This written testimony was submitted to the Rhode Island House Finance Committee on May 6, 2025.

Thank you for the opportunity to provide testimony in support of H-5473, a bill to create a 3 percent surcharge on those earning over $625,000 a year. My name is Miles Trinidad. I am an analyst at the Institute on Taxation and Economic Policy (ITEP), a nonprofit research group based in Washington, D.C. ITEP’s research focuses on state, local and federal tax policy issues, with an emphasis on equity and sustainability.

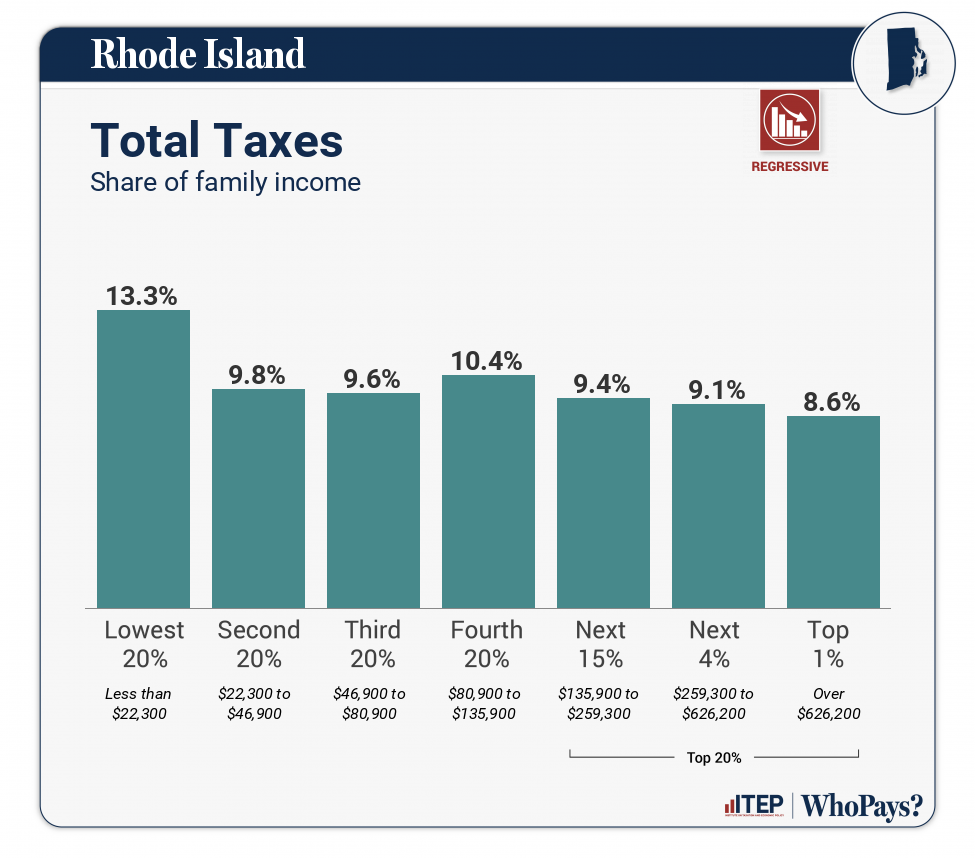

When people are asked to think of a fair tax system, most people would not point to one where the wealthiest are asked to pay a lower tax rate, as a share of their income, than low- and middle-income households. Yet, this is the case in Rhode Island. According to ITEP’s Who Pays? report, the top 1 percent of Rhode Island taxpayers pay 8.6 percent of their income in total state and local taxes—the lowest of any income group in the state. By comparison, the lowest 20 percent, with annual incomes of less than $22,300, pay 13.3 percent.

As Rhode Island faces a looming budget deficit that will likely be compounded by federal policy changes, our analysis shows that H-5473 would raise taxes in a targeted way, moving the state toward a more progressive tax system. The bill would help ensure that wealthy individuals start contributing their share to the public services that benefit all Rhode Islanders.

With the surcharge, the total taxes paid as a share of income for the top 1 percent of Rhode Island taxpayers would increase from 8.6 percent to 9.2 percent – the only income group that would see an increase under this proposal. This important step in the right direction would slightly reduce the regressivity of the state’s tax system.

In addition, the proposal would raise an estimated $190 million a year, in today’s dollars. This would help the state build a more robust and sustainable income tax to more effectively fund key priorities while building up revenue resilience as the state faces fiscal uncertainty driven by federal proposals such as:

- federal budget cuts to Medicaid, SNAP, education and other areas;

- targeting immigrants and the threat of mass deportation, which will lower revenues from these individuals and from the industries in which they work;

- a weaker economy tied both to labor force loss from deportations and from unpredictable tariff policies;

- weaker IRS enforcement of the tax base, with risks to state tax collections; and

- efforts to hollow out the federal definition of income in ways that could flow through to state income taxes.

While there are opportunities to ask even more of those with the most income in Rhode Island, and raise more revenue, this proposal is a great first step to improve the progressivity of the state’s tax system. H-5473 would ensure that the richest in the state are paying more to fund shared priorities that benefit all Rhode Islanders while allowing the state to make smaller budget cuts to critical services—such as education, child care, health care, and transportation—than otherwise would be needed.

Wealth and income inequality in this country are at historic highs, and tax policy can be a critical tool to make our economy work better for all of us, not just the wealthy and well-connected.

Thank you for the opportunity to submit this testimony.