Recent Work by ITEP

Supreme Corporate Tax Giveaway: Who Would Benefit from the Roberts Court Striking Down the Mandatory Repatriation Tax?

September 27, 2023 • By Matthew Gardner, Spandan Marasini

The Supreme Court is set to hear what could become one of the most important tax cases in a century. If decided broadly—with a ruling that strikes down the Mandatory Repatriation Tax for corporations, effectively making it unconstitutional to tax unrealized income—the Roberts Court’s decision in Moore v. US could stretch far beyond the plaintiffs themselves and would put in legal jeopardy many laws that prevent corporations and individuals from avoiding taxes and level the economic playing field.

Kyrsten Sinema’s Latest Fight to Protect Tax Breaks for Private Equity

September 15, 2023 • By Steve Wamhoff

Sen. Sinema's bill to stop a seemingly arcane business tax increase that was enacted as part of the 2017 Trump tax law would be hugely beneficial to the private equity industry.

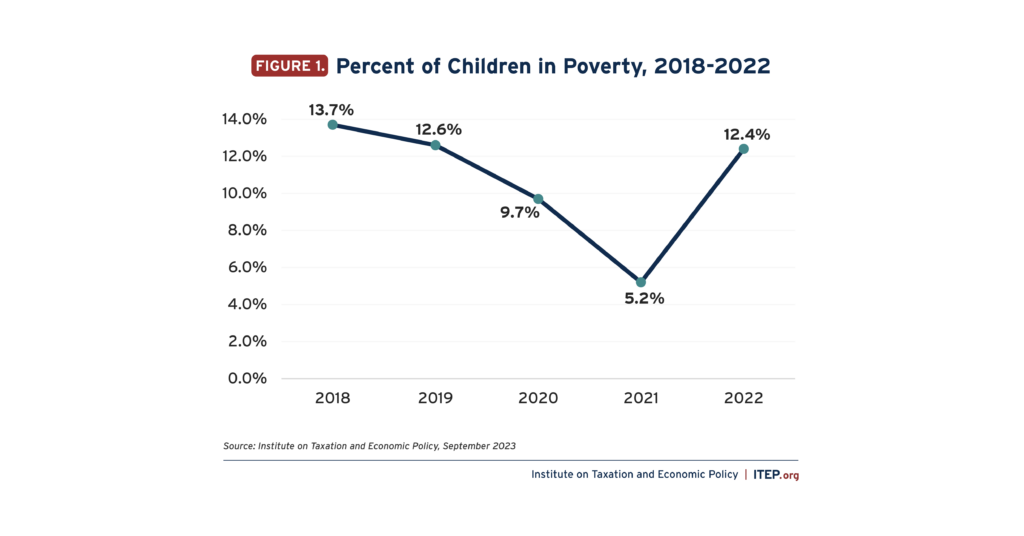

The U.S. Census Bureau released its annual assessment of poverty in America this week...

State Tax Credits Have Transformative Power to Improve Economic Security

September 12, 2023 • By Aidan Davis

The latest analysis from the U.S. Census Bureau provides an important reminder of the compelling link between public investments and families’ economic well-being. Policy decisions can drastically reduce poverty and improve family economic stability for low- and middle-income families alike, as today’s data release shows.

States are Boosting Economic Security with Child Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Fourteen states now provide Child Tax Credits to reduce poverty, boost economic security, and invest in children. This year alone, lawmakers in three states created new Child Tax Credits while lawmakers in seven states expanded existing credits. To maximize impact, lawmakers should consider making their credits fully refundable, not including an earnings requirement, setting a maximum amount per child instead of per household, setting state-specific phase-out ranges that target low- and middle-income families, indexing to inflation, and offering the option of advanced payments.

Lapse of Expanded Child Tax Credit Led to Unprecedented Rise in Child Poverty

September 12, 2023 • By Joe Hughes

The new Census data should provide both concern and optimism for lawmakers. The steep rise in child poverty is an inexcusable tragedy. But it shows that child poverty is avoidable when Congress makes the decision to make tax policy for those who need the hand up rather than for the rich and powerful.

Boosting Incomes, Improving Equity: State Earned Income Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Nearly two-thirds of states (31 plus the District of Columbia and Puerto Rico) have an Earned Income Tax Credit, an effective tool that boosts low-paid workers’ incomes and helps lower-income families achieve greater economic security. This year, 12 states expanded and improved EITCs.

How to Better Tax the Rich Men North (and South) of Richmond

September 7, 2023 • By Amy Hanauer

When you examine tax policy through the lens of how much working (and poor) people are taxed compared to rich men north (and south) of Richmond, it’s hard not to take Oliver Anthony's runaway hit as a jumping off point to amplify some important facts.

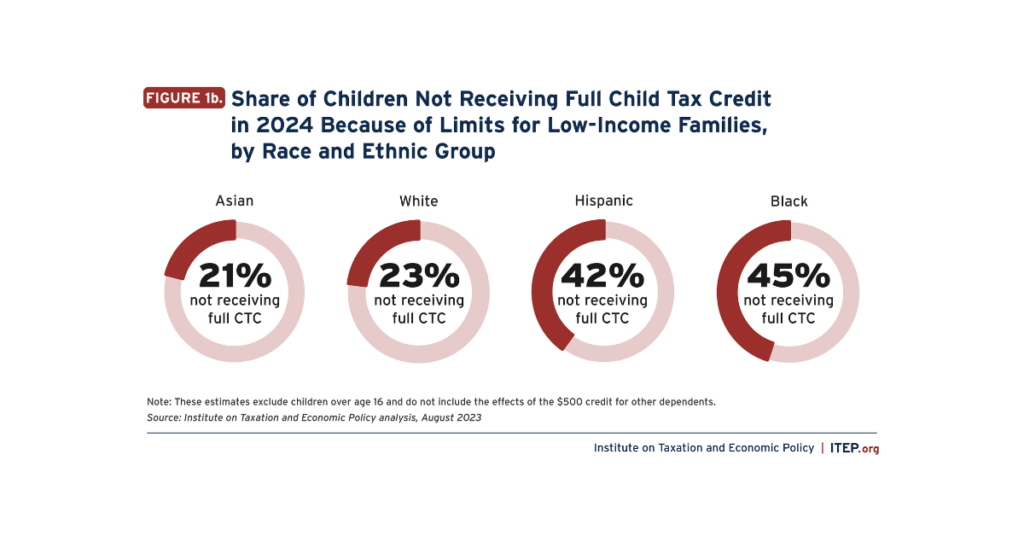

Expanding the Child Tax Credit Would Advance Racial Equity in the Tax Code

August 29, 2023 • By Emma Sifre, Joe Hughes

Expanding the federal Child Tax Credit to 2021 levels would help nearly 60 million children next year. It would help the lowest-income children the most and would particularly help children and families of color.

While a number of state tax laws are debated, approved, and vetoed in any given year, many go unnoticed...