Today, Sen. Ron Wyden, the ranking Democrat on the Senate Finance Committee, fulfilled a promise he made several months ago to release a proposal that could fundamentally transform how the U.S. taxes capital gains of the wealthy.

The paper he released today proposes “anti-deferral accounting” to ensure that wealthy people are taxed on all of their income, just like everyone else. Depending on the details—and there are still many to be worked out—this could be a truly progressive tax reform.

As ITEP explained in comments sent to Wyden’s staff, this reform will be most effective if it applies widely to the wealthy with few or no exceptions, treating all assets in a comparable way regardless of what taxpayers do with them. The following describes the proposal and explains some details that still need to be worked out.

Wyden’s Proposal Tackles the Most Complex Tax Break for Capital Gains

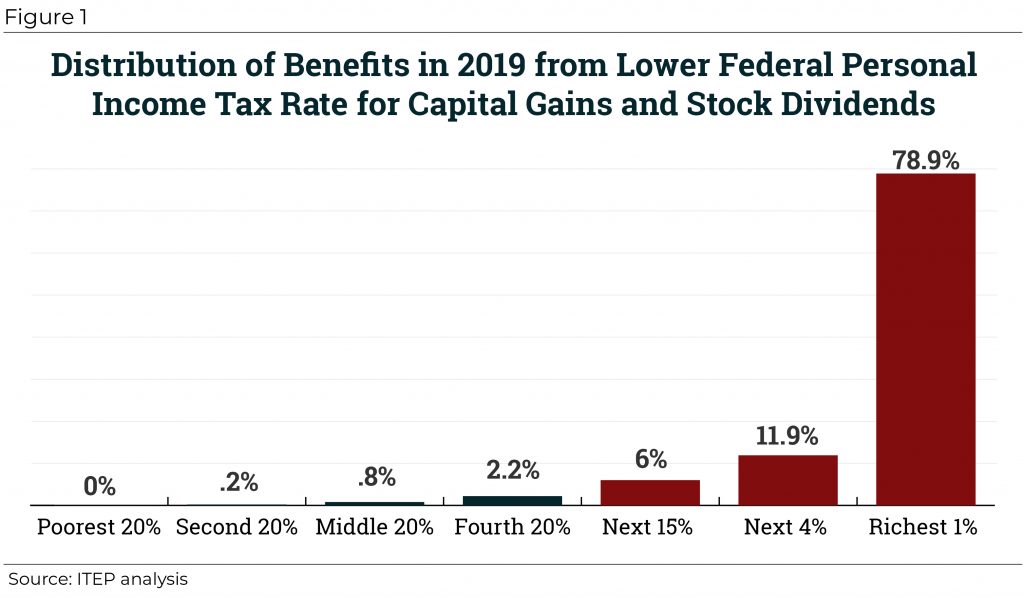

Most capital gains, which are profits from selling assets, go to the richest 1 percent. Capital gains even make up the majority of income for some very wealthy individuals. And yet our tax rules provide several breaks for capital gains that are not available for other types of income.

The most well-known is the special, lower income tax rates for capital gains, but that is not the only one. As ITEP explained in a report last year, if Congress eliminates the special, lower rates but leaves the other capital gains breaks in place, many wealthy people might avoid the tax increase by relying more heavily on the remaining tax breaks.

This is where Sen. Wyden’s proposal comes in. His paper proposes eliminating the special income tax rates for capital gains, but it does not stop there. Another break for capital gains is deferral of income tax on gains until an asset is sold. If a wealthy person’s assets increase in value from $10 million in one year to $15 million in the next year, economists would say that person received income of at least $5 million. But that $5 million of asset appreciation is not counted as income under the current tax rules except in the year assets are sold. The current rules treat that $5 million as “unrealized” capital gains.

Tax deferral on unrealized capital gains may seem like an arcane matter, but over time it provides an enormous benefit to people with assets, who are mostly very well-off, allowing them to accumulate growing fortunes largely free of tax while working people pay income taxes on most of their income each year. Wyden’s paper proposes to end the benefits of this tax deferral for the very wealthy.

How Anti-Deferral Accounting Would Work

For assets that are traded on a public exchange such as stocks and bonds, whose value is therefore easily determined, the proposal would tax asset appreciation annually (and allow taxpayers to deduct losses annually if assets lose value). This approach is also known as “mark-to-market” taxation and is already used under our current tax rules in limited situations.

For assets that are not traded—for example, an interest in a privately owned company or a large piece of real estate—mark-to-market taxation would be more difficult to implement because the asset’s value and changes in that value from one year to the next are not as easily ascertained. For non-tradable assets, Wyden’s paper proposes a lookback rule that would continue allowing taxpayers to defer income tax on gains until selling the asset but would then increase the income tax due in a way that diminishes the benefit of the tax deferral.

Anti-Deferral Accounting Could Simplify the Tax Code

If this sounds complicated, keep two things in mind. First, the proposal is designed to apply to only the very richest taxpayers, who can handle the complexity. Wyden’s paper suggests that a taxpayer must have income exceeding $1 million or net worth exceeding $10 million, with at least one of those two tests triggered each year for three consecutive years, before being subject to anti-deferral accounting. The people whose income or wealth exceed these thresholds already have tax accountants and tax lawyers. They are not doing their income taxes at the kitchen table in an evening the way a middle-class family might.

Second, the current system probably creates more complexity than this proposal. The current rules encourage wealthy people to use convoluted techniques to take advantage of capital gains tax breaks. For example, managers of buyout funds claim that the fees they collect are a form of capital gains called “carried interest.” Real estate investors like the Kushners exploit tax deferral by trading appreciated properties for other properties and claim that these “like-kind exchanges” generate no income. Some very wealthy people have used derivatives to arrange deals that are really sales of assets but that allow them to claim they still own the asset (and thus have no gains to report) for many years. Sen. Wyden’s proposal, depending on the final details, could eliminate all this nonsense.

Wyden’s Proposal Needs Some Improvements

That being said, there are several areas where the proposal could be strengthened.

As explained in ITEP’s comments to Wyden’s staff, taxes are simpler and more efficient when there are fewer exceptions, so that taxpayers have fewer opportunities to recharacterize income or assets to avoid taxes. Wyden’s proposal provides too many exceptions that have no clear rationale. The first $2 million of value in a taxpayer’s first and second home is excluded. The first $5 million of value in a family farm is excluded. The first $3 million of value in tax-preferred savings accounts (such as a 401(k)) is excluded from the calculation to determine whether a taxpayer meets the asset threshold, while the assets in such accounts are excluded entirely from the tax calculation.

These exceptions complicate the rules unnecessarily and provide opportunities for well-off people to game the system. It would be much simpler to set high income and asset thresholds — which the proposal already does — and then subject anyone who exceeds those thresholds to the new rules without exceptions. This would create a simpler system that would likely generate great public support because it could be easily understood. The vast majority of Americans understand very well that they do not have income exceeding $1 million or assets exceeding $10 million.

For more examples of the types of details that still need to be worked out, see ITEP’s comments on the anti-deferral accounting proposal.