CHICAGO — Following is a statement by Lisa Christensen Gee, director of special initiatives at the Institute on Taxation and Economic Policy, regarding Gov. J.B. Pritzker’s Fair Tax proposal. Ms. Christensen Gee is based in Chicago and analyzing the Illinois tax system is part of her portfolio of work.

“Gov. Pritzker’s Fair Tax proposal reflects a necessary and strong commitment to reforming Illinois’s tax system in a fair way that will help the state raise the revenue it needs to stabilize its finances and improve quality of life for all its residents. The state’s financial crisis spans several years and getting the state back on firm fiscal footing requires bold solutions and—yes—tax increases.

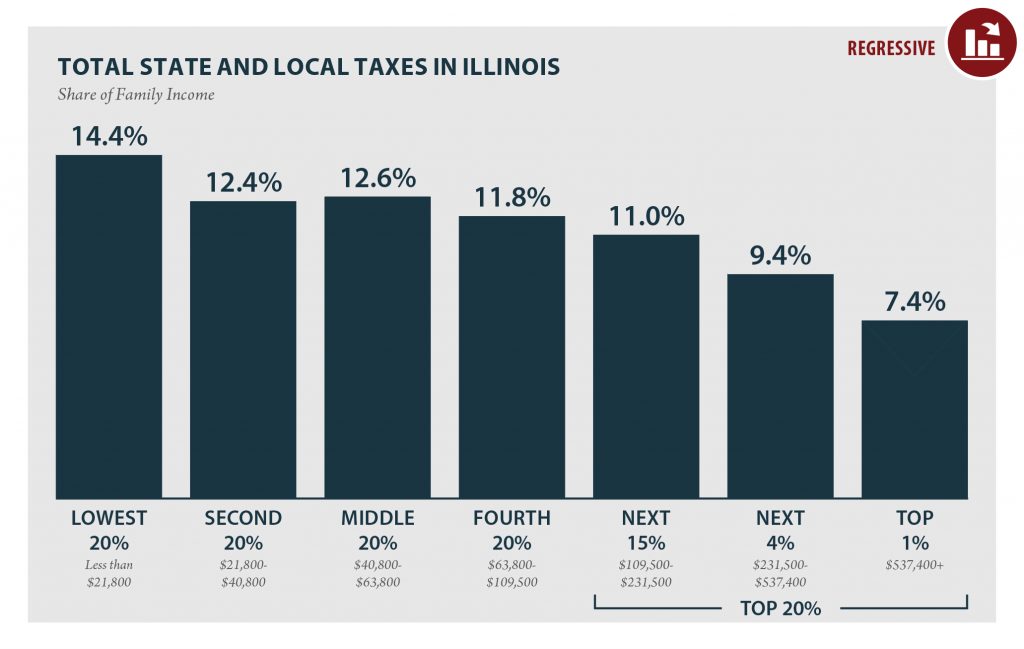

“ITEP has done an in-depth analysis of every state’s tax system, and currently Illinois has one of the most unfair tax systems in the country. When most taxes that people pay are factored (including income, property, sales and excise), the lowest-income Illinois residents pay a 14.4 percent effective tax rate, which is nearly double the 7.4 percent rate paid by the richest 1 percent. Gov. Pritzker’s plan rightly asks the wealthy to pay more. A graduated income tax is one of the most progressive ways to raise revenue, so it makes sense that this is part of Gov. Pritzker’s solution for addressing the state’s fiscal crisis.

“The nation is in the throes of a serious conversation about how our public policies have enabled economic growth that has enriched the highest-income households while low- and middle-income families stand still. It is fair to ask those who have benefited the most from economic growth to contribute more.”