For years, anti-tax proponents have broadly labeled all wealthy people as “jobs creators” in their persistent pursuit of lower tax rates.

Higher tax rates on the rich mean fewer jobs for the rest of us, so the story goes. But this fallacy has fallen out of favor because it’s clear that continual tax cuts for the rich are primarily benefiting the rich and will eventually cost the rest of us in the form of broad cuts to critical programs and services.

The lore of the privileged few benevolently creating jobs for the rest of us comes from the same ideological space that figures wealth and opportunity are there for the taking for anyone who works hard enough. This myth is comforting for the rich because it confers a moral sanction on their privilege. It’s also an ideal that powerful special interests have exploited to rig the system in their favor and funnel more of the nation’s wealth to those at the top. But it simply doesn’t hold true for working people—those who are already contributing but unable to get by—that hard work translates into economic mobility.

The 2017 Tax Cuts and Jobs Act bestowed half of its benefit on the top 5 percent of taxpayers, further reduced the already weakened estate tax, and dramatically slashed the corporate tax rate among other things. It was more unpopular than tax increases under the Clinton Administration, and it (along with a heightened awareness of how the system has been rigged in favor of the wealthy few) may very well be the straw that broke the camel’s back. A chorus is building and calling on our elected officials to tax the rich. And pundits and policymakers are seriously debating proposals calling for higher income taxes and a wealth tax instead of attempting to shut down the conversation by labeling such proposals as class warfare.

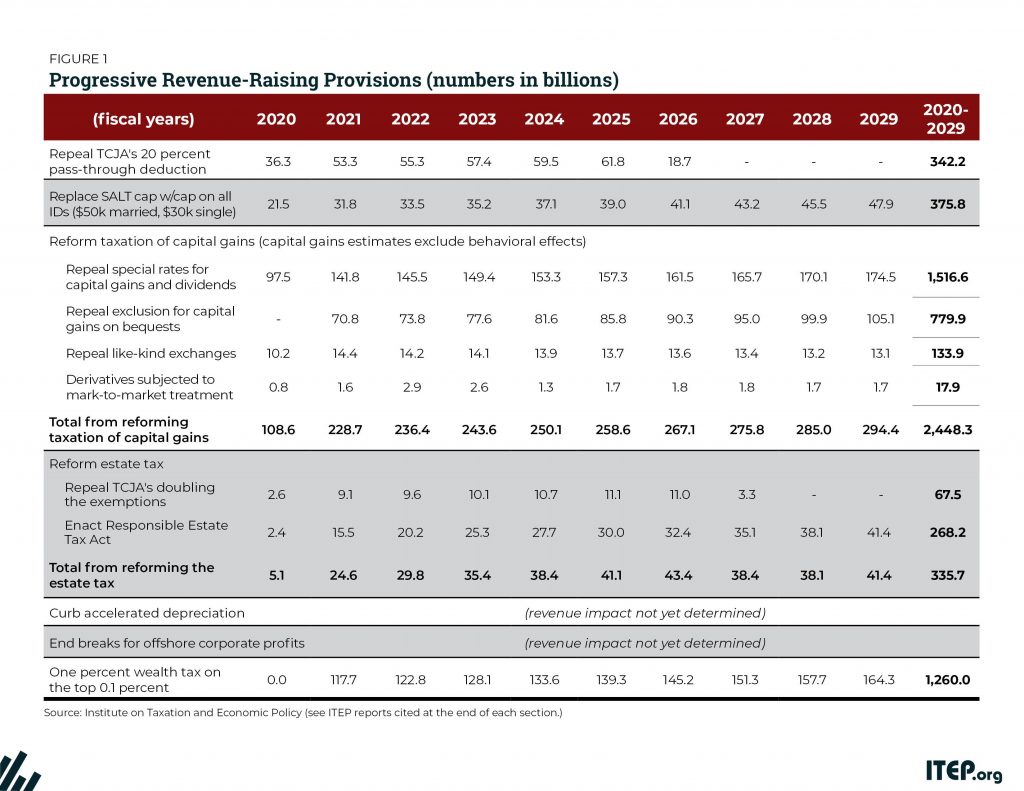

In a recent report, Progressive Revenue-Raising Options, we outline how lawmakers can create a more equitable tax system. And we take a deeper dive into some of the options in the below reports:

A federal wealth tax: In a recent report, The U.S. Needs a Federal Wealth Tax, we outline how such a tax could both raise revenue and address widening inequality. The top 1 percent of households capture about one-fifth of annual income but holds about 42 percent of all wealth. This means wealth inequality is even more severe than income inequality.

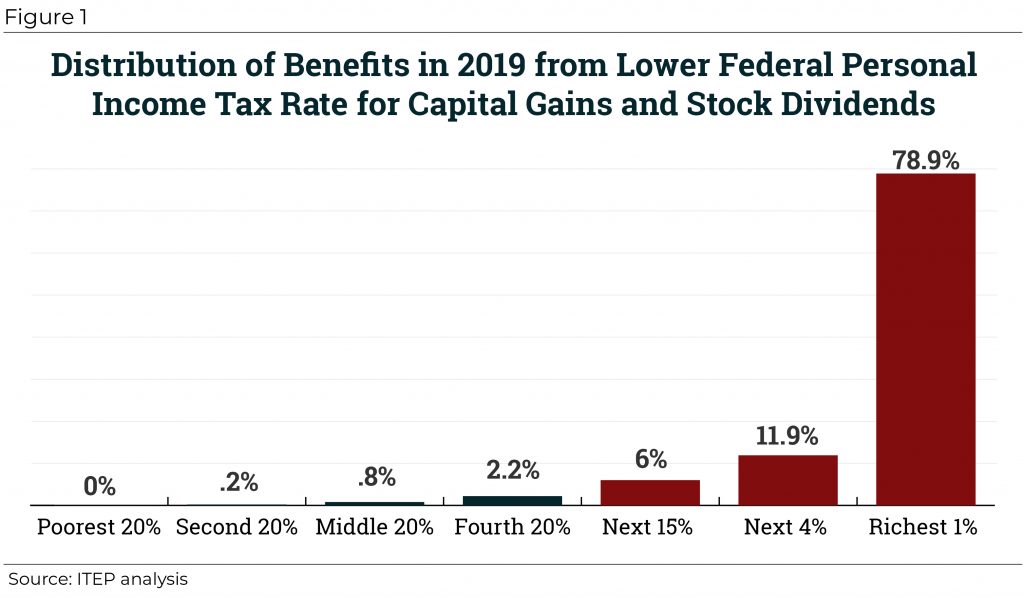

Tax capital gains the same as ordinary income: Income from capital gains is taxed at a substantially lower rate than income earned from work (a top rate of 20 percent on capital gains versus 37 percent for ordinary income), as we explain in the report Congress Should Reduce, Not Expand, Tax Breaks for Capital Gains. Wealthy individuals are more likely to derive a greater share of their income from capital gains, so this provision in the tax code provides favorable, unfair treatment to those in the highest income brackets. It also provides perverse incentive for wealthy people to contrive ways to classify their income as capital gains so that they can be subject to lower tax rates.

End the break for pass-through deduction. The Trump tax law created a new tax deduction for income from “pass-through” businesses, which are businesses that are subject to the personal income tax but not the corporate income tax. Proponents of the Trump law often call these “small businesses,” but in reality, most pass-through income goes to the richest one percent of taxpayers.

State Tax Systems Make a Difference Too: Forty-five state tax systems are upside down, meaning they tax low-income people at higher rates than the rich. Post-tax, lower-income people in most states have a smaller share of all income than before tax. Examining the federal tax system is a logical place to start when it comes to remedying income inequality, but state policymakers are missing a key opportunity if they don’t take a hard look at how their tax systems are contributing to income inequality, my colleague Meg Wiehe wrote in a recent op-ed.