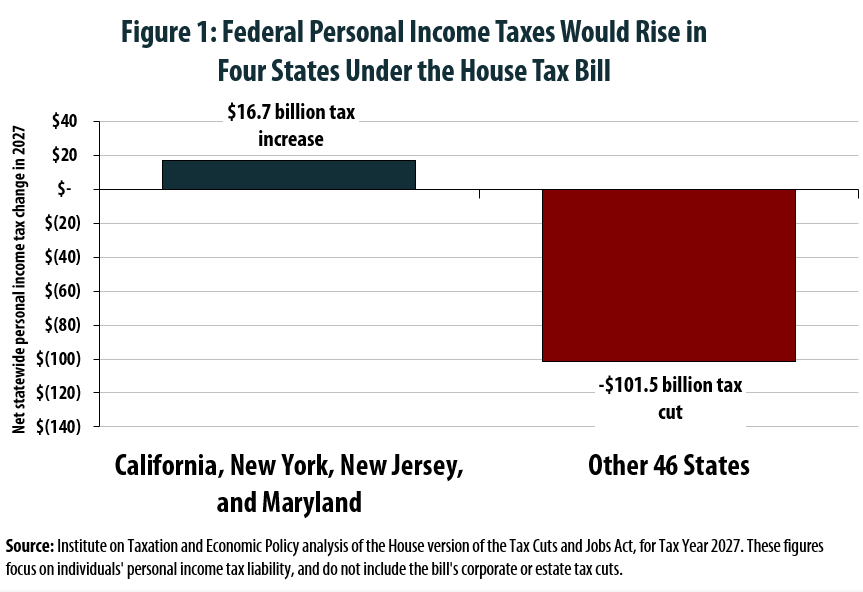

The plans also differ on their treatment of state and local tax deductions. The Senate would kill them entirely. The House would maintain them only for property taxes and cap the deduction at $10,000 a year. Economists generally say that those tax breaks are inefficient. But eliminating them, in the context of the House bill, would add up to a large geographic transfer of income, according to research by Carl Davis, the research director of the Institute on Taxation and Economic Policy in Washington.

The House bill would raise personal taxes on Californians and New Yorkers by a combined $16 billion in 2027, Mr. Davis found, while cutting personal taxes on Texans and Floridians by more than $30 billion in total. Read more