The Louisiana Legislature has been in session for two weeks now. The stage has been set for fiscal reform and the stakes are high. The state faces a $1.3 billion loss of revenue starting July 1, 2018 when the temporary sales tax base expansion and rate increase expires if lawmakers fail to close the gap this legislative session. (State law prohibits the adjustment of taxes during the 2018 regular session.)

After years of repeated budget cuts, the appetite to cut an additional $1.3 billion doesn’t appear to be there. Reform-minded revenue raising is understood broadly to be a necessary part of reaching a solution.

But getting there will prove to be difficult.

This isn’t due to a lack of focus or shortage of ideas. The Task Force on Structural Changes in Budget and Tax Policy has been working on recommendations for “comprehensive solutions for a sustainable tax and spending structure” since last fall. The Louisiana Budget Project has proposed a Blueprint for a Stronger Louisiana. A few lawmakers have put forward suggested reform packages that have received early hearings this session.

But income tax reforms are apparently a non-starter with a large enough group of lawmakers that many of these progressive revenue solutions are being viewed as politically inviable. In light of this, Gov. Bel Edwards has presented a reform plan that includes a Commercial Activities Tax (CAT) at its core, catching many off guard and drawing early and growing opposition from the business community.

The CAT will get its first formal hearing this coming Monday in the House Ways and Means Committee, where it is expected to die a bloody death. The governor has not issued a “Plan B” reform plan, calling on oppositional lawmakers to be proactive participants in the process and present alternatives.

If income taxes and major reforms to corporate taxes are really off the table, this leaves the sale tax as the only major revenue source to tap for reform. While expansion of the sales tax through taxing certain services and eliminating current exemptions could replace an estimated $700 million of lost revenue from the expiration of the temporary sales tax increase, this is just over half of what is needed to fill the budget hole, let alone restore investments in priorities like the TOPS program. Without consensus on other revenue sources, making the sales tax increase permanent—giving Louisiana the highest combined state and local sales tax rate in the nation—may become the more tempting solution for lawmakers to reach for.

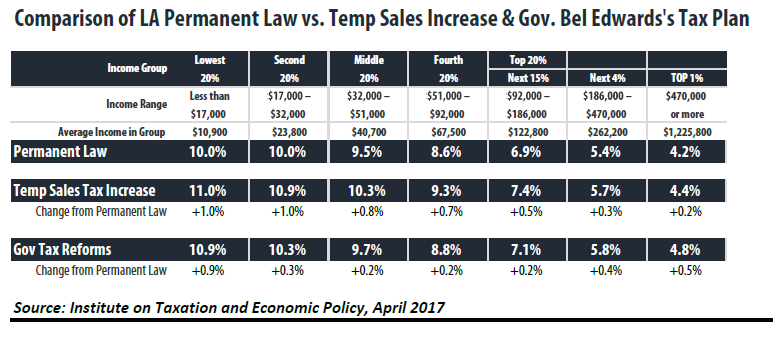

However problematic lawmakers may find the CAT or personal income tax reforms to be, simply extending the sales tax increase won’t resolve Louisiana’s revenue problems and it will make taxes more unfair. An ITEP analysis of the temporary sales tax increase versus the governor’s proposal shows how the bottom 95% of taxpayers pay more under the sales tax increase than they would under the governor’s plan, while the richest 5% of taxpayers pay less. (This is true even given the recently revised revenue estimates for the Commercial Activities Tax.)

As the governor said, “Fiscal reform is hard. It requires people to have some courage.” Until they do, this legislative session will continue to feel like a cat on a hot tin roof.