The United Kingdom’s parliament has enacted a new law requiring its overseas territories — which include notorious tax havens like Bermuda, the Cayman Islands, and the British Virgin Islands — to start disclosing by 2020 the owners of corporations they register.

This could shut down a huge amount of offshore tax evasion and other financial crimes because individuals from anywhere in the world, including the United States. have long been able to set up secret corporations in these tax havens to stash their money.

While details of the rules are complicated, the bottom line is that the governments of these territories generally do not hand over information to the tax enforcement or law enforcement agencies of other countries that are trying to track down those suspected of tax evasion, money laundering, terrorist financing and other financial crimes. They certainly do not make such information available to reporters and the public. Under the new law, all this will change by 2020.

UK Overseas Territories’ Starring Role in Undermining Tax Systems Worldwide

There are really two types of offshore tax dodging, and both have long been facilitated by Bermuda, the Cayman Islands, and the British Virgin Islands. The first type is tax evasion, which this new law seeks to address, and involves individuals simply hiding their income from their tax authorities. This is clearly illegal. The second type is usually called tax avoidance, which involves using loopholes and accounting gimmicks to make profits appear to be earned offshore when they really are not, but without necessarily breaking the law.

The distinction between the two can be hazy, and indeed some say the difference depends on how good your attorney is. Typically, offshore tax evasion is a crime committed by individuals whereas tax avoidance is common among major corporations. One thing both these practices have in common is a dependence on tax haven jurisdictions.

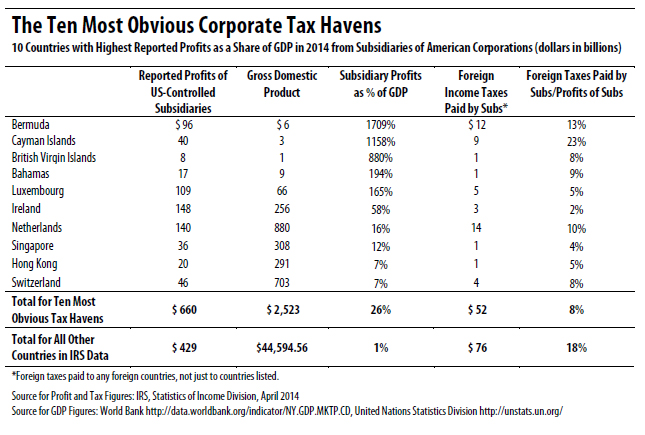

Bermuda, the Cayman Islands, and the British Virgin Islands topped the list of the 10 most obvious offshore tax havens published last year by ITEP. The report found, for example, that the American-owned corporations and subsidiaries in Bermuda reported $96 billion in profits in 2014, a year when the entire gross domestic product (entire economic output) of Bermuda was just $6 billion. What these corporations and subsidiaries are reporting to the IRS is obviously impossible.

It is likely that most of the profits reported to the IRS as earned in these countries are the result of offshore tax avoidance by major corporations — technically legal, but clearly undermining the integrity of the tax system — as opposed to the crime of tax evasion. For the United States, corporate tax avoidance will always be a problem until Congress closes the loopholes that make it possible. But unfortunately the new tax law, the Tax Cuts and Jobs Act, is likely to expand it in many ways.

Objections Are Mostly Not Credible, With One Exception

The governments of these overseas territories are objecting vocally to the new UK law because it will deprive them of the ability to generate millions each year in incorporation fees. The Cayman Islands is threatening to sue to block its enforcement on the grounds that it unconstitutionally interferes with their right of self-governance.

The irony here is rich. One of the main reasons people looking to hide their money choose these territories is that they think of them as part of the UK, largely using British law and benefiting from the stability that comes with it. But now, when the UK wants to put an end to the financial secrecy that facilitates crime, the territories cry that they are independent nations that cannot be told what to do. Regardless of what the territories claim, it is generally accepted that the UK does in fact control international affairs for them and this issue certainly falls within that realm.

But critics of the new British law do make one valid point. They argue that much of the income flowing into secret entities in these overseas territories will instead be rerouted into shell companies in U.S. states like Delaware, which do not even collect the identities of people who register corporations in their jurisdictions.

The obvious solution to this problem is for the United States to join the bandwagon and enact a comparable reform. Thankfully there are bills in Congress that would accomplish this, including the bipartisan Corporate Transparency Act and the True Incorporation Transparency for Law Enforcement (TITLE) Act. In addition, the House Financial Services Committee is seriously considering approving bipartisan money laundering legislation, the Counter Terrorism and Illicit Finance Act, which would also allow for the collection of ownership information. These bills would not go so far as the UK law in the sense that the government would not publicly publish who owns which business entity. But this information would be at least recorded and made available to law enforcement authorities trying to crack down on tax evasion and other crimes.

This is a commonsense reform. Given that the British overseas territories will be forced to clean up their act, members of Congress need to ask whether they really want the U.S. to be known as a more notorious tax haven than the Cayman Islands.