Recent Work by ITEP

State Rundown 12/15: State Priorities for 2023 Begin to Take Shape

December 15, 2022 • By ITEP Staff

State leaders have begun to release budget projections for 2023 and a familiar theme has emerged once again: big revenue surpluses, which have many state lawmakers pushing for another round of tax cuts despite the monumental challenges that we as a country face that call for sustainable revenues...

Any tax legislation enacted before this Congress ends should prioritize policies that have a proven track record of helping workers and children rather than policies that cut taxes for corporations or for individuals who are already well-off. It's not clear right now whether lawmakers will do that - or whether they will enact any tax legislation at all before the year ends, but here we take a look at the key tax issues that lawmakers are discussing.

Lawmakers Seek to Extend Tax Break for “Research” that Corporations Use to Develop Frozen Foods, New Beer Flavors, Casino Games and Tax Avoidance

December 8, 2022 • By Steve Wamhoff

If Congress creates a tax break to encourage businesses to conduct research that benefits society, should Netflix be eligible for it? There is no shame in binge-watching Stranger Things or Bridgerton or The Crown, but how many of us really think Netflix deserves a tax break for whatever “research” the company did to provide this […]

Reversing the Stricter Limit on Interest Deductions: Another Huge Tax Break for Private Equity

December 6, 2022 • By Steve Wamhoff

Private equity is doing fine on its own and does not need another tax break. Congress should keep the stricter limit on deductions for interest payments —one of the few provisions in the 2017 tax law that asked large businesses to pay a little bit more.

Bipartisan Retirement Proposals Are Mostly Just More Tax Cuts for the Wealthy

December 5, 2022 • By Steve Wamhoff

The EARN Act and SECURE Act 2.0, two bipartisan retirement bills working their way through Congress, are major disappointments. They would mainly provide more tax breaks for the well-off who will most likely retire comfortably regardless of what policies Congress enacts. The bills would provide modest assistance for those who really need help to save.

State Rundown 11/30: ‘Lame Duck’ December Could Have Major Tax Implications

November 30, 2022 • By ITEP Staff

As federal lawmakers begin their lame duck deliberations, the revival of the expanded child tax credit remains a strong possibility...

Child Tax Credit Expansion Would Shrink the Racial Wealth Gap

November 21, 2022 • By ITEP Staff

Extending the expanded Child Tax Credit would benefit nearly every child in low- and middle-income families. Under current rules, 24% of white children, 45% of Black children, and 42% of Hispanic children will not receive the full credit in 2023 because their families make too little. These figures would drop to zero if the provisions were extended, helping families of all races and disproportionately helping families of color.

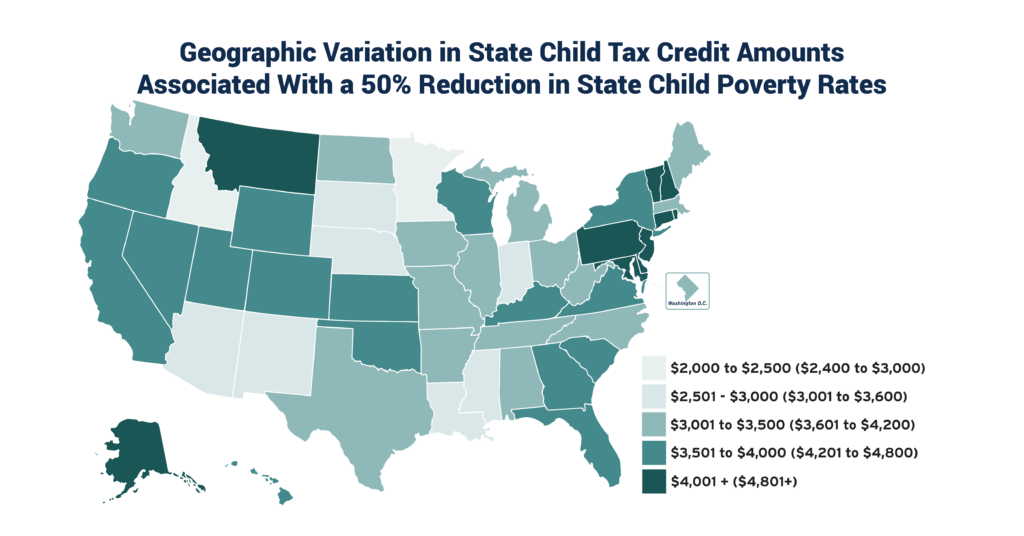

State policymakers have the tools they need to drastically reduce child poverty within their borders. A new ITEP report, coauthored with Columbia University’s Center on Poverty and Social Policy, explores state Child Tax Credit (CTC) options that would reduce child poverty by up to 50 percent. Temporary expansion of the federal CTC in 2021 reduced […]

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

As states continue to tally the remaining votes and the news stories roll out at a breakneck pace, the unofficial results of the 2022 midterm elections have brought with it significant changes across the state tax policy landscape...