Worries about housing costs and property tax bills are leading people to check the history books for solutions, but there’s a danger that they’ll repeat past mistakes. If anti-tax lawmakers carelessly weaken property taxes as they did in the 1970s, they will undercut public finances, making municipalities, school districts, and other special districts worse off.

The first anti-tax revolt was kicked off more than 45 years ago, as stagflation led to higher prices, lower real wages, and growing property tax bills for huge swaths of homeowners. The most damaging of these property tax cuts was California’s Proposition 13, which passed in 1978 with four major legs:

- Rolling back property values to 1975-1976 valuations

- Limiting total taxing district levies to 1 percent of total assessed valuation

- Limiting increases in annual assessments to 2 percent except in the case of property sales

- Requiring a supermajority vote of two-thirds to pass any new local taxes or pass municipal bond offerings

Parts of this have been amended over the years, but the core is intact. According to Michael Graetz’s recent book The Power to Destroy, since 1978, California local governments have lost over $1 trillion in estimated revenues due to these caps. School districts in California suffered nearly 50 percent cuts in revenues in the immediate aftermath. (State and federal aid eventually made up for some of the loss in revenues.) And nearly three-quarters of the tax cut went to commercial property owners, particularly big businesses.

Among homeowners, the law has distorted behavior, making it impossible for many to move, which would remove their property tax advantage. This means that long-term owners are paying property tax bills much lower than neighbors on the same block who bought their properties more recently. California has also extended Prop 13 cuts to heirs – children and grandchildren – which means that some current homeowners may be paying taxes based on 2 percent growth of 1975 dollars – far less than the 700 percent increase in property values in the state.

Prop 13 has also contributed to the state’s housing shortage, as declining property tax revenues led municipalities to seek revenue from sales and hotel taxes, leading to the proliferation of retail and hotel properties at the expense of housing development. In addition, it took the power of taxation out of the hands of municipalities and handed it to the state. While California has one of the most progressive income taxes in the country, it has knee-capped municipalities which now must rely on other forms of taxation.

Additional research has also shown that ratings agencies tend to give lower grades to municipalities and states with particularly strong caps on revenue-raising. This means municipal borrowing gets more expensive in the long run when states have stricter tax and expenditure limits like Prop 13. Expensive infrastructure projects, like building schools, also then end up costing more. In California, issuing bonds became politically prohibitive, leading to the proliferation of Certificates of Participation and the creation of the Mello-Roos bonds.

As a result, Prop 13 has become the albatross around California’s neck. The “third rail” of California politics has tied the hands of elected officials up and down the state. The right-wing coalition that argued for its passage saw none of the shrinkage of government they wanted, and lower-income parts of the state have crushing sales tax rates to make up the gap.

States across the country followed California’s lead and passed similar legislation, including the Headlee Amendment in Michigan and Prop 2 ½ in Massachusetts. Research from Isaac William Martin in The Permanent Tax Revolt showed that between 1978 and 1990, 19 states created new tax caps like Prop 13.

So why are some people advocating for this kind of thing again? There are some economic similarities between the 1970s and today. In the wake of the Covid-19 pandemic, home prices skyrocketed, inflation increased precipitously, and wages were perceived to be stagnating. Not quite stagflation, but certainly unpleasant for taxpayers.

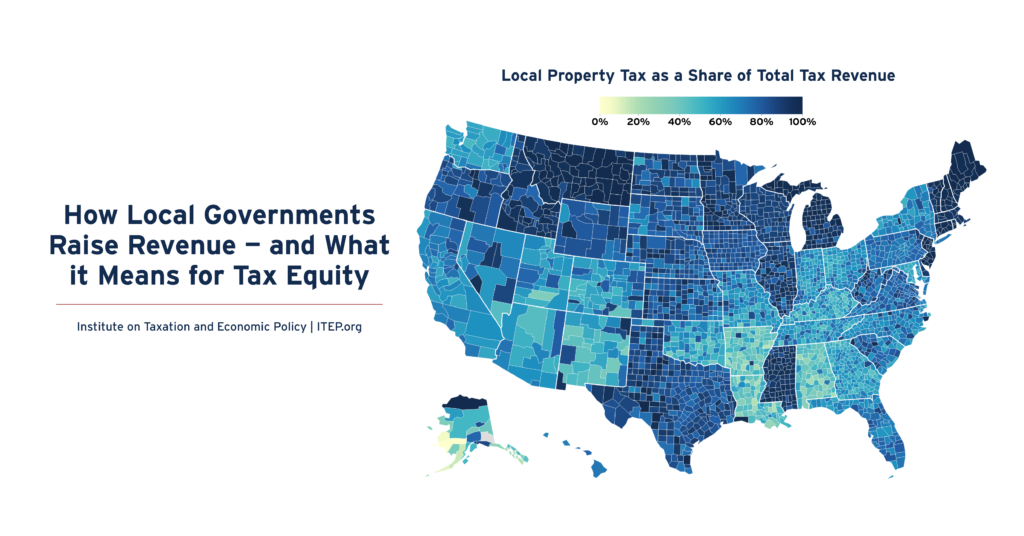

Though the American Rescue Plan Act filled in some municipal revenues, the temporary funds had to be designated by the end of 2024. Municipalities will be on the hook for new costs and ongoing funding disagreements suggest the federal government cannot be a reliable source of revenue in years to come. Since property taxes make up the largest revenue source for 93 percent of all local governments in the country, homeowners and businesses will be on the hook for those new costs.

As a result, anti-tax lawmakers and advocates across the country are floating new tax caps or rollbacks that look an awful lot like Prop 13. Proposals in Kansas, Missouri, Montana, Ohio, North Dakota, Texas, and Wyoming all include things like caps on assessment growth, rollback of assessed values, or limits on the spending of local governments.

These proposals can be popular with voters, who think they might protect their wallets and their properties. But they would lead to a massive loss in revenue for local governments that safeguard our water and health programs, pay our first responders, and maintain our streets, sidewalks, and buses. School districts will suffer the most, as they are overwhelmingly reliant on property taxes nationwide. We all pay taxes because we all benefit from what they pay for. Government is not something that exists for the benefit of someone else.

What’s more, many of these states lack the robust income tax structure that California has, adding uncertainty to where municipalities will make up the money.

Homeowners are understandably frustrated about the cost of housing, and long-term residents may see this as a commonsense solution. Proponents of this system may even say this protects long-term residents from newer, richer residents. But all this does is make everything more unaffordable for everyone. Every dollar saved by long-term residents is another dollar owed by families who had the misfortune of buying later.

States and municipalities interested in trying to keep long-term residents in their homes have better options. Circuit breakers enable low-income owners and renters of all ages can stay in their homes, while preserving revenue for municipalities and school districts. Other options include split rate taxation or vacancy taxes on properties like second homes, short-term rentals, and other types of vacation properties. These alternatives can incentivize long-term rentals and reduce speculative investing.