Donald Trump paid just $750 in federal income taxes in 2016 and 2017—and absolutely nothing in 10 of the 15 years prior to his election, according to staggering reporting published Sunday by the New York Times.

You undoubtedly paid more taxes than Trump those years. Nurses paid more. Teachers paid more. Construction workers, delivery drivers and coal miners paid more.

We at the Institute on Taxation and Economic Policy study the tax system, and we know that many rich people and corporations pay less than their fair share. But when it comes to tax dodging, Trump has always been in a league of his own. Trump, armed with accountants, shirked a basic responsibility that other Americans rise to regularly. Even given his catastrophic business decisions—which generated massive losses—he lives a life of luxury and wealth. That he avoids taxes that regular working people pay is an outrage.

Although Trump inherited huge sums ($413 million from his father) and borrowed colossal amounts (still owes some $400 million to unnamed sources), the reporting reveals that he still managed to lose money most years. Contrast this to most Americans who would struggle to pay a $1,000 expense for an unexpected emergency room visit or car repair but don’t have easy sources to give or lend them money.

Trump used write-offs of $315 million in losses on his unprofitable golf courses, of personal expenses for his $24 million family estate, of private planes. This kind of tax avoidance leaves the public sector underfunded and is part of why we skimp on essentials that regular people need. Federal financial aid has shrunk from covering more than three-quarters to less than a third of a student’s college costs, the lowest level in more than 40 years. Fewer than one in four eligible families get rental assistance. Families who need food aid in this country get only $1.39 per person per meal and only if they earn less than $28,500 for a family of three.

There is something deeply wrong with this system.

Donald Trump’s tax skirting exceeds that of most rich people by miles. Most regular people pay taxes, most rich people pay taxes, and most businesses pay taxes too. That’s what allows us to have health care, interstate highways and veterans’ benefits, among many other things we all need.

But a better tax system would prevent Trump from avoiding taxes. It would also make sure that every profitable corporation ponied up too. Instead, in 2018, 91 profitable Fortune 500 companies—including behemoths like Delta Airlines, Chevron and Halliburton—also paid nothing in taxes.

We need a country where nobody—not Donald Trump, not Amazon, not FedEx—could game the system this way.

Imagine an America where instead of letting Donald Trump write off $70,000 in haircuts (and another $95,464 to Ivanka’s beautician), we helped more young people pay for community college or a bachelor’s degree.

Imagine if instead of giving Trump a $70 million tax refund, we created green jobs in Appalachia or Atlanta, upgrading our antiquated electrical grid or driving transit vehicles.

Imagine that instead of letting Trump deduct $26 million in fees to consultants ($747,622 of which might have gone straight to his daughter), we allotted $26 million more federal aid to Michigan, which recently announced that it will cut lead remediation, health care, and road maintenance (as well as the jobs that go with them) because of a budget shortfall.

Imagine if Chevron, instead of paying no federal income taxes, had to help fund Arizona’s $874 million revenue loss during this recession.

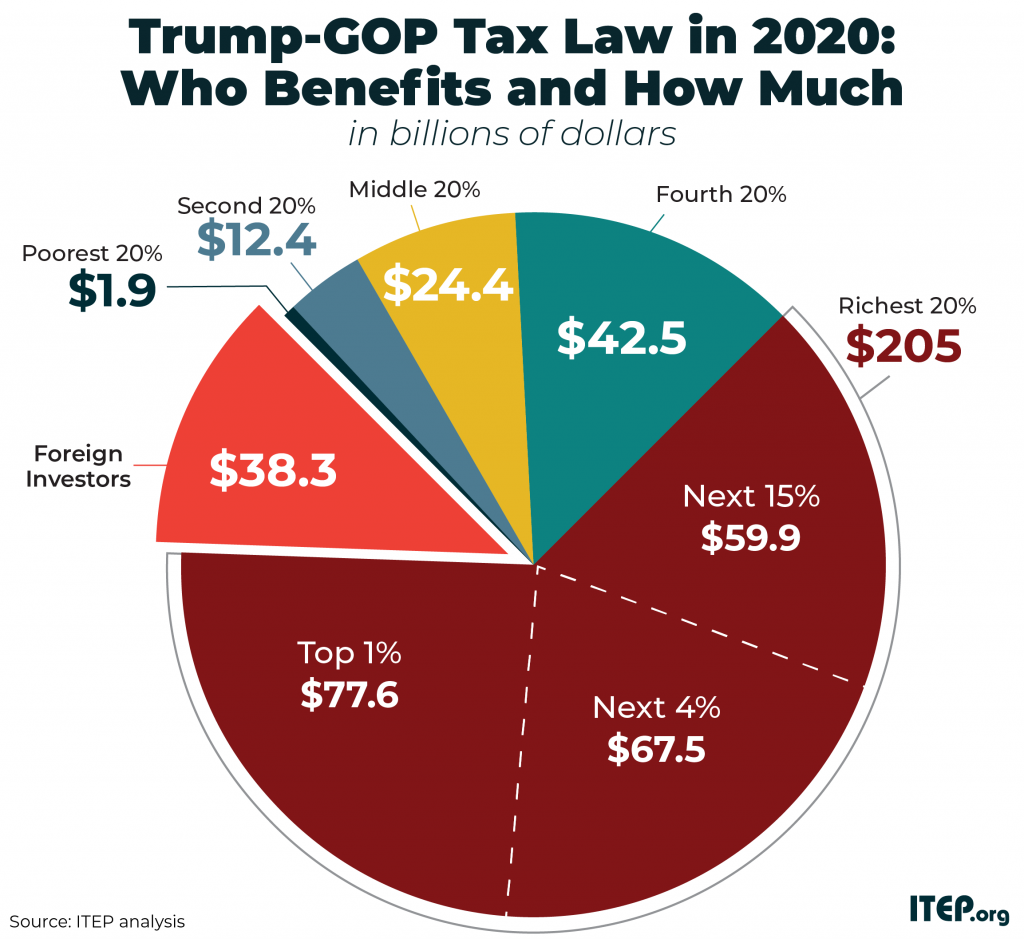

Instead, Trump’s 2017 tax law took us backward, slashing taxes for the richest 1 percent by more than $50,000 on average, reducing corporate taxes, and reducing revenue available for public needs by $1.9 trillion over a decade.

It’s time for a new approach. Trump’s egregious tax avoidance further exposes a system that preserves an enormous and growing economic divide. Congress has gutted IRS funding so that we don’t have the resources to audit wealthy tax avoiders. And lobbyists continue to get giveaways for corporate clients that do nothing for our communities.

We need to close the real estate loopholes that let Donald Trump and other developers escape their tax obligations. We need a wealth tax and a better tax on inheritance to reduce the overwhelming intergenerational wealth transfers that let Trump and others cling to an increasing share of our economy. And we need a strong corporate income tax, so that every company helps pay for the public investments that make their profits possible.

Imagine an America where Donald Trump pays taxes. Where Amazon, Halliburton, Chevron pay taxes. Where we could all afford preschool and college. Where we could all count on healthcare and a secure retirement. Where we could depend on our leaders to rise to the challenges of a pandemic, a hurricane, or a wildfire.

Imagine what we could do for all of us if people—like Donald Trump—paid their fair share.