Property Taxes

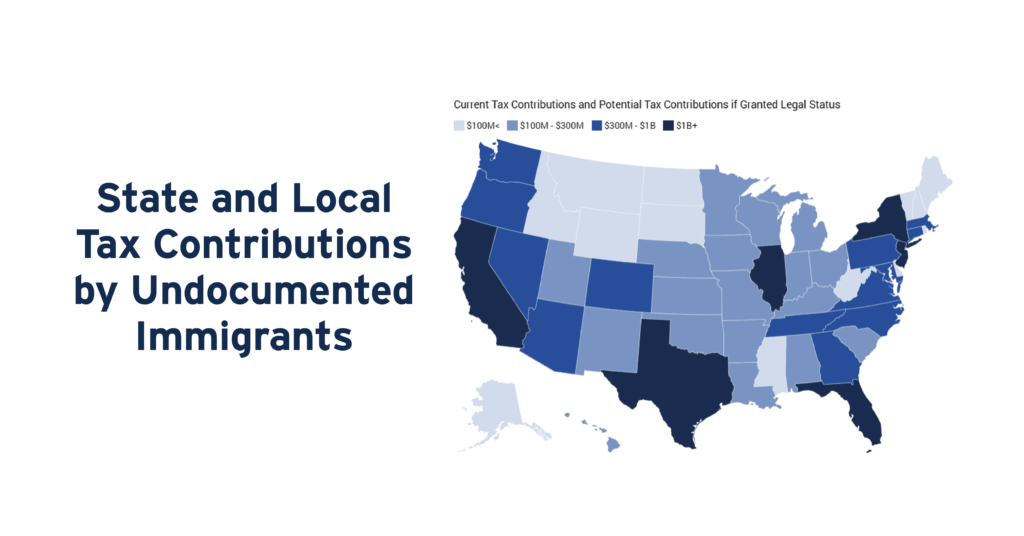

Undocumented immigrants pay taxes that help fund public infrastructure, institutions, and services in every U.S. state. Nearly 39 percent of the total tax dollars paid by undocumented immigrants in 2022 ($37.3 billion) went to state and local governments.

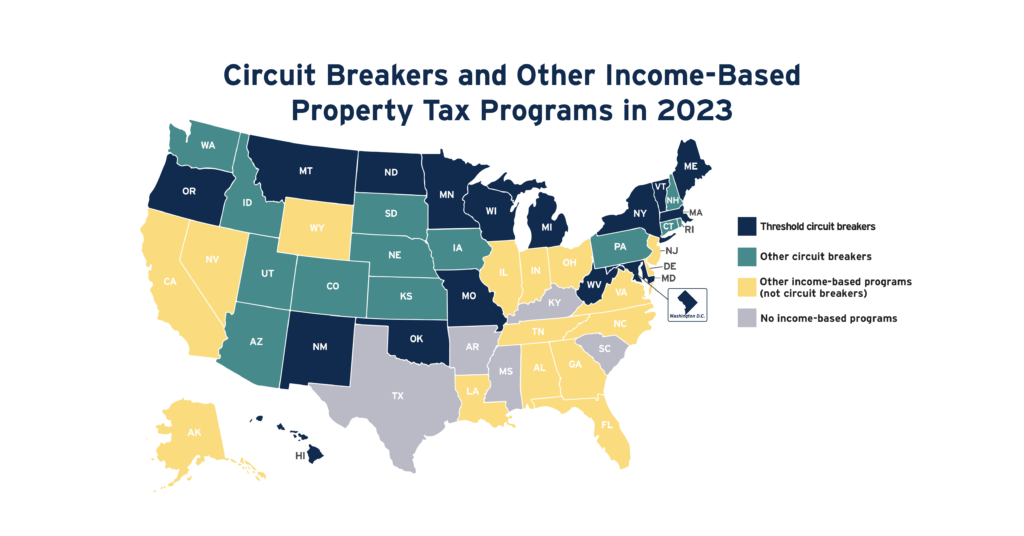

Circuit Breakers and Other Income-Based Property Tax Programs in 2023

May 19, 2023 • By ITEP Staff

No tax cut offers a more targeted solution to property tax affordability problems than circuit breaker credits. This is because circuit breakers are the only tools for reducing property taxes that measure the affordability of property taxes relative to families’ ability to pay. Circuit breakers protect families from property tax “overload” much like how traditional […]

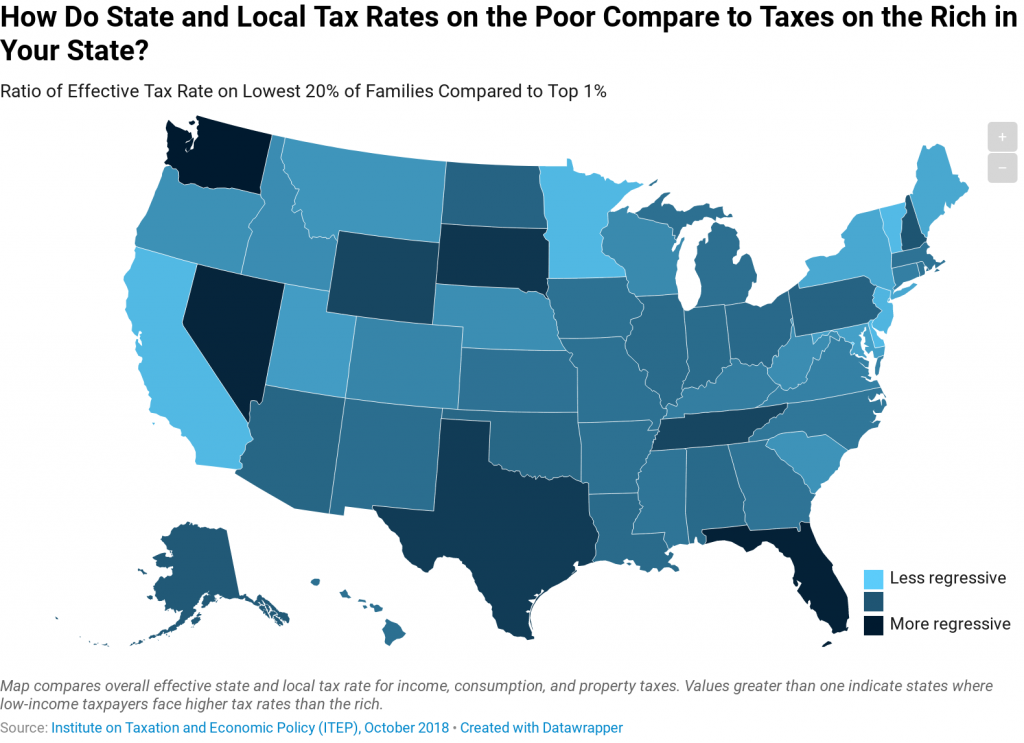

How Do Tax Rates on the Poor Compare to Taxes on the Rich in Your State?

August 1, 2019 • By ITEP Staff

No two state tax systems are the same, but 45 states have one thing in common: Low-income residents are taxed at a higher rate than the top 1 percent. Effective tax rates for the lowest 20 percent of families range from a high of 17.8 percent in Washington State to a low of 5.5 percent in Delaware.

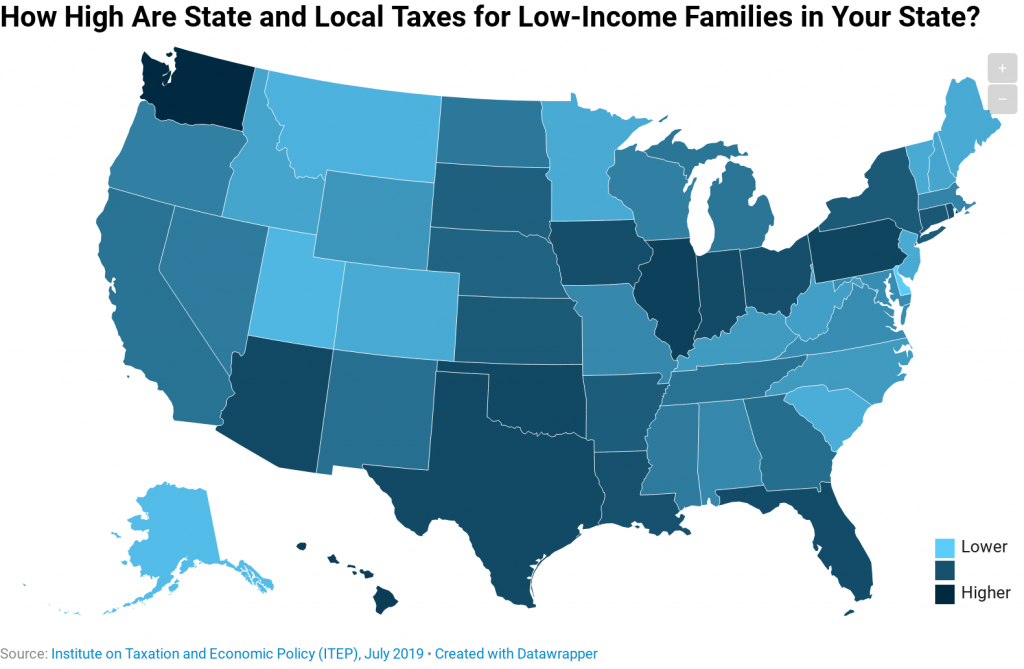

No two state tax systems are the same, but 45 states have one thing in common: Low-income residents are taxed at a higher rate than the top 1 percent. This map shows the effective tax rates for the lowest-income 20 percent in each state--ranging from a high of 17.8 percent in Washington to a low of 5.5 percent in Delaware.

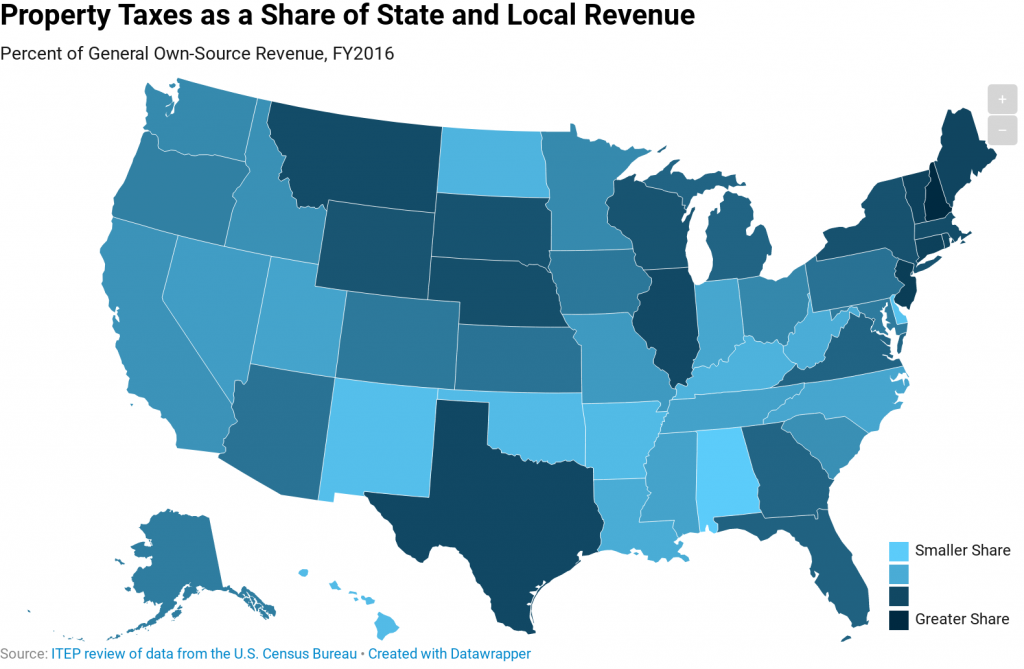

The property tax is the oldest major revenue source for state and local governments and remains an important mechanism for funding education and other local services. This map shows the share of state and local general revenue in each state that is raised through property taxes.