A recent headline tells us that bold tax plans proposed by lawmakers today reflect a “profound shift in public mood.” But, in fact, the public’s mood has not changed at all. Americans have long wanted progressive taxes but few, if any, lawmakers publicly backed this view. What’s happening now isn’t a shift in public opinion, rather it’s Washington finally catching up with the American people.

The share of survey respondents telling Gallup that the wealthy pay too little in taxes has never fallen below 55 percent ever since Gallup started asking the question in 1992.

In 2004 Gallup started asking about corporate taxes. Support for the view that corporations pay too little has ranged from 62 percent to 73 percent since then.

The public has long rejected tax cuts for the rich, but members of Congress and the media often seemed to be unaware of this in the past.

When George W. Bush was President, little attention was given to public opposition to his tax cuts, whereas media coverage of President Trump’s Tax Cut and Jobs Act (TCJA) indicates that it’s wildly unpopular.

But is the public’s reaction really any different now than it was then? Just after President Bush signed his major 2003 tax cut into law, Gallup found that just 34 percent of those polled believed that the legislation would help their own family. In December of 2017, just as President Trump and Congressional Republicans were finalizing the TCJA, the share of Gallup’s survey respondents who believed TCJA would help their family was… 34 percent.

The public has been consistent about what it wants, and Congress has been consistent about doing the opposite.

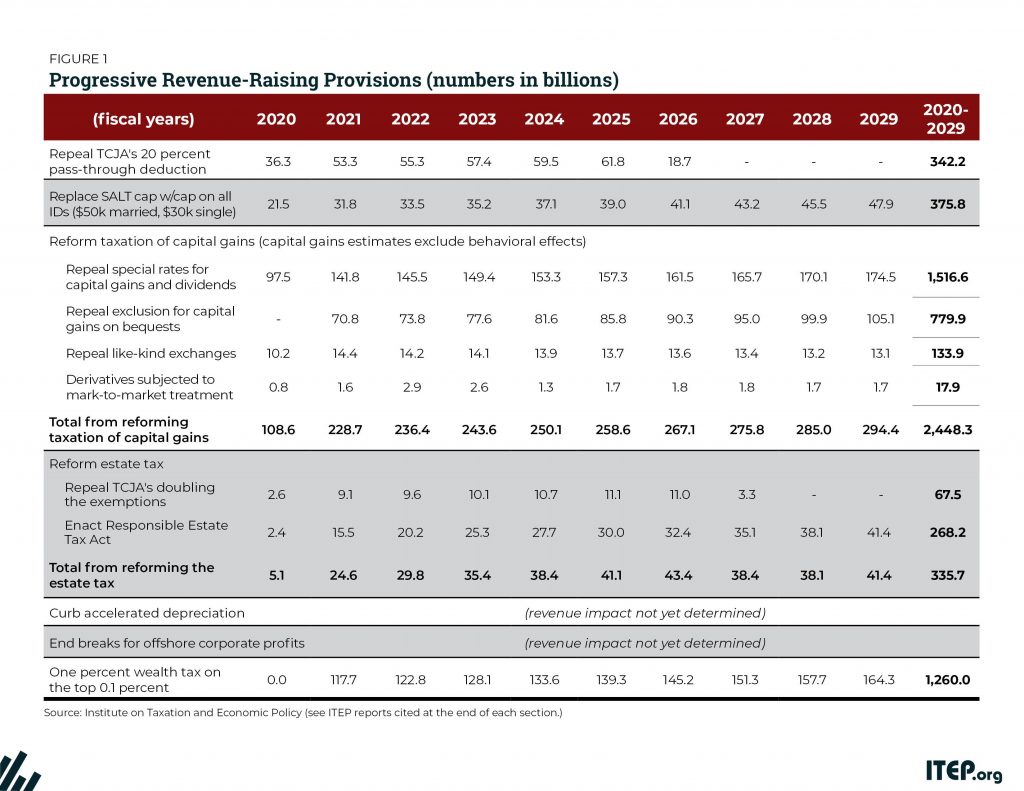

Now is the time to change that. ITEP today released a report that charts a path for Congress to enact progressive, revenue-raising tax policies that the public has long desired. While any comprehensive tax plan would have many components, this report focuses on some of the most significant revenue-raising policies that would be necessary for any true tax reform.

The options mostly focus on eliminating or sharply limiting special breaks and loopholes for the rich.

One target is TCJA’s 20 percent deduction for profits of businesses that are mostly owned by the richest one percent.

Another is the itemized deductions that benefit high-income households more than middle-income households even when they do the exact same thing (donate the same amount to charity or borrow the same amount to finance a home purchase).

Several breaks for capital gains, profits from selling assets that mostly flow to the richest one percent, are also on the list.

Estate tax reform is included, as well as reform of the corporate income tax, which is mostly paid by the well-off households who own most corporate stocks.

The one brand new tax proposed is the federal wealth tax that ITEP described in a recent report. Sen. Warren recently released a similar proposal which, unsurprisingly, is favored by 61 percent of voters according to a new poll. DC’s political class read about these poll results with amazement this week, but to anyone paying close attention to public opinion over the years, the real surprise is how long it took for politicians to embrace proposals of this sort.

Read ITEP’s report, Progressive Revenue-Raising Options.