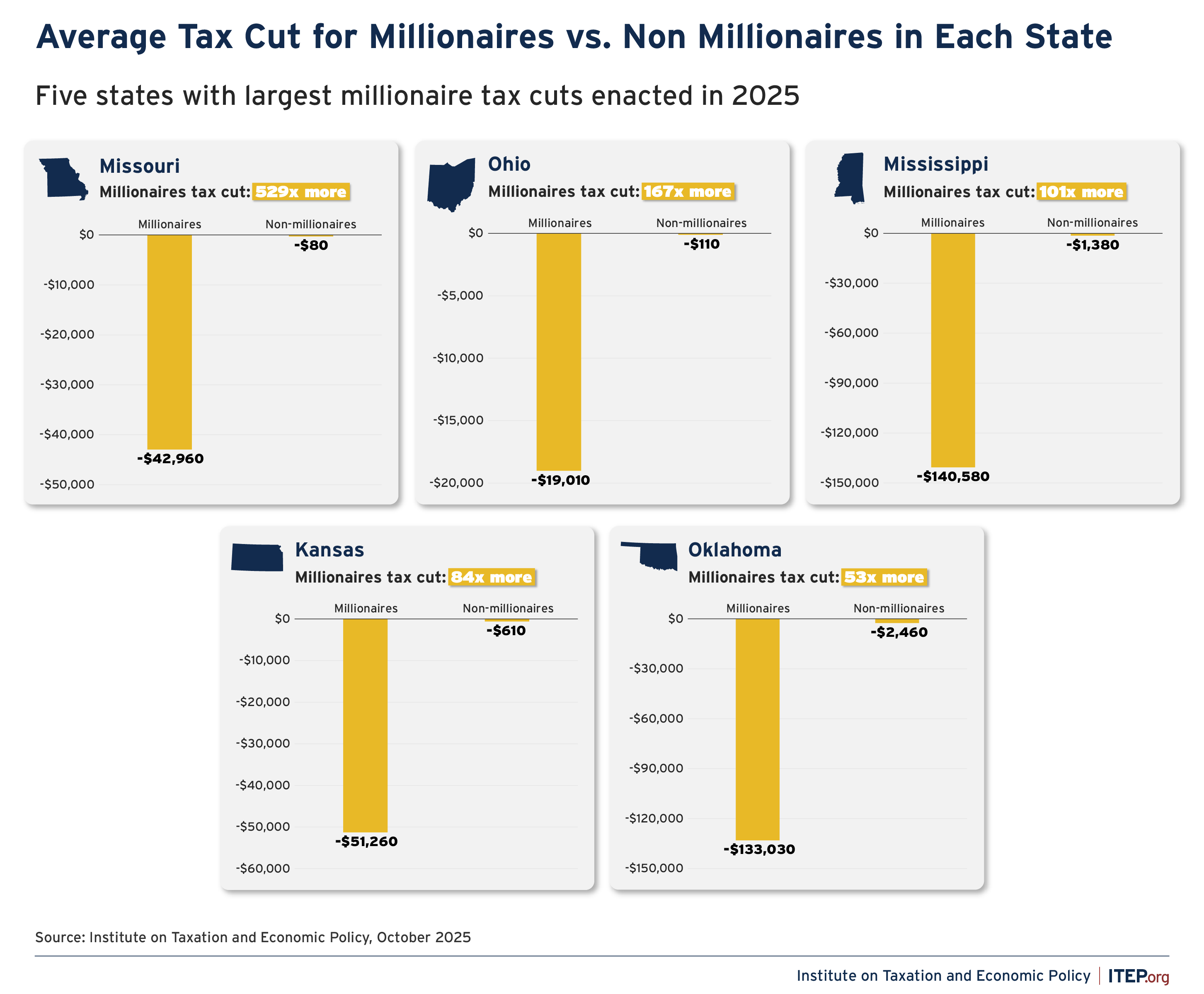

- By any measure, all these tax cuts are dramatically skewed in favor of the richest in these states, with the average cuts for millionaires dwarfing those received by everyone else:

- The average millionaire tax cut is more than 50 times the size of the average cut for non-millionaires in each of the five states included in this report. In Mississippi and Ohio the average tax cuts for millionaires are over 100 times the size of those for non-millionaires. And in Missouri, where lawmakers decided to fully exempt a large share of wealthy families’ passive incomes, the millionaire cuts are a whopping 529 times larger than the average non-millionaire cut — almost $43,000 per millionaire compared to a paltry $80 on average for everyone else.

- Even though millionaires make up less than 0.5 percent of the population of these states, they take home over 60 percent of the total tax cut in Missouri, one-third of the cut in Ohio, and 20 percent of the cuts overall across the five states.

- The larger cuts for millionaires are not simply a product of their larger incomes: even when taken as a percentage of income, the cuts are larger for millionaires in every case.

Prioritizing Millionaires During Tough Times

The new Trump tax law will hand the top 1 percent of American taxpayers a grand total of $1 trillion in tax cuts over the coming decade, including an average tax cut per filer of more than $66,000 in 2026 alone.1 Even though the American public consistently opposes big tax cuts to the wealthy, some state lawmakers have chosen to double down on them with new state tax laws that benefit millionaires over everyone else.2

Our review of state tax legislation enacted across the country this year finds that lawmakers in Kansas, Mississippi, Missouri, Ohio, and Oklahoma have enacted the largest state income tax cuts for millionaires this year. This is despite the fact that just 12 percent of the American public says that rich families are paying too much in taxes today.3

These costly and regressive tax cuts are especially alarming in light of the long list of economic and policy realities beginning to weigh on states. Revenue growth has slowed just as federal budget cuts have shifted enormous new costs to states, and tariffs have begun inflating those costs and slowing economic growth. A reasonable response to these pressures, as we’ve seen begin to play out in a handful of states, is to pursue cautious budgeting, roll back recent tax cuts, and explore new revenue-raising measures. These approaches can shield essential services and protect vulnerable populations from damaging cuts.

The states highlighted in this brief, however, have chosen to ignore these fiscal realities, instead enacting large tax cuts that overwhelmingly benefit their richest residents. When taken together and fully implemented, choices made this year by lawmakers in Kansas, Mississippi, Missouri, Ohio, and Oklahoma will cut millionaires’ income tax bills by $2.2 billion a year.4

The tax cuts enacted in Mississippi and Oklahoma, in particular, are shockingly generous toward millionaires. Fully eliminating these states’ individual income taxes over time will result in average annual tax cuts for millionaires of $141,000 and $133,000, respectively. Those cuts are 101 times (in Mississippi) and 53 times (in Oklahoma) larger than the tax cuts non-millionaires will receive.

Once fully implemented, the average millionaire tax cut ranges from $19,000 a year in Ohio to more than $141,000 a year in Mississippi.

Figure 1

By any measure, the cuts in each of these five states are dramatically skewed in favor of the richest, benefiting millionaires over everyone else. The average millionaire tax cut is more than 50 times the size of the average cut for non-millionaires in each of the five states. The average tax cuts in Ohio and Mississippi are 167 and 101 times, respectively, larger than the average cuts for non-millionaires. In Missouri, the unprecedented decision to fully eliminate taxes on capital gains that wealthy families receive when selling their assets results in an average tax cut for millionaires that is 529 times larger than the average received by non-millionaires.

Figure 2

Despite millionaires making up no more than roughly 0.5 percent of the population in any of these states, they take home over 60 percent of the tax cut in Missouri, one-third of the tax cut in Ohio, and 20 percent of the cuts overall across the five states. These larger cuts are not just a product of outsized incomes. Even when taken as a percentage of income, the cuts are larger for millionaires in every case (see Table 1).

2025 State Income Tax Cuts

During 2025 state legislative sessions, 13 states cut personal income taxes through lower rates or steeper carveouts for specific types of income.5 Of those, the five states offering the largest tax cuts for millionaires pursued a mix of changes: enacting a long-run path to full individual income tax elimination (Mississippi and Oklahoma), shifting toward flat-rate individual income taxes (Kansas and Ohio), and eliminating tax on income from capital gains (Missouri). More detailed descriptions of these policy changes are provided below.

Kansas

Legislators passed Senate Bill 269 then overrode Gov. Laura Kelly’s veto of the bill to pass their new millionaire tax cut. The new law will, through triggered reductions, ultimately bring the state’s graduated individual and corporate income taxes to flat rates of 4 percent, down from the current respective top rates of 5.58 and 7 percent. Future reductions in tax rates will go into effect when income tax collections exceed Fiscal Year 2024 revenues plus the rate of inflation. This approach conceals the fiscal impact of moving to a flat tax, but the full impact of the income tax cuts is estimated to cost the state more than $1 billion a year.

Mississippi

Gov. Tate Reeves signed into law House Bill 1 which will, over time, fully eliminate the state’s individual income tax. The new law phases down the state’s personal income tax rate from 4 to 3 percent by 2030 (phase one) and then further reduces the rate, ultimately to zero, using triggered reductions.6 The final legislation also reduces the state’s sales tax on groceries from 7 to 5 percent and increases the gas tax from 18.4 to 27.4 cents over three years. When fully implemented, the policy is expected to reduce state revenues by about $2.5 billion a year.

Missouri

Gov. Mike Kehoe signed House Bill 594 directing the state to continue taxing wages and salaries while fully exempting the income that wealthy people receive from their assets as capital gains. The policy, which was retroactively enacted to eliminate taxes on income from capital gains back to January 2025, prioritizes affluent families enjoying passive income over working-class families earning wages from work or living off the returns generated in their retirement accounts. This move makes Missouri the first state in the nation to eliminate this tax, resulting in an annual revenue loss of more than $600 million.7

Ohio

Gov. Mike DeWine’s signing of House Bill 96 moves the state toward a flat rate income tax by 2026. The new law cuts the top income tax rate that begins at taxable incomes of $100,000 from 3.5 to 3.125 percent in the first year and then, in the second year, eliminates the top bracket – taxing all income over $26,050 at a lower 2.75 percent flat rate. This change is estimated to cost the state more than $1 billion in annual lost revenue.

Oklahoma

Gov. Kevin Stitt signed House Bill 2764 which immediately decreases the state’s top personal income tax rate from 4.75 to 4.5 percent and eliminates three of the state’s six tax brackets. After that, additional tax cuts will be triggered in future years if certain revenue requirements are met – until the rate reaches zero. Because the legislative language only affects the rate and appears to leave the state’s tax credits for modest income families in place, our analysis assumes they are retained. If those credits are eliminated with the rest of the income tax, the uber wealthy would receive even more of the bill’s proceeds than what we find here.

These new tax cuts for millionaires are occurring against a backdrop not just of deep federal tax cuts for the wealthy, but also of state tax systems that already tend to favor the wealthiest families. When looking at the overall tax systems in place in each of the five states highlighted in this brief, all five already taxed their highest-income taxpayers at lower rates than other families prior to enactment of the legislation analyzed here.8 In other words, when income taxes, sales taxes, property taxes, and various other levies are taken into consideration, the rich were already paying lower rates than middle-class and working-class families prior to 2025. These new tax changes will only make that reality worse.

Figure 3

Methodology

The analysis considers only personal income tax changes enacted in 2025. All results are expressed in 2026 dollars. Unless otherwise stated, this analysis shows the effects of fully implemented tax policies. Legislative changes in every state were reviewed and preliminary modeling was conducted in the 13 states with income tax cuts to identify the five with the largest cuts for millionaires for more detailed analyses.

For purposes of this analysis, a millionaire is defined as a tax filer with at least $1 million in Federal Adjusted Gross Income (AGI). Data from the Internal Revenue Service, Congressional Budget Office, and ITEP’s Microsimulation Tax Model were used to estimate the number of millionaires and average millionaire income in each state in 2026.9

The proposed cuts were then modeled relative to existing law prior to 2025 legislative sessions in each state and disaggregated into effects on millionaires and effects on non-millionaires.

Endnotes

- 1. Carl Davis. “Top 1% to Receive $1 Trillion Tax Cut from Trump Megabill Over the Next Decade,” Institute on Taxation and Economic Policy, July 7, 2025. Steve Wamhoff et al. “Analysis of Tax Provisions in the Trump Megabill as Signed into Law: National and State Level Estimates,” Institute on Taxation and Economic Policy, July 22, 2025.

- 2. Joseph J. Thorndike. “Grim Polls for the GOP Budget Bill,” taxnotes, June 30, 2025. Sona Wyse et al. “When tax laws defy public opinion: What OBBBA reveals,” Brookings, August 19, 2025.

- 3. Jeffrey M Jones. “U.S. Perceptions of ‘Fair’ Income Taxes Hold Near Record Low,” Gallup, April 8, 2025.

- 4. Unless otherwise stated, this analysis shows the effects of fully implemented tax policies.

- 5. Those states are Georgia, Idaho, Kansas, Kentucky, Mississippi, Missouri, Montana, New York, Ohio, Oklahoma, Utah, Vermont, and Wisconsin.

- 6. Neva Butkus et al. “A Windfall for the Wealthy: A Distributional Analysis of Mississippi HB 1,” Institute on Taxation and Economic Policy, April 8, 2025.

- 7. Carl Davis. “Missouri is Sleepwalking into a Half-Billion Dollar Tax Cut for the Rich,” Missouri Independent, April 22, 2025.

- 8. Institute on Taxation and Economic Policy. “Who Pays? Seventh Edition,” January 2024.

- 9. See Institute on Taxation and Economic Policy. “ITEP Tax Microsimulation Model Overview.”