News Releases

New Report Shows Romney Child Tax Credit Proposal Falls Short for Low- and Moderate-Income Families

September 9, 2022 • By ITEP Staff

Plan Would Leave 1 in 4 Children Worse Off Compared to Current Law and Help Half as Many Low-Income Children as the 2021 Expansion of the Credit Washington, D.C. — With pressure mounting on lawmakers to find a way forward for expanding the Child Tax Credit, Sen. Mitt Romney’s CTC proposal is being pushed as […]

ITEP: Inflation Reduction Act is Biggest Corporate Tax Reform in Decades

August 12, 2022 • By Amy Hanauer

Amy Hanauer, Executive Director of the Institute on Taxation and Economic Policy, issued the following statement on “The Inflation Reduction Act (IRA) of 2022,” the reconciliation bill passed today by the House of Representatives. “Today Congress signed off on the biggest corporate tax reform in decades as part of a bill that will provide a […]

Inflation Reduction Act Will Increase Tax Fairness, Reduce Inequality

August 7, 2022 • By Amy Hanauer

Amy Hanauer, Executive Director of the Institute on Taxation and Economic Policy, issued the following statement on “The Inflation Reduction Act (IRA) of 2022,” the reconciliation bill passed today by the Senate. “Today we made remarkable progress for America’s tax and climate policy. The IRA reduces corporate loopholes, collects revenue from those who defy tax […]

ITEP: Reconciliation Deal Represents “Transformational Change” for U.S. Tax Policy

July 28, 2022 • By Amy Hanauer

Amy Hanauer, Executive Director of the Institute on Taxation and Economic Policy, issued the following statement on “The Inflation Reduction Act of 2022,” the reconciliation bill announced yesterday by Senate Democrats. “This is a transformational change for U.S. tax and energy policy. The bill restores sorely needed and long-overdue accountability to our tax code. By […]

ITEP: Tax and Climate Provisions Are What Americans Want and Need

July 15, 2022 • By Amy Hanauer

In response to conflicting reports on negotiations with Sen. Joe Manchin of West Virginia on tax increases and climate provisions, Amy Hanauer, ITEP Executive Director, released the following statement: Sen. Joe Manchin may be uncertain about higher taxes on the rich and corporations, but the American people are not. Large majorities of Americans support the tax […]

ITEP Statement on Biden Administration’s Billionaire Minimum Income Tax Plan

March 28, 2022 • By ITEP Staff

The following is a statement from Amy Hanauer, executive director of the Institute on Taxation and Economic Policy, on the Biden administration’s inclusion of a Billionaire Minimum Income Tax in its latest budget proposal: “Creating a Billionaire Minimum Income Tax would ensure for the first time that the very wealthiest people in this country, those […]

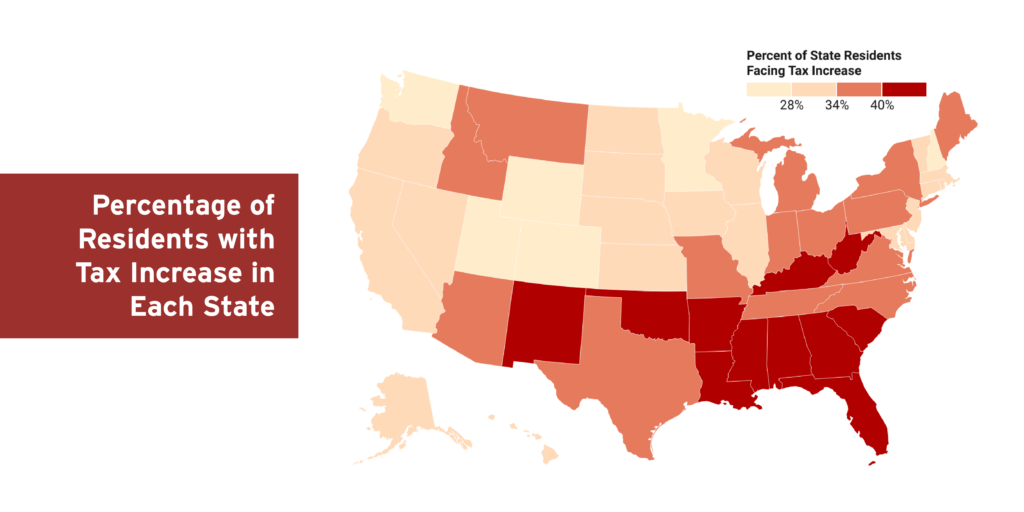

New 50-State Analysis: Poorest Two-Fifths Would Bear the Brunt of Sen. Rick Scott’s Proposed Tax Increase

March 7, 2022 • By ITEP Staff

“Billionaires are getting richer, and some of them are altogether avoiding taxes or paying a tiny percentage relative to their income and wealth. The 2017 tax law further worsened inequality by giving huge tax breaks to the rich. It’s inconceivable that a lawmaker would propose to single out the most vulnerable households for higher taxes.” --Steve Wamhoff

House Passage of Build Back Better Bill Moves America’s Tax Code in the Right Direction

November 19, 2021 • By Amy Hanauer

The Build Back Better plan that the House passed today will transform the country and make our tax code more progressive, more equitable and better able to pay for crucial priorities.

ITEP Statement on President Biden Signing the Infrastructure Investment and Jobs Act

November 15, 2021 • By Amy Hanauer

America does better when we invest in our people, our places and our planet. The infrastructure bill that President Biden signed today will restore and strengthen our physical infrastructure, making repairs and improvements that are long overdue. Now Congress needs to take the next step and pass legislation that taxes wealthy people and corporations to pay for our care and climate infrastructure.

New Study: Increase in Working from Home Could Depress Commercial Real Estate Prices, Reduce Local Tax Revenue

November 4, 2021 • By ITEP Staff

Covid-19 dramatically altered how and where many employees work, a shift that could have a long-term negative effect on commercial real estate occupancy rates and, ultimately, on local governments’ tax revenue base, a new study reveals. The Impact of Work from Home on Commercial Property Values and the Property Tax in U.S. Cities concludes that even as the recovery strengthens, if […]

How State Income Tax Reforms Can Narrow the Racial Income and Wealth Gaps

October 4, 2021 • By ITEP Staff

This report is second in a series that will examine how state tax codes impact the racial income and wealth gaps and offer policy recommendations for addressing those inequities. Currently, all but five state tax systems are upside down, meaning they tax the top 1 percent at a lower rate than the poorest 20 percent. Longstanding economic and social injustices, including unequal access to education and job discrimination among other things, have created an economy in which white families are more likely to thrive and build wealth and be in the highest-income brackets. So, state tax systems that rely more on regressive…

New ITEP Report Reveals a Trove of Data that Support the Case for a Higher Corporate Tax Rate

September 17, 2021 • By ITEP Staff

Media contact A new report from ITEP highlights multiple data sets that reveal how U.S.-based multinational corporations are avoiding taxes and debunks claims that a higher tax rate would make firms less globally competitive. The report, Why Congress Should Reform the Federal Corporate Income Tax, comes as Congress is weighing a budget plan that would increase the statutory corporate […]

ITEP: House Ways and Means Revenue Proposals Are a Promising Start, Leave Some Crucial Work Undone

September 13, 2021 • By Amy Hanauer

Earlier this year, the Biden administration put forth a transformative tax proposal that would raise significant revenue, reduce corporate tax avoidance, and substantially increase taxes paid by the wealthiest individuals. The Ways and Means Committee has kept some of these important reforms but has diluted others in ways that would leave some of the work of tax reform undone.

New Report Outlines Less Costly Alternatives to SALT Repeal

August 26, 2021 • By ITEP Staff

Media contact Ever since former President Trump and the GOP-led Congress enacted a $10,000 cap on state and local tax (SALT) deductions in December 2017, federal and state lawmakers in the mostly “blue”, higher-income states that have more residents affected by the provision have been weighing measures to repeal the cap or provide state-level workarounds. Repealing the cap has made […]

ITEP Statement on AFL-CIO President Richard Trumka’s Death

August 5, 2021 • By Amy Hanauer

Following is a statement from Amy Hanauer, executive director of the Institute on Taxation and Economic Policy, regarding the death of AFL-CIO President Richard Trumka: “The board and staff of the Institute on Taxation and Economic Policy and Citizens for Tax Justice mourn the sad news of the loss of AFL-CIO President Richard Trumka. Mr. […]

Zero-tax Corporations Are a Problem and So Are Corporations that Pay Less Than Half

July 29, 2021 • By ITEP Staff

Media Contact Corporate tax avoidance is a perennial problem that is annually depriving the U.S. Treasury of tens of billions in needed revenue, a new report from the Institute on Taxation and Economic Policy (ITEP) reveals. The report, Corporate Tax Avoidance Under the Tax Cuts and Jobs Act (TCJA), finds that 39 corporations paid no federal taxes over the first three years of […]

ITEP: Bipartisan Infrastructure Deal Must Be Accompanied by Bolder Legislation

June 24, 2021 • By Amy Hanauer

Following is a statement by Amy Hanauer, executive director of ITEP, regarding the bipartisan deal announced today by senators and the White House. “While the bipartisan infrastructure deal announced today may do some good, on its own, it is not enough, as President Biden said today during a press briefing. Congress must also enact additional […]

ITEP: ProPublica’s Expose on Billionaires’ Taxes Is Another Wake-up Call

June 8, 2021 • By Amy Hanauer

The explosive ProPublica report released today confirmed what we have known for quite some time: the wealthy and powerful play by a different set of rules than the rest of us. Following is a statement by Amy Hanauer, executive director of the Institute on Taxation and Economic Policy, regarding the report: “ProPublica’s reporting today on the details of how 25 billionaires pay little to nothing in federal tax relative to their incomes is a wakeup call: the nation needs tax reform that will impart some balance to our tax system."

Biden’s Budget Signals the End of Trickle-Down Economics Era

May 28, 2021 • By Amy Hanauer, ITEP Staff

President Joe Biden’s 2022 budget proposal released today signals a commitment to transformational policy solutions that not only invest in people and communities but also ensure corporations and rich people contribute more in taxes to support the economy that makes their wealth and profits possible, the Institute on Taxation and Economic Policy (ITEP) said today.

American Families Plan Proposes Transformational Investments and More Equitable Tax Reform

April 28, 2021 • By Amy Hanauer

Following is a statement by Amy Hanauer, executive director of the Institute on Taxation and Economic Policy, regarding President Biden’s remarks on the American Families Plan. “Longstanding inequities, deepened by the pandemic, mean that too many American families and communities are struggling. The American Families Plan makes long-overdue investments that will dramatically broaden access to […]

A new ITEP analysis provides critical data for the debate over whether to repeal the $10,000 cap on state and local tax (SALT) deductions. The report finds that repeal of the SALT cap without other reforms would worsen economic disparities and exacerbate racial inequities baked into the federal tax system.

55 Corporations Exploit Old and New Loopholes to Pay $0 in Federal Taxes in 2020

April 2, 2021 • By ITEP Staff

Media contact Twenty-six of the 55 companies paid nothing over three years In 2020, a year marked by a pandemic, small business closures and widespread job loss for ordinary people, many major U.S. corporations remained profitable and 55 of them paid $0 in federal corporate income taxes on a combined $40 billion in profits, the […]

President Biden’s Infrastructure Plan Moves Toward Ending “Zero-Tax” Profitable Corporations

March 31, 2021 • By Matthew Gardner

Following is a statement by Matthew Gardner, a senior fellow at the Institute on Taxation and Economic Policy, regarding the corporate tax provisions in the “American Jobs Plan,” released by the White House on March 31. “For years, our corporate tax has been broken, allowing profitable corporations to altogether avoid taxes or pay far below […]

New Research: Tax Policy Choices Can Narrow or Worsen the Racial Income Gap

March 31, 2021 • By ITEP Staff

Media contact A new report released today by the Institute on Taxation and Economic Policy spotlights a stark challenge confronting state and local lawmakers. Tax policy has the potential to narrow the racial income and wealth gaps, but an overreliance on inequitable revenue sources in some states indefensibly makes those gaps worse. The research builds […]

American Rescue Plan Uses Government Muscle to Tackle Big Economic Problems

March 10, 2021 • By Amy Hanauer

Media contact Following is a statement by Amy Hanauer, executive director of The Institute on Taxation and Economic Policy, regarding the American Rescue Plan, which has cleared both houses of Congress and President Biden is expected to sign. “The American Rescue Plan is a monumental first step toward President Joe Biden’s pledge to build back […]