News Releases

Paradise Papers Underscore Why Lawmakers Should Focus on Offshore Tax Avoidance

November 5, 2017 • By ITEP Staff

Following is a statement by Matthew Gardner, a senior fellow at the Institute on Taxation and Economic Policy, regarding the release of the “Paradise Papers,” a series of documents from Appleby, a leading offshore law firm. The International Consortium of Investigative Journalists released the investigative report today.

Bottom-Line Conclusion about GOP Tax Plan Is the Same After Reviewing More Details

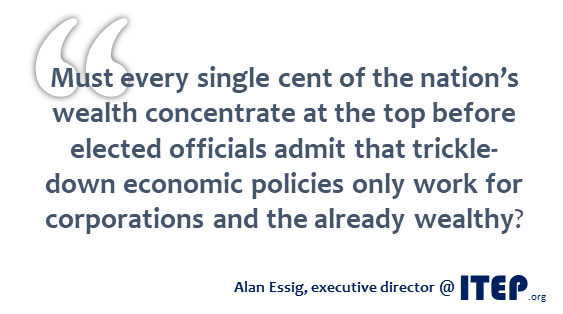

November 2, 2017 • By Alan Essig

Instead of engaging in thorough, public process that may have yielded real tax reform for middle-class families, lawmakers covertly put together a plan that reserves its biggest benefits for corporations and the wealthy while throwing in a few gimmicks for political cover.

Even if Top Marginal Tax Rate Remains 39.6%, GOP Tax Plan Will Still Largely Benefit the Wealthy

November 1, 2017 • By ITEP Staff

Keeping the top tax rate at 39.6 percent for millionaires is a cosmetic change meant to make this tax plan more palatable. Unless tax writers take out other provisions that almost exclusively benefit the highest-income households, millionaires will still benefit most.

States with Highest Income Tax Rates Economically Outperform States with No Income Tax

October 26, 2017 • By ITEP Staff

A comparative analysis of economic trends in the nine states that do not levy an income tax and the nine states that levy the highest top income tax rates found that the latter group performed significantly better on more than half a dozen measures of economic well-being, the Institute on Taxation and Economic Policy said […]

ITEP Statement on House Budget Resolution: Lawmakers Gear up to Give the Public What It Doesn’t Want

October 5, 2017 • By Alan Essig

Passing a budget is supposed to provide a structure for our elected officials to responsibly manage our nation’s finances and public investments. But that is not the purpose of this budget resolution.

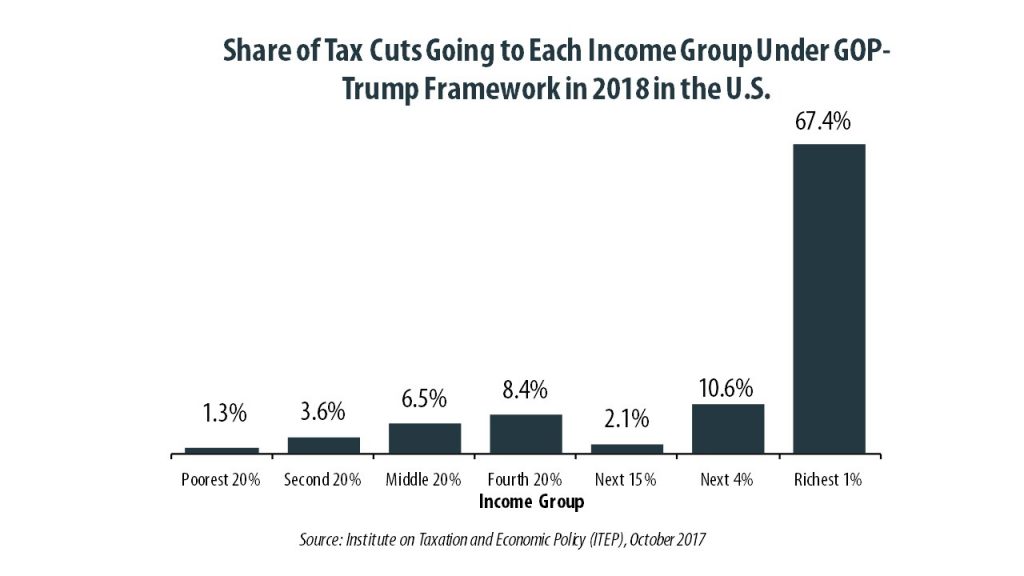

50-State Analysis: GOP-Trump Tax Proposal Would Give the Store Away to the Wealthy, Exacerbate the Income Divide

October 4, 2017 • By Alan Essig

A 50-state analysis of the GOP tax framework reveals the top 1 percent of taxpayers would receive a substantial tax cut while middle- and upper-middle-income taxpayers in many states would pay more, the Institute on Taxation and Economic Policy said today. The GOP continues to tout its tax plan as “beneficial to the middle class.” […]

ITEP ED on GOP Tax Plan: “There is Something Terribly Wrong with This Picture”

September 27, 2017 • By Alan Essig

Economically, the rich are doing just fine, yet the GOP is brazenly selling old hat trickle-down economic theories laden with rhetoric about projected economic growth that will benefit working people. Worse, they are doing so even though opinion polling shows the majority of Americans do not want Congress to pass tax cuts for the wealthy and corporations.

New Analysis Shows White House Tax Proposal Would be an Unprecedented Upward Redistribution of Wealth

September 13, 2017 • By ITEP Staff

The tax plan outlined by President Trump would strip away the U.S. tax system’s moderate progressivity by lowering the effective tax rate for the wealthiest 1 percent of Americans by 7.5 percentage points and shifting more of the nation’s tax bill to every other income group, a new analysis released today by the Institute on […]

ITEP on President Trump’s Missouri Visit: The Policy Doesn’t Match the Rhetoric

August 30, 2017 • By Alan Essig

Following is a statement by Alan Essig, executive director of the Institute on Taxation and Economic Policy, regarding President Trump’s visit to Springfield, Mo. The president is expected to tout his plans for overhauling the federal tax code. “Much like the GOP health plan was a tax cut for the wealthy masquerading as health reform, […]

GOP Will Have to Radically Depart from Previous Proposals to Meet Its Tax Reform Goals

July 27, 2017 • By ITEP Staff

Following is a statement by Alan Essig, executive director of the Institute on Taxation and Economic Policy, regarding GOP leadership’s tax reform goals released today. The tax reform goals outlined in the letter will not be achieved if the GOP pursues pending Trump Administration and House tax proposals. “First was a so-called health reform bill […]

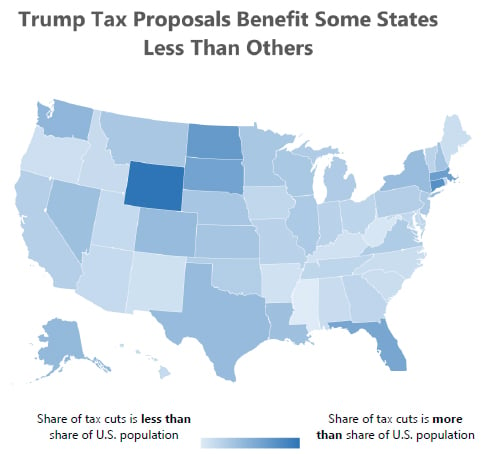

50-State Analysis of Trump’s Tax Outline: Poorer Taxpayers and Poorer States are Disadvantaged

July 20, 2017 • By Alan Essig

Not only would President Trump’s proposed tax plan fail to deliver on its promise of largely helping middle-class taxpayers, it also would shower a disproportionate share of the total tax cut on taxpayers in some of the richest states while southern and a few other states would receive a smaller share of the tax cut […]

Regardless of Political Maneuvers, Tax Cuts for the Rich Remain Tied to Cuts in Health Care

July 13, 2017 • By ITEP Staff

The GOP continues its dogged attempt to unravel the Affordable Care Act under the guise of ‘fixing’ our health system despite multiple Congressional Budget Office reports indicating millions stand to lose health care coverage. It’s is not obvious that this version of the bill is much different from the previous fiasco of a bill in which CBO projected 22 million would lose coverage.

Speaker Ryan’s “Bold Agenda” for the Country Boils Down to Tax Breaks for the Wealthy

June 20, 2017 • By Alan Essig

Speaker Paul Ryan today correctly outlined some of working people’s concerns, including the desire for more good jobs and access to the training required to secure those jobs. But his bottom line policy prescriptions for addressing the concerns of working people are the same old trickle-down economic policies that time after time have proven to primarily benefit the wealthy.

Trump’s Budget Proposal and Tax Plan Are the Antithesis of Populism

May 23, 2017 • By Alan Essig

A month ago, President Trump released a tax sketch that likely would redistribute wealth upward, and today he has poured salt on the wound with a proposed budget that would gut safety net programs and cut funding for other services that help move people out of poverty. Yet the PR refrain is the same Orwellian prattle we’ve been hearing for years: water isn’t wet, tax cuts for the rich will eventually trickle down to the rest of us, and balancing the federal budget must always rely on cutting programs that benefit ordinary people.

Corporate Lobbyists Should Not Shape the Nation’s Tax Reform Debate

May 18, 2017 • By Alan Essig

If the lineup for today's House Ways and Means Committee hearing on tax reform is an indication of how the tax policy debate will unfold in the coming months, businesses and their lobbyists will have outsize influence in the process. This is a mistake.

Report: Private School Voucher Proposal Creates Tax Shelter for Wealthy; Would Starve Public Schools of Critical Funds

May 17, 2017 • By ITEP Staff

A new report by the Institute on Taxation and Economic Policy (ITEP) and AASA, the School Superintendents Association, details how tax subsidies that funnel money toward private schools are being used as profitable tax shelters by high-income taxpayers. Further, legislation pending in Congress would create new opportunities for corporations and successful investors to earn huge […]

Profitable Fortune 500 Companies Avoid $126 Billion in State Corporate Taxes Over Eight Years

April 27, 2017 • By ITEP Staff

The Effective State Tax Rate Paid by Profitable Fortune 500 Corporations Is Declining,Yet States Continue to Actively Dismantle Their Corporate Income Taxes (Washington, D.C.) As states struggle with tough budget decisions about funding essential public services, the average effective state tax rate paid by profitable Fortunate 500 companies continues to drop due to copious loopholes […]

Following is a statement by Alan Essig, executive director of the Institute on Taxation and Economic Policy, regarding the tax plan released today by the Trump Administration. The administration has said that this plan will be the “largest tax cut in history.” “The Trump tax plan is not tax reform but a massive tax cut […]

New Report: DACA-Eligible Immigrants Annually Pay $2 billion in State and Local Taxes

April 24, 2017 • By Meg Wiehe

Young undocumented immigrants’ tax contributions would drop by nearly half if DACA protections were rescinded A new Institute on Taxation and Economic Policy report examined the state and local tax contributions of young immigrants eligible for DACA (deferred action for childhood arrivals) and found that, collectively, they annually contribute $2 billion in state and local […]

New Analysis: Average Alaskan Would Pay Less Under Income Tax Than Under Other Fiscal Options

April 23, 2017 • By ITEP Staff

Cutting the Permanent Fund Dividend (PFD) or Implementing a Sales Tax Would Be Costlier than Income Tax for Most Alaskans A new analysis by the Institute on Taxation and Economic Policy (ITEP) finds that for most Alaskans, a state income tax would capture less of their income than other revenue-raising alternatives such as cutting the […]

Federal and state taxes are a contentious point of policy debate all year round but are especially salient in the minds of most Americans as Tax Day approaches. This year, people across the country will take to the streets in cities across the nation to demand President Donald Trump release his tax returns. This isn’t […]

New Analysis Compares Tax Rates Paid by Companies Lobbying for/against Border Adjustment Tax

March 31, 2017 • By Matthew Gardner

An Institute on Taxation and Economic Policy analysis finds that, on average, companies that are opposed to the Border Adjustment Tax pay higher tax rates than a coalition of companies lobbying against the tax. The Border Adjustment Tax or BAT is being proposed as part of a broader GOP plan to overhaul the corporate tax […]

April 1 will mark the longest-running streak that the federal gas tax has remained stagnant, a short analysis from the Institute on Taxation and Economic Policy reveals. Saturday will mark the 8,584th day (23.5 years) that the nation’s federal gasoline tax rate has remained at 18.3 cents per gallon. This surpasses the previous record of […]

Corporations’ Offshore Cash Hoard Grew to $2.6 Trillion in 2016

March 28, 2017 • By ITEP Staff

U.S. corporations now hold a record $2.6 trillion offshore, a sum that ballooned by more than $200 billion over the last year as companies moved more aggressively to shift their profits offshore, according to a new report, Fortune 500 Companies Hold a Record $2.6 Trillion Offshore, released today by the Institute on Taxation and Economic Policy (ITEP).

A new Institute on Taxation and Economic Policy analysis of tax provisions in the American Health Care Act provides a 50-state breakdown of how taxpayers would be affected by the Republican plan to repeal the net investment tax and additional Medicare tax, each of which apply only to the best-off Americans. Repealing these taxes would, […]