Contact: Jon Whiten – [email protected]

Lawmakers in several states are discussing enacting or expanding school voucher tax credits, which reimburse individuals and businesses for “donations” they make to organizations that give out vouchers for free or reduced tuition at private K-12 schools, as a new brief released today by the Institute on Taxation and Economic Policy (ITEP) explains. In effect, these credits allow contributing families to opt out of paying for public education and other public services and redirect their tax payments to private and religious schools instead.

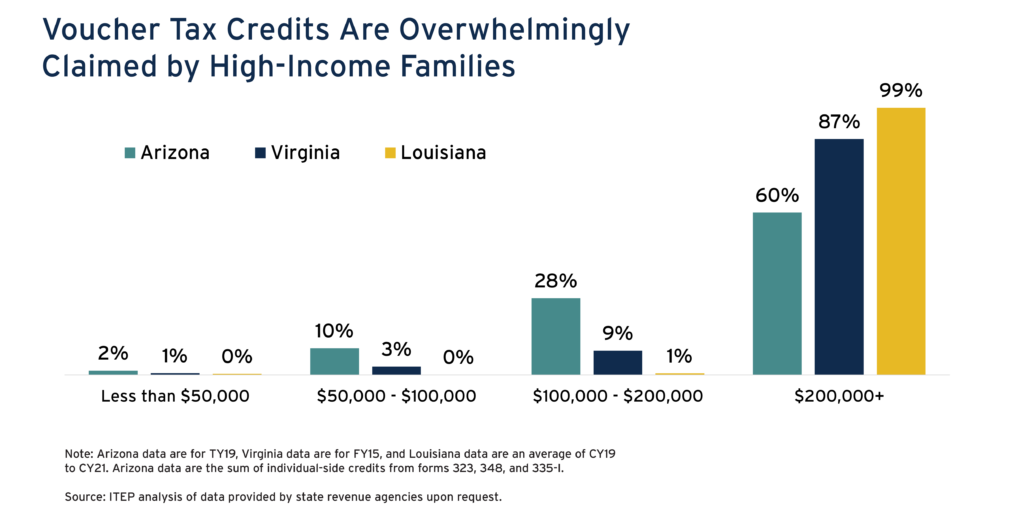

New data published for the first time today by ITEP reveal that the bulk of these credits are being claimed by wealthy families. Many of those families have little genuine interest in school vouchers and are instead being motivated by tax shelters that private schools are pitching as a way to get a “double tax benefit” and “make money” in the process. While the IRS and some states have taken steps to narrow these tax shelters, more work remains to be done.

“This isn’t how the tax law is supposed to work” said Carl Davis, research director at ITEP and author of the brief. “We have a system in place that’s siphoning billions out of public coffers and into unaccountable private schools instead, and it’s being fueled in part by tax schemes that the wealthy see as too good to pass up. There’s an obvious need for reform here.”

These tax credits are among the most significant tools eroding the public education system and propping up private schools. Voucher tax credits are on the books in 21 states and proposals to create or expand them are being discussed this year in places like Alabama, Georgia, Kansas, Montana, Nebraska, South Carolina, and Texas.

In the three states whose tax agencies provided data—Arizona, Louisiana, and Virginia—more than half of all voucher tax credits are flowing to families with annual incomes over $200,000. Virginia and Louisiana’s credits are especially skewed toward these high-income families because of very high caps on the maximum amount of credit that can be claimed per taxpayer.

Two different tax shelters can make “donating” profitable for wealthy individuals. The first relies on pairing state voucher credits with federal business expense deductions, while the second uses state voucher credits as a means of dodging federal and state tax on capital gains. The fact that these shelters exist is a reflection of the supersized nature of the tax benefits being offered for private and religious K-12 schooling. Contributions to voucher-bundling organizations are treated far more generously than those made to groups serving other populations such as veterans or survivors of domestic violence.

The best voucher tax credit reform is a simple one: repeal these credits outright and make voucher-bundling organizations use the same kinds of charitable giving incentives as other nonprofits. Short of that, there are other steps states can take to curb tax avoidance via these programs, such as only paying out the credits on donations made with cash and denying the credits on payments deducted as businesses expenses on one’s federal tax return.

The IRS also has an important role to play here. The federal tax treatment of these transactions is deeply problematic, and the stakes of getting this right are high. Public education is foundational to our democracy. While tax reforms won’t be enough on their own to stop the seemingly relentless campaign to privatize the U.S. public education system, addressing shortcomings in federal tax law that are hastening privatization is as good a place as any to start.