Read this Policy Brief in PDF Form

The personal income tax can be—and usually is—the fairest of the main revenue sources relied on by state and local governments. When properly structured, it ensures that wealthier taxpayers pay their fair share and provides lower tax rates on middle-income families. The personal income tax can be used to offset regressive sales, excise and property taxes. This policy brief explains the basic workings of the income tax.

The Tax Base

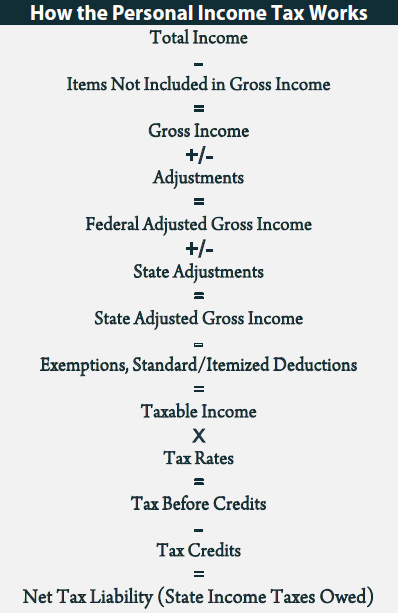

In most states, the income tax base—that is, the types of income that are subject to the tax—looks a lot like the federal income tax base. In practice, this means that income taxpayers can calculate their federal taxes first, and then simply copy their total income from the federal tax forms to their state form. Thirty states link to federal adjusted gross income (AGI), which is income before exemptions and deductions, and then allow their own special exemptions and deductions. Six states link instead to federal taxable income, which means that these states adopt the generous federal exemptions and deductions, and then apply their own tax rates. A few states do not link to the federal tax base at all.

Which Income is Taxed and Not Taxed?

The federal income tax and most state income taxes apply to most, but not all, types of income. But different types of income are, in some systems, taxed differently:

- The wages and salaries that form the bulk of income for most middle-income families are almost always fully taxed.

- Interest from bank accounts and bonds is generally taxed.

- Some business income is reported on individual tax forms. In particular, businesses that are unincorporated include their taxable profit (or loss) in personal income.

- Rental income from real estate is also part of the personal income tax base.

- Capital gains are profits from the sale of assets such as stocks, bonds and real estate. Income tax on a capital gain is paid only when the asset is sold. A few states provide capital-gains tax breaks. These tax breaks are discussed in ITEP Brief, “State Capital Gains Tax Breaks.”

- Dividends are the part of a corporation’s earnings that are distributed to its shareholders.

- Transfer payments from governments to individuals are subject to a variety of different rules. Payments from the Temporary Assistance to Needy Families program are fully exempt; unemployment compensation is generally fully taxed, and the federal income tax taxes a fraction of Social Security benefits above certain income levels.

- Pension income is generally taxable at the federal level, but many states depart from the federal rule by excluding all or some pension income from taxation.

Once all of a taxpayer’s potentially-taxable income is added up, adjustments to income are applied. Many adjustments originate on federal tax forms—and most states following federal rules will include these adjustments, too. Of course, states always have the option of “decoupling” from these federal adjustments, and sometimes do so. Most states diverge from the federal starting point and allow their own adjustments which include: exemptions for capital gains or dividends and tax breaks for pensions and Social Security.

Computing Taxable Income

Computing Taxable Income

Taxable income is the amount of income that is subject to tax after subtracting all deductions and exemptions from AGI. This is the amount of your income to which the tax rates are actually applied. In computing their taxable income, federal taxpayers (and many state taxpayers) have a choice of subtracting either a basic standard deduction or special “itemized” deductions—whichever is larger. The standard deduction is a basic “no-tax floor”, designed to ensure that all families should have a certain amount of income that should not be subject to tax. Itemized deductions are the collective name for a motley group of about a dozen separate tax deductions available as an alternative to the basic standard deduction. Generally, better off families are more likely than lower income families to have enough deductions to make itemizing worthwhile. In general, the rationale for each itemized deduction is to take into account large or unusual personal expenditures that affect a taxpayer’s ability to pay. Itemized deductions include: Charitable contributions, mortgage interest, state and local income and property taxes, very large medical expenses. (For more detail on itemized deductions, see ITEP Brief, “State Treatment of Itemized Deductions”).

The final step in arriving at taxable income—the tax base to which income tax rates are applied—is to subtract personal exemptions. A personal exemption is a set dollar exemption for each person listed in a state tax return. The theory behind exemptions is that at any income level, a taxpayer’s ability to pay declines as family size increases: the more mouths to feed, the less money is left over to pay taxes.

Tax Rates

The single most important policy choice in determining the fairness of a state’s income tax is the way its tax rates work. Most states use graduated tax rate schedules where higher tax rates are applied at higher income levels. The easiest way to make an income tax progressive is through graduated rates. The higher the rates are on wealthier taxpayers, the lower the rates can be on everyone else to raise the same amount of revenue.

Tax policy debates sometimes confuse the distinction between effective tax rates, which tell us what fraction of a taxpayer’s income goes to income tax overall, and marginal tax rates, which tell us the tax rate that applied to the last dollar of income. Anti-income-tax advocates are only too happy to foster this confusion—which is why it’s important for clear-eyed observers to understand this important distinction. As the marginal rate increases, the effective rate increases too—but it always remains well below the top marginal rate.

Credits

After computing the amount of income tax based on the applicable tax rates, credits (if any) are subtracted. Credits are taken directly off the tax amount that would otherwise be owed, as opposed to deductions, which are subtracted from the amount of income that is subject to tax.

Conclusion

The nuts and bolts of the personal income tax be quite complex and vary widely by state. Yet, the basics of personal income tax: base, adjustments, deductions, personal exemptions, and credits are largely universal. Understanding the components of the personal income tax and how it works is a good step toward understanding how the income tax can counterbalance other regressive taxes that states levy.