A federal wealth tax on the top 0.1 percent of households could raise significant tax revenue, curb growing economic inequality and help make the tax system fairer, a new report released today by the Institute on Taxation and Economic Policy (ITEP) finds.

The report (The U.S. Needs a Federal Wealth Tax) details how most of the nation’s economic gains over the past three decades have concentrated among the nation’s wealthiest households, discusses how a wealth tax could be administered and describes how such a tax could pass constitutional muster.

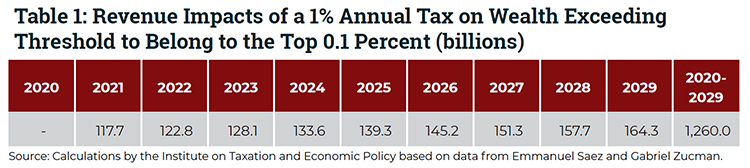

Households in the top 0.1 percent have net worth of $32.2 million or more. The report proposes assessing a tax of 1 percent on net worth exceeding that amount, adjusting the threshold for inflation every year. So, for example, if such a tax were in place, a household with a net worth of $32.4 million would pay a 1 percent wealth tax on $200,000. Using data from University of California at Berkley economists Emmanuel Saez and Gabriel Zucman, ITEP found that a wealth tax implemented in 2020 would raise $117.7 in its first year and $1.26 trillion over a decade. See https://itep.org/the-u-s-needs-a-federal-wealth-tax/#methodology.

“Our tax system is designed to allow the wealthy to shield significant parts of their income and economic gains from taxation,” said Steve Wamhoff, ITEP’s federal policy director and author of the report. “Tax and other policies that favor the wealthy have contributed to the growing economic divide. It’s time to shift the national conversation away from failed supply-side economic theories and have serious discussions on fairer, more progressive tax policies. A federal wealth tax is a good place to start.”

Much of the wealth owned by the middle-income families is their homes. This wealth is taxed every year via property taxes. Very wealthy families usually own assets that go far beyond their homes and which are not subject to any type of annual wealth tax.

“The United States is the birthplace of progressive taxation,” said Gabriel Zucman, a professor of economics at Berkley whose work examines global wealth, inequality and tax havens. “It’s the country that has pioneered the sharply progressive taxation of income and estates, two of the most important fiscal innovations of the 20th century. The time has come again for the United States to pave the way toward a modern tax system, adapted to the challenges of the 21st century. A progressive wealth tax, on all assets net of debts above a high exemption level, is the right answer to the dramatic increase in inequality—the defining challenge of our time.”

More than a year after federal lawmakers enacted the unpopular Tax Cuts and Jobs Act, it is clear that its primary beneficiaries are corporations and the wealthy. The law perpetuates the nation’s economic divide by shifting even more of the nation’s wealth to those who already have the most.

“Democracies become oligarchies when wealth is too concentrated,” said Emmanuel Saez, who is the director of the Center for Equitable Growth at Berkley and whose work examines inequality and capital income taxation. “A progressive wealth tax is the most direct policy tool to curb the growing concentration of wealth in the United States. It can also raise sorely needed tax revenue to fund the public good. Wamhoff’s carefully documented plan of imposing a 1 percent wealth tax on the richest 0.1 percent of Americans is an important step in this direction. Even though modest in size, this wealth tax could raise about $1.3 trillion over a decade reversing most of the $1.5 trillion Trump tax cut for the rich.”

Read Wamhoff’s blog, which summarizes the report: https://itep.org/thoughts-about-a-federal-wealth-tax-and-how-it-could-raise-revenue-address-income-inequality

Read the report: https://itep.org/the-u-s-needs-a-federal-wealth-tax/