In spite of Article 44’s boundaries, the Commonwealth has effectively mitigated the flat tax for people at the lower end of the income scale by using exemptions and tax credits. According to the Institute on Taxation and Economic Policy, the bottom twenty percent of filers in Massachusetts pay virtually no state income tax. The next twenty percent average 2.4 percent and not until the top fifth of filers is the effective tax rate 4 percent or more. Read more

Related Reading

October 17, 2018

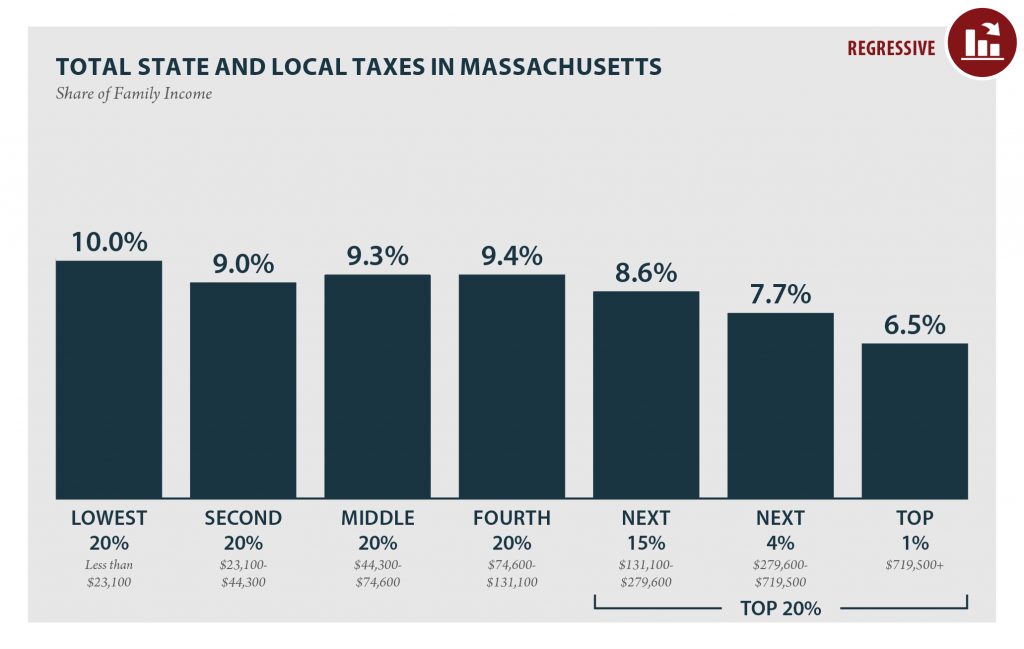

Massachusetts: Who Pays? 6th Edition

February 2, 2026

State Tax Watch 2026

January 28, 2026

State Rundown 1/28: State Tax Cutting Plans Face Scrutiny

Mentioned Locations

Massachusetts