Contact: Jon Whiten ([email protected])

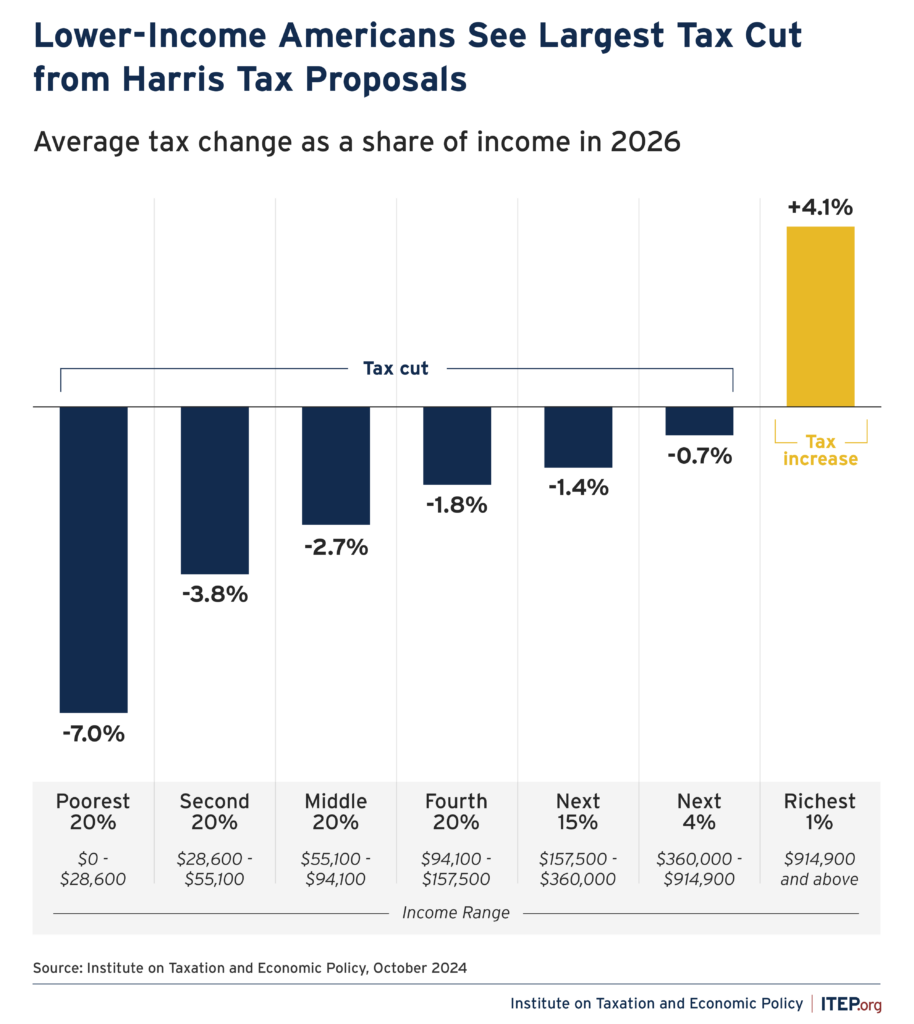

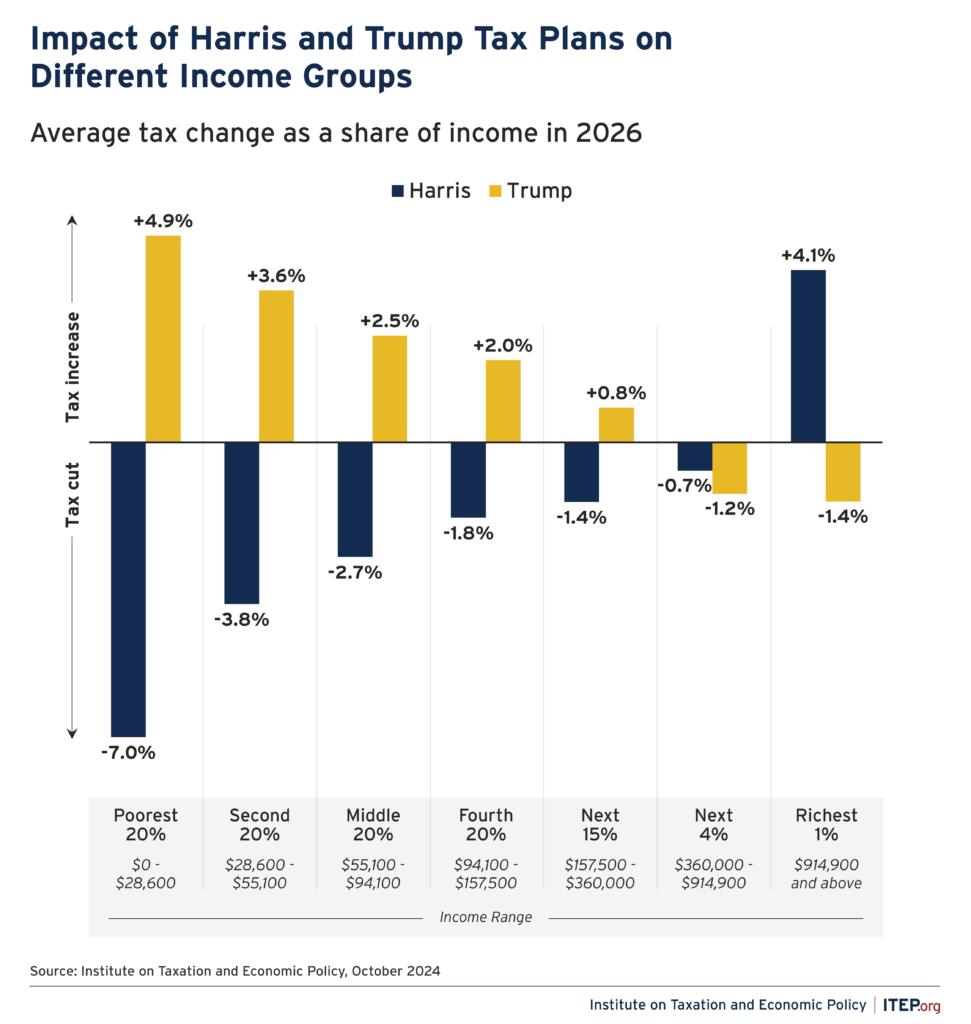

The tax proposals announced by Vice President Harris would, on average, lead to a tax increase for the richest 1 percent of Americans and a tax cut for all other income groups, according to a new in-depth analysis by the Institute on Taxation and Economic Policy (ITEP).

This is in stark contrast to the tax proposals announced by former President Trump, which would, on average, lead to a tax cut for the richest 5 percent of Americans and a tax increase for all other income groups. (Check out our side-by-side comparison here.)

“If you are among the richest 1 percent who benefited a great deal from the Trump tax cuts or a foreign investor who benefited from Trump’s corporate tax cuts, you would pay more under Harris’ plan,” said Steve Wamhoff, ITEP’s federal policy director. “But everyone else would pay less overall, because Harris would use the tax code to help Americans with the costs of raising children, obtaining health insurance and housing, and other costs, and she would extend previously enacted policies to the extent that they benefit the middle class.”

If the Harris proposals were in effect in 2026, the richest 1 percent – with incomes of $914,900 and above – would receive an average tax increase equal to 4.1 percent of their income. All other income groups would, on average, receive tax cuts, including an average tax cut equal to 2.7 percent of income for the middle fifth of Americans – with incomes between $55,100 and $94,100 – and an average tax cut equal to 7 percent of income for the poorest fifth of Americans (those with incomes less than $28,600).

“The contrast between Harris and Trump on taxation could not be more clear,” said Amy Hanauer, ITEP Executive Director. “Trump’s plan would widen inequality by making middle-income and low-income families pay more on average while slashing taxes for the very wealthiest. The Harris proposals would cut taxes for most regular families while raising average taxes on the richest 1 percent with incomes of nearly a million a year or more.”

The ITEP analysis examines major tax proposals Harris has explicitly announced and others that are major pieces of President Biden’s tax agenda, which Harris has said she would pursue and which are consistent with her campaign pledges:

- Extending the temporary provisions in the 2017 Trump tax law that will otherwise expire at the end of 2025 fully for those with incomes of less than $400,000 but with strict limits on benefits for those with incomes above $400,000

- Helping workers and families with proposals related to raising children and obtaining health coverage, assisting service workers and making housing more affordable

- Reforming the taxes that fund Medicare, which would raise taxes on those with incomes of more than $400,000

- Scaling back existing tax breaks on capital gains and dividends for those with incomes of more than $1 million (and in some cases far more)

- Reforming the corporate tax code to scale back recently enacted breaks and long-standing loopholes that have been shown to increase income inequality and racial inequality