Written Testimony of Aidan Davis, Senior Policy Analyst

Institute on Taxation and Economic Policy

Submitted to Finance, Revenue and Bonding Committee

Testimony Supporting H.B. No. 7415,

An Act Concerning a Surcharge on Capital Gains

April 26, 2019

Thank you for the opportunity to submit these written comments on the merits of adding a surcharge on capital gains and other investment income.[i] My name is Aidan Davis and I am a senior tax policy analyst with the Institute on Taxation and Economic Policy (ITEP), a nonprofit research organization. ITEP’s research focuses on state and federal tax policy issues with an emphasis on revenue sustainability and tax equity.

My comments are intended to offer some perspective on the broader tax policy context in which this proposal is being considered. We find that this proposal would help to lessen long-running inequities in Connecticut’s state and local tax law that have allowed high-income taxpayers to pay lower overall effective tax rates than most low- and middle-income families. We also find the impact of this proposal to be modest when compared alongside the federal tax cuts that Connecticut’s high-income earners received under the recent Tax Cuts and Jobs Act (TCJA). Specifically, the proposal essentially asks Connecticut’s highest-income earners to pay an amount equal to roughly one-fourth of the federal tax cut they are expected to receive this year.

Mitigating State Tax Inequities

Meaningful investment in Connecticut’s future requires a tax code that recognizes current economic realities and that can raise a sustainable stream of funding over the long-haul. Unfortunately, one reality we’re confronting in Connecticut and across the nation is a soaring level of inequality in both income and wealth.[ii] This problem is particularly pertinent in Connecticut—one of the richest but most unequal states in the country.[iii]

In this context, it is more vital than ever that states, especially Connecticut, require those families experiencing immense economic success to give back to funding the education systems, infrastructure networks, and countless other services that have made their success possible, and that can position more families for success in the years ahead. But Connecticut is falling short of this goal. In fact, the wealthiest taxpayers are currently allowed to pay lower effective tax rates than any other income group, including both poor and the middle-class taxpayers.[iv]

In a recent report, ITEP found that the top 1 percent of taxpayers in Connecticut, a group of taxpayers earning roughly $1 million or more per year, face an effective state and local tax rate of 8.1 percent once income, sales, property, and excise taxes are taken into account. This is significantly lower than the 11 or 12 percent rates paid by most low- and middle-income families.

The proposal to add a surcharge on capital gains and investments held by the wealthiest taxpayers in the state would raise more than $200 million and would help make a small dent in income and wealth inequality. The sizeable gap in tax rates between the state’s wealthiest taxpayers and everyone else would be narrowed somewhat as the effective tax rates for the state’s top 1 percent of taxpayers would rise by roughly half a percentage point, or less.

Partially Recapturing Top-Heavy Federal Tax Cuts

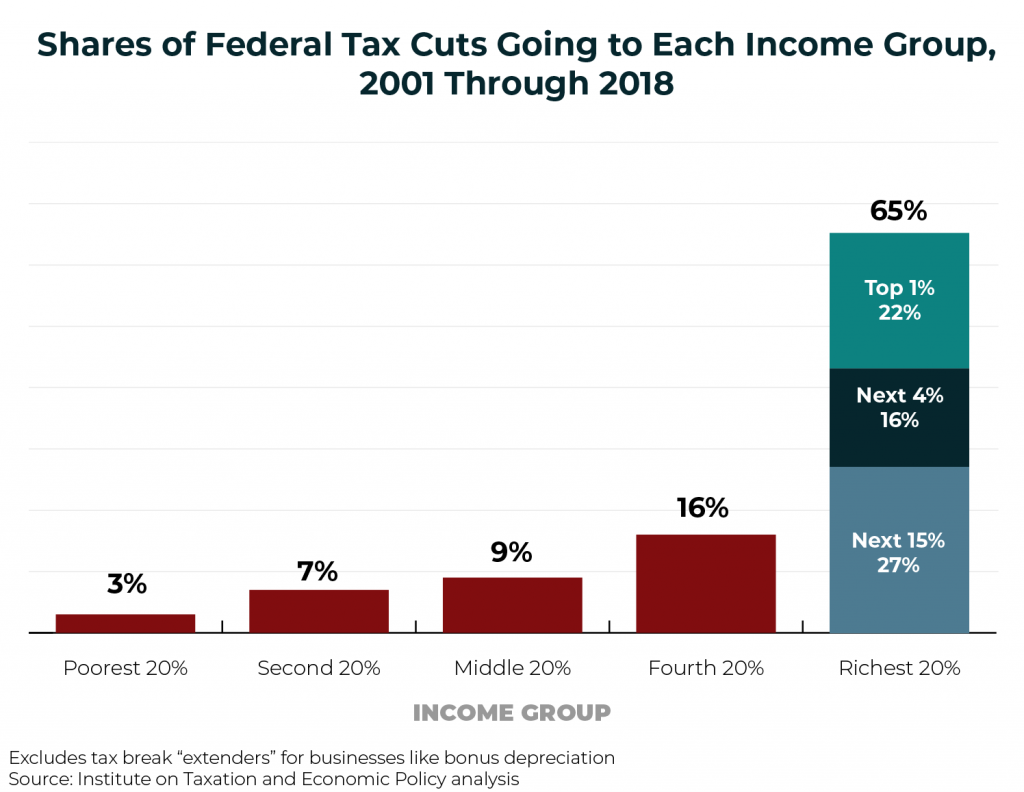

In late 2017, President Trump signed the Tax Cuts and Jobs Act (TCJA), which passed Congress on a party-line vote. While the new law cut taxes for most taxpayers, it reserved its largest cuts for large corporations (passed through primarily to shareholders) and high-income individuals.

ITEP estimates that in 2019, the top 1 percent of Connecticut residents will receive a federal tax cut averaging nearly $60,000. Collectively this small, elite group will receive more than 28 percent of federal tax cuts flowing to Connecticut residents as a result of this law.

The proposal put forth in HB 7415 (2019) would raise substantial revenue from high-income earners by essentially recapturing just a portion of the tax cuts this group received under the TCJA. ITEP modeled two slight variations of this proposal:

1) a two percentage point surcharge on capital gains and qualified dividends (both of which receive preferential treatment at the federal level) on the state’s top income bracket starting at $950,000 of income, and

2) a slightly expanded version that would levy a two percentage point surcharge on capital gains, interest and dividends (both qualified and ordinary) on the same bracket.

According to our analysis, the first proposal would raise roughly $225 million, with an average tax increase of $12,600 on the top 1 percent of Connecticut residents. That equates to just over one-fifth (21 percent) of the nearly $60,000 tax cut this group is expected to receive under the TCJA.

The second version of the proposal would raise just over $285 million, with an average tax increase of $16,100 on the state’s top earners. That results in a little more than one-fourth (27 percent) of this group’s $60,000 average federal tax cut.

In total, this proposal would impact less than 1 percent of Connecticut residents and is tailored to ask more of those families who are paying the lowest state and local effective tax rates today, and who just saw their federal tax bills drop significantly as a result of the TCJA. In this light, the proposal is valuable not just as a revenue-raising measure, but also as a tool for lessening the damage that state and federal tax law have done in worsening income and wealth inequality.

Thank you for your time and consideration of these remarks.

[i]https://www.cga.ct.gov/asp/cgabillstatus/cgabillstatus.asp?selBillType=Bill&bill_num=HB07415&which_year=2019

[ii] https://itep.org/the-case-for-progressive-revenue-policies/

[iii] https://www.epi.org/publication/the-new-gilded-age-income-inequality-in-the-u-s-by-state-metropolitan-area-and-county/ and https://ctmirror.org/2018/05/29/already-deep-debt-connecticut-struggles-extremes-wealth-income/