Key Findings

- To avoid taxation, American corporations use accounting gimmicks that make profits appear to be earned in foreign jurisdictions which tax corporate profits very lightly or not at all.

- In 2020, American corporations claimed profits in 15 of these jurisdictions that were often far too high to be possible. For example, in four jurisdictions – Bermuda, the Cayman Islands, the British Virgin Islands and Barbados – American corporations claimed profits that dramatically exceeded the jurisdiction’s entire economic output. In the first three of these, the claimed profits are more than five times the size of the jurisdiction’s entire economy.

- Many of these are dependent territories of much larger countries (the U.S., United Kingdom, China, and the Netherlands), indicating that powerful governments are, at best, complicit in arrangements that have allowed corporate tax avoidance to thrive.

- These 15 jurisdictions together accounted for just 3 percent of global economic output outside the U.S. in 2020, yet American corporations reported to the IRS that 59 percent of their total offshore profits were generated in these tiny places. This obviously reflects accounting gimmicks used to escape taxes.

- These jurisdictions have joined most of the world in pledging to end tax avoidance with a global minimum tax negotiated by the Biden administration and other governments. Congress should enact legislation to implement this global minimum tax. Doing so would dramatically reduce or eliminate most of the benefits of claiming profits were earned in such tax havens.

Offshore Corporate Tax Avoidance Is a Major Problem

Even in 2020, a year when corporate profits fell compared to the previous year because of the pandemic-induced economic downturn, American corporations reported significant investments in offshore countries and jurisdictions that are clearly tax havens, the most recent data from the IRS show.

Many of these places have no corporate tax, like Bermuda, the Cayman Islands, the British Virgin Islands, the Bahamas, and the Isle of Man. Some have very low corporate tax rates, like Barbados (a maximum of 5.5 percent) while others have special breaks and loopholes that facilitate other types of tax avoidance. The total profits that American-owned corporations, as a group, claimed to earn in these countries are suspiciously large. In some cases, they are impossible because they exceed the country’s entire economic output for the year.

The only explanation is that corporations use accounting gimmicks to make their profits appear to be earned in these countries to avoid taxes. This problem would be largely addressed by the global minimum tax that was negotiated by the Biden administration and most of the world’s governments, but which Congress has yet to implement.

The 15 Most Likely Tax Havens

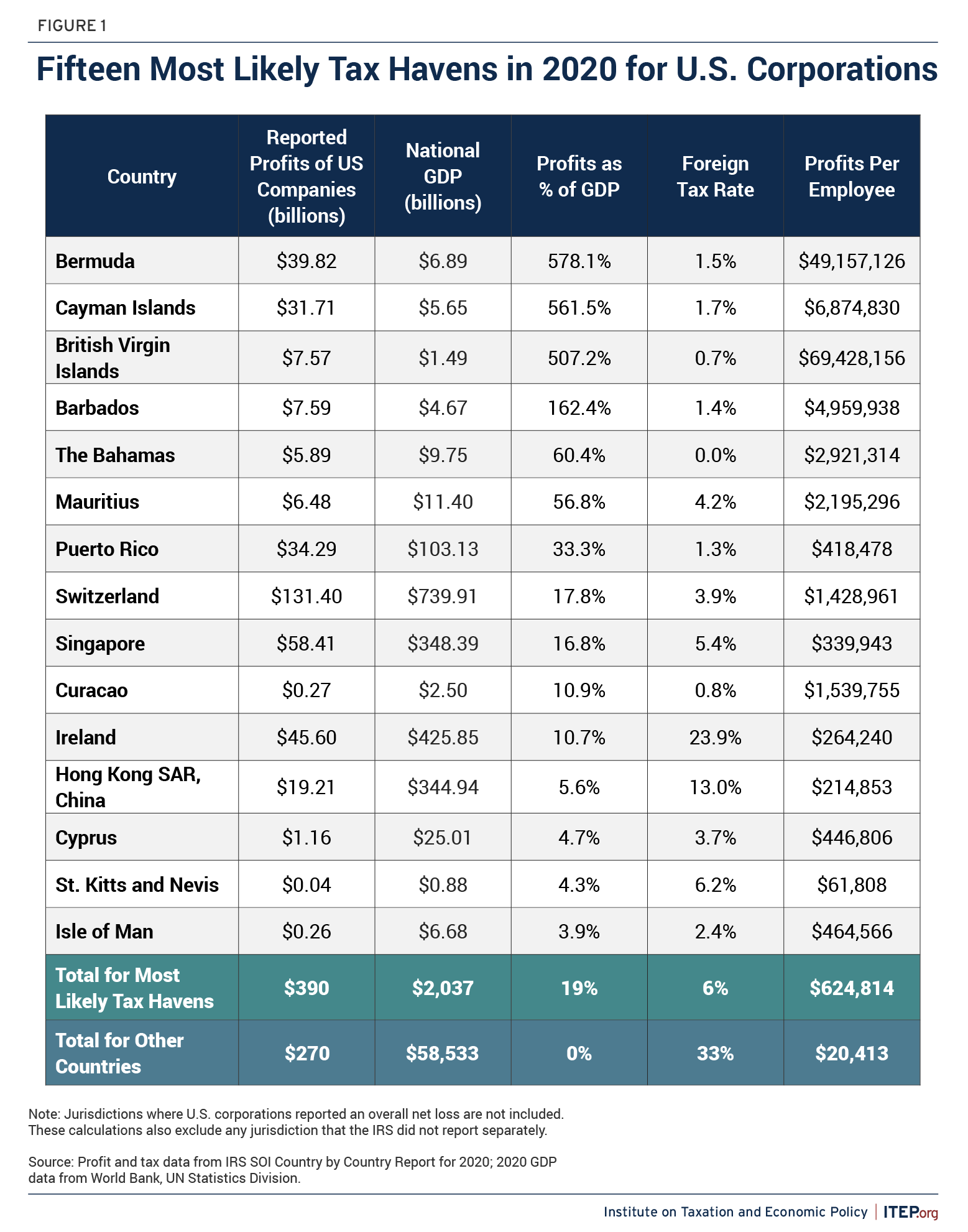

Table 1 shows 15 countries or jurisdictions where American-owned corporations report the highest profits, as a share of the country’s gross domestic product (GDP), according to information they provided to the IRS for 2020.

In four of these jurisdictions, the information reported to the IRS is clearly impossible because it suggests that the total profits of American-owned companies exceed 100 percent of the jurisdiction’s GDP, meaning they are larger than the jurisdiction’s entire economic output. In three of them – Bermuda, the Cayman Islands, and the British Virgin Islands – the reported profits exceed 500 percent of GDP, meaning they exceed five times their total economic output.

In most jurisdictions outside the U.S., the profits of American-owned companies make up a small share of the jurisdiction’s total GDP, much smaller than what is shown for any of the 15 in Table 1. For example, profits of America-owned companies in Canada, Mexico, and the United Kingdom equal about 1 percent of GDP, meaning they account for 1 percent of the economy in those places. In other countries, like France, Germany, and Japan, they equal a fraction of 1 percent of the nation’s GDP.

The profits reported for the 15 jurisdictions in Table 1 are particularly suspicious because American corporations also report to have relatively few employees in these places despite the large profits they claim to earn there. In some cases, this implies improbably large profits generated by the average employee.

For example, each employee these companies have in the Isle of Man generated an average profit of $465,000 in 2020, according to the information provided to the IRS. In several places on the list, the implied profits generated by each employee is in the millions, reaching an unbelievable $49 million in Bermuda and $69 million in the British Virgin Islands.

Incredibly, the total profits that American corporations claimed to earn through their subsidiaries in these 15 jurisdictions in 2020 ($390 billion) is greater than the total profits they claimed to earn that year through their subsidiaries in in the rest of the world outside the United States ($270 billion). One cannot take this at face value given that these 15 countries and jurisdictions had a combined GDP of $2 trillion in 2020, compared to the $58.5 trillion of combined GDP for the rest of the world, as illustrated at the bottom of Table 1.

How Corporations Get Away with This

The American corporations are clearly reporting nonsense to the IRS – but they are not necessarily breaking any laws, at least not as the IRS interprets and enforces our tax laws today.

Corporations often create transactions that only exist on paper to effectively shift income into jurisdictions where they will be taxed lightly, if at all. For example, an American corporation might transfer a patent to a subsidiary company that is nothing more than a post office box in Bermuda or the Cayman Islands. The subsidiary pays a small fee to the U.S. parent company for the patent. The U.S. parent company then pays hugely inflated royalties to the subsidiary to use that patent.

The subsidiary company is not really “doing” anything in a physical sense or any business sense. The transaction only exists on paper. The parent company tells the IRS that it has no U.S. profits to report because it pays such huge royalties to the offshore subsidiary. The effect is to shift profits into the offshore tax haven.

The U.S. does have rules to prevent this, and a real-life example would be more complicated in order to circumvent these rules. Often this has involved complex transactions that route profits through countries like Ireland or the Netherlands and then to other jurisdictions like Bermuda. The laws in these countries and the tactics used by the companies often change, but the data illustrates that the result has not changed. As in previous years, we see that American corporations are claiming to earn impossible sums in the places where they will not be taxed.

Congress Should Implement the Global Minimum Tax to Stop Offshore Tax Avoidance

The Biden administration negotiated an international agreement with the OECD and other nations to impose a minimum tax of 15 percent on corporate profits that would wipe out most of the benefits that corporations obtain when they claim that profits are earned in tax havens. (This is distinct from a different type of minimum tax that Congress enacted in 2022 and which, confusingly, also has a rate of 15 percent.) Most governments have signed on.

But the U.S. cannot implement the global minimum tax until Congress enacts legislation to do so. Republicans who control the House of Representatives have refused.

President Biden has proposed that Congress enact rules for U.S. corporations and corporations operating in the U.S. that are even stronger than required under the international agreement. For example, the President’s proposals would tax offshore profits at a minimum rate of 21 percent rather than the 15 percent required under the international agreement.

The Treasury Department estimated that President Biden’s proposal to revise our global minimum tax rules to comply with and go further than the international agreement would raise $493 billion over a decade.

Treasury also estimated that a related proposal to implement another part of the international agreement, the Undertaxed Profits Rule (which limits tax breaks for companies based in countries that are not complying) would raise an additional $549 billion over a decade.

Similarly, the No Tax Breaks for Outsourcing Act introduced by a group of Democrats in Congress would also require that offshore profits of American corporations are taxed at a rate of at least 21 percent.

Corporate tax avoidance is not inevitable, it is a choice made by governments to apply inconsistent tax rules that fail to achieve their ostensible purpose. The global minimum tax proposal provides Congress the opportunity to make a different choice.