Recent Work by ITEP

The Innovative Non-Tax Tax Parts of the Inflation Reduction Act

August 23, 2023 • By Michael Ettlinger

In the year since Congress enacted the Inflation Reduction Act (IRA), ITEP has written extensively on the law’s provisions to increase tax fairness and raise revenue for public investments. The IRA, however, also includes tax provisions that serve purposes other than ensuring that we raise adequate revenue and that we do so in a fair […]

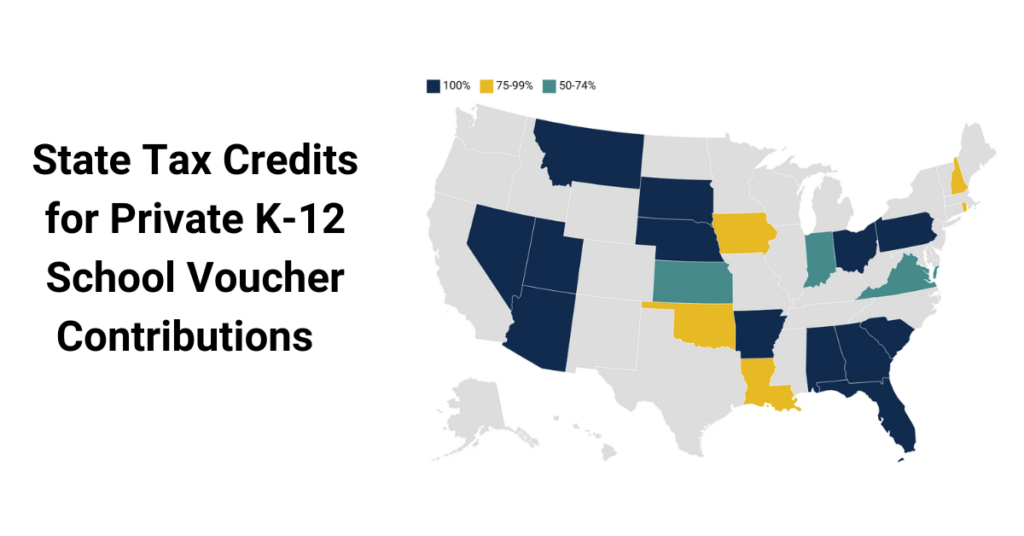

Does Your State Offer Tax Credits for Private K-12 School Voucher Contributions?

August 15, 2023 • By Carl Davis

Twenty-one states provide public support to private and religious K-12 schools through school voucher tax credits.

Celebrating One Year Since the Landmark Inflation Reduction Act

August 14, 2023 • By Joe Hughes

The Inflation Reduction Act was a course correction from decades of tax cuts that primarily went to the richest Americans and left the rest of us with budget shortfalls that conservative lawmakers now seek to plug with cuts to Social Security and Medicare. For the first time in generations we are finally asking those who have benefited the most from our economy to contribute back.

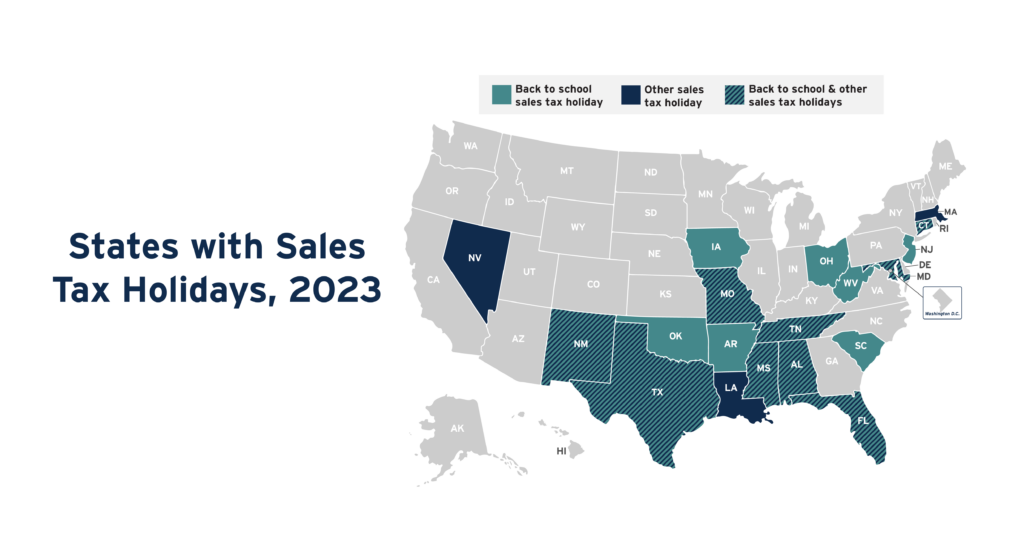

State Rundown 8/10: Pump the ‘Breaks’ on Sales Tax Holiday Celebrations

August 10, 2023 • By ITEP Staff

August is here, school is starting, and with that comes back to school shopping...

Weakening the SALT Cap Would Make House Tax Package More Expensive and More Tilted in Favor of the Wealthiest

August 7, 2023 • By Steve Wamhoff

The three tax bills that cleared the House Ways and Means Committee in June are reportedly stalled due to some House Republicans’ demands that the package include provisions weakening the $10,000 cap on deductions for state and local taxes (SALT). Modifying the House tax package in this way would make it much more expensive while benefiting the richest fifth of taxpayers almost exclusively.

The number of states with sales tax holidays on the books fell to 19 in 2023 from 20 in 2022. Yet even as slightly fewer states have them, they are estimated to cost much more. In 2023, sales tax holidays will cost states and localities nearly $1.6 billion in lost revenue, up from an estimated $1 billion just a year ago.

A Lot for A Little: Gimmicky Sales Tax Holidays Are an Ineffective Substitute for Real Sales Tax Reform

August 3, 2023 • By Marco Guzman

This year, 19 states will forgo a combined $1.6 billion in tax revenue on sales tax holidays—politically popular, yet ultimately ineffective gimmicks with minimal benefits and significant downsides.

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 2, 2023 • By Marco Guzman

Nineteen states have sales tax holidays on the books in 2023, and these suspensions will cost nearly $1.6 billion in lost revenue this year. Sales tax holidays are poorly targeted and too temporary to meaningfully change the regressive nature of a state’s tax system. Overall, the benefits of sales tax holidays are minimal while their downsides are significant.

The Dog Days of summer are upon us, and with most states out of session and extreme heat waves making their way across the country, it’s a perfect time to sit back and catch up on all your favorite state tax happenings (ideally with a cool drink in hand)...

States and Localities are Making Progress on Curbing Unjust Fees and Fines

July 18, 2023 • By Andrew Boardman

Too many state and local governments tap legal-system collections, rather than adequate tax systems, to fund shared essentials like public safety and education. But a growing number of states and localities are choosing a better approach. Momentum for change has continued to build in 2023, with no fewer than seven states enacting substantial improvements.