New Jersey

Improving Refundable Tax Credits by Making Them Immigrant-Inclusive

July 17, 2024 • By Emma Sifre, Marco Guzman

Undocumented immigrants who work and pay taxes but don't have a valid Social Security number for either themselves or their children are excluded from federal EITC and CTC benefits. Fortunately, several states have stepped in to ensure undocumented immigrants are not left behind by the gaps in the federal EITC and CTC. State lawmakers should continue to ensure that immigrants who are otherwise eligible for these tax credits receive them.

While Massachusetts legislators recently dropped a real estate transfer tax from their major housing bill, the District of Columbia council sent a budget to the mayor that includes a mansion tax that would increase the tax rate on properties valued over $2.5 million. Meanwhile, lawmakers in New Jersey and South Carolina continue to, respectively, raise and reduce needed revenues.

State Rundown 6/26: Summer Special Sessions Are In, Anti-tax Ballot Initiatives Out

June 26, 2024 • By ITEP Staff

Many families are heading out on summer vacations, but legislators across the country are heading back to statehouses for special sessions...

States Should Enact, Expand Mansion Taxes to Advance Fairness and Shared Prosperity

June 26, 2024 • By Carl Davis, Erika Frankel

The report was produced in partnership with the Center on Budget and Policy Priorities and co-authored by CBPP’s Deputy Director of State Policy Research Samantha Waxman.[1] Click here to use our State Mansion Tax Estimator A historically large share of the nation’s wealth is concentrated in the hands of a few, a reality glaring in […]

There are a variety of factors that affect teacher pay. But one often overlooked factor is progressive tax policies that allow states to raise and provide the funding educators and their students deserve.

Uncertainty abounds in state tax debates lately...

Many state legislative sessions are wrapping up...

Tax History Matters: A Q&A with Professor Andrew Kahrl, Author of ‘The Black Tax’

April 24, 2024 • By Brakeyshia Samms

In his new book, The Black Tax: 150 Years of Theft, Exploitation, and Dispossession in America, Professor Andrew Kahrl walks readers through the history of the property tax system and its structural defects that have led to widespread discrimination against Black Americans.

New Jersey Policy Perspective: New Immigrants Drive Economic Growth in New Jersey

April 15, 2024

New Jersey’s fundamental strength lies in the rich tapestry of people who call the Garden State home, reflecting a diverse range of cultures and backgrounds. Nearly one in four residents (2.2 million) are immigrants,[i] who play a pivotal role in shaping the state’s identity. Immigrants bring a wealth of skills and talents that enrich New Jersey’s arts, cuisine, and entertainment, add to the intellectual achievements across various fields, and play essential roles in the private and public sectors. Across the state, immigrants make significant contributions to their local communities and the broader economy through their labor, entrepreneurial endeavors, and tax contributions.

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

April 11, 2024 • By ITEP Staff

State and local tax codes can do a lot to reduce inequality. But they add to the nation’s growing income inequality problem when they capture a greater share of income from low- or moderate-income taxpayers. These regressive tax codes also result in higher tax rates on communities of color, further worsening racial income and wealth divides.

State Rundown 3/28: Tax Cut Madness, But Our Brackets Bet on Tax Fairness

March 28, 2024 • By ITEP Staff

While madness is typically reserved for basketball in March, several high-profile, regressive tax cuts are making their way through state legislatures this week...

Over the past week Utah continued its slow march toward a more inequitable tax code...

These forward-thinking states are demonstrating the wide variety of options for policymakers who want to raise more from the wealthiest people, rein in corporate tax avoidance, create fair tax codes and build strong communities.

ITEP’s Marco Guzman Testifies in Favor of Tax Fairness Bills in Connecticut

March 11, 2024

Good afternoon, Senator Fonfara, Representative Horn, and members of the Committee, and thank you for this opportunity to testify. My name is Marco Guzman and I'm a senior policy analyst with the Institute on Taxation and Economic Policy, or ITEP, and we’re a nonprofit research organization that focuses on state, local, and federal tax policy issues.

Anti-tax interests finally found the end of the tax cutting appetite in a few states this week...

ITEP’s Kamolika Das Testifies on Pennsylvania’s Upside-Down Tax Code

March 4, 2024

Below is written testimony delivered by ITEP Local Policy Director Kamolika Das before the Pennsylvania House Finance Subcommittee on Tax Modernization & Reform on March 1, 2024. Good afternoon and thank you for this opportunity to testify. My name is Kamolika Das, I live in South Philly, and I’m the Local Tax Policy Director at […]

State legislative sessions are in full swing with New Jersey and Oklahoma both particularly active this week...

The ‘Low-Tax’ Lie: States Hyped for Low Taxes Usually Only Low-Tax for the Rich

February 20, 2024 • By Jon Whiten

It’s hard to go a week without seeing a politician or a news article hype up a state as the place that everyone is moving to – or should move to – because of low taxes. However, there’s a big problem with these proclamations: they aren’t true.

State Rundown 1/26: Wealth Taxes Drawing Interest Early in Legislative Sessions

January 26, 2024 • By ITEP Staff

Bills are moving and state legislative sessions are picking up across the country, giving elected officials the opportunity to consider two distinct paths when it comes to tax policy...

State Tax Watch 2024

January 23, 2024 • By ITEP Staff

Updated July 15, 2024 In 2024, state lawmakers have a choice: advance tax policy that improves equity and helps communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for low-income and working families to get ahead. Despite worsening state fiscal conditions, we expect […]

The findings of Who Pays? go a long way toward explaining why so many states are failing to raise the amount of revenue needed to provide full and robust support for our public schools.

Worthwhile Ideas for a Stronger and Fairer D.C. Tax Code

January 17, 2024 • By Andrew Boardman, Kamolika Das, Marco Guzman

The nation’s capital has a once-in-a-decade opportunity to advance a stronger and fairer local tax code. New draft recommendations from a key advisory panel will help leaders make the most of the moment.

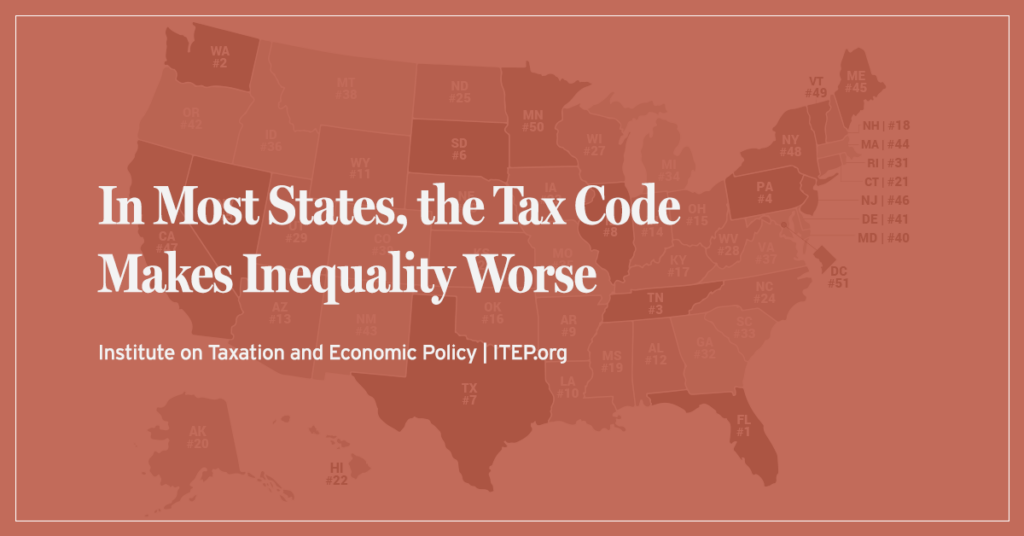

The vast majority of state and local tax systems are upside-down, with the wealthy paying a far lesser share of their income in taxes than low- and middle-income families. Yet a few states have made strides to buck that trend and have tax codes that are somewhat progressive and therefore do not worsen inequality.

Tax Systems in 44 States Exacerbate Inequality, In-Depth ‘Who Pays?’ Study Finds

January 9, 2024 • By ITEP Staff

The vast majority of state and local tax systems are upside-down, with the wealthy paying a far lesser share of their income in taxes than low- and middle-income families. That’s according to the latest edition of the Institute on Taxation and Economic Policy’s Who Pays?, the only distributional analysis of tax systems in all 50 states and the District of Columbia.

New Jersey: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

New Jersey Download PDF All figures and charts show 2024 tax law in New Jersey, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.9 percent) state and local tax revenue collected in New Jersey. State and local tax shares of family income Top […]