Washington state came into the year with strong tax justice momentum. Lawmakers’ innovative Capital Gains Excise Tax on the state’s highest-income households was upheld by the state and federal Supreme Courts and was overwhelmingly affirmed by voters despite a well-funded repeal effort. The new tax is bringing in much-needed revenue for schools, child care, and early learning. Meanwhile, the new Working Families Tax credit provided a boost to middle- and low-income families throughout the state. Those two policies combined moved Washington from the most regressive tax code in the nation to the second-most regressive, a notable achievement years in the making. And finally, voters reaffirmed their support for these efforts by electing even more progressive representatives, with equity-oriented revenue raising ambitions, in November.

But state lawmakers are now faced with the challenge of addressing a $16 billion revenue shortfall, impending federal funding uncertainty, and a new governor calling for billions in budget cuts. Negotiations underway in the final week of legislative session have come to center on a package that includes regressive tax increases on the same voters who showed such clear support for progressive tax policy.

Both houses of the legislature looked to carry the momentum forward as they took up that challenge, beginning budget negotiations with significant new targeted revenue proposals to help close the deficit. House and Senate leaders put forth tax packages in March that agreed on some key pillars, including: loosening restrictions that prevent local governments from raising adequate property tax revenue, raising a state gas tax that had fallen behind, and taxing financial assets held by the wealthiest Washingtonians.

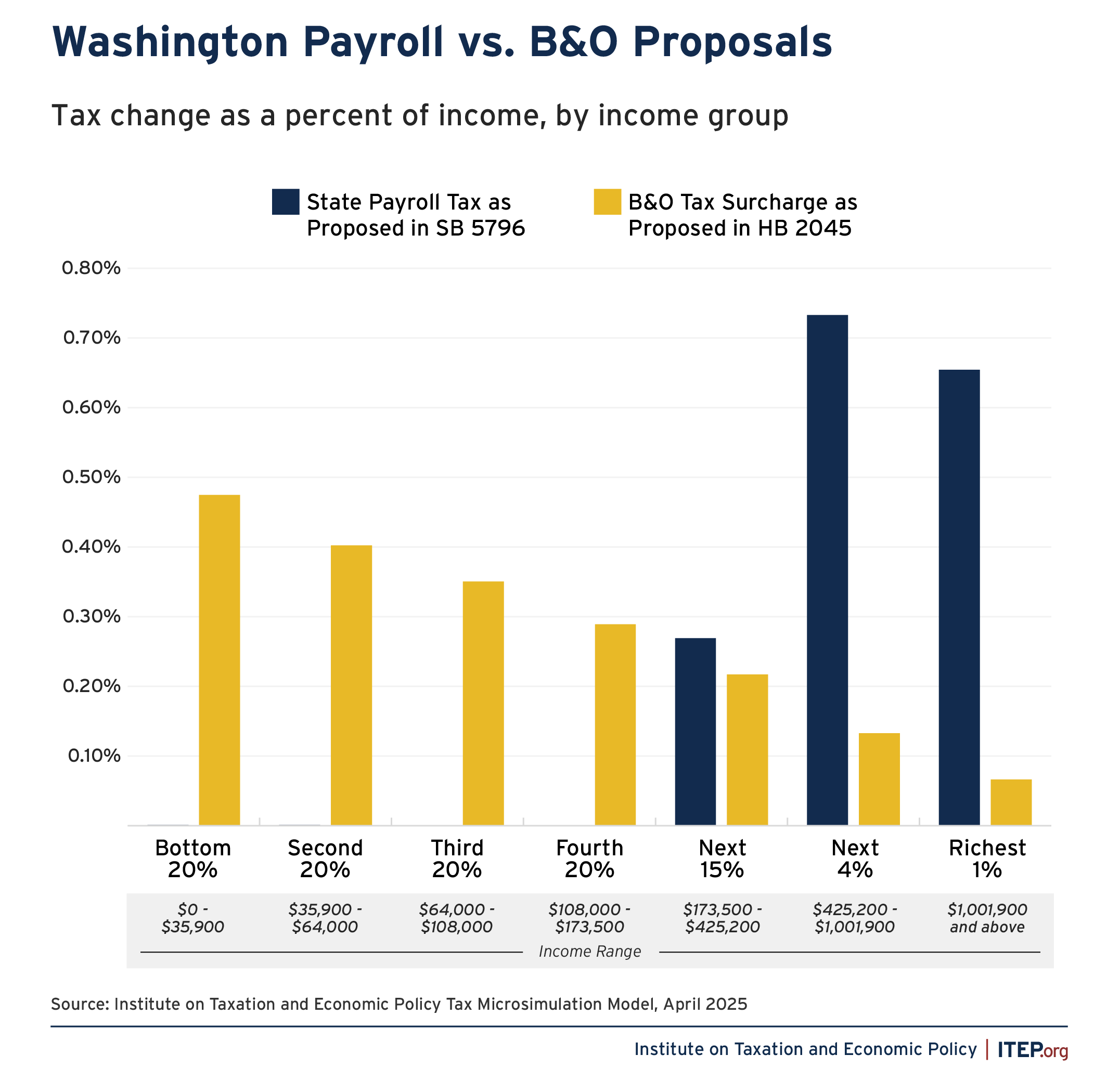

While the debate has continued to shift (and is being actively debated upon publication), there is a key difference between the initial proposals that remains extremely relevant. The Senate legislation included a 5 percent payroll tax on income exceeding $176,100 (the threshold at which payroll stops being taxed for Social Security) at companies with over $7 million in total payroll. This would create a rare progressive payroll tax that would ultimately be paid by upper-income Washingtonians and continue the momentum of bringing more balance to the state’s upside-down tax code.

This proposed tax on highly paid employees is in contrast to another nominally business-focused proposal. The House proposed an adjustment to the Business and Occupations (B&O) Tax via a surcharge on most companies with at least $250 million of revenue. The B&O surcharge has since become the leading proposal, with broad rate increases added and exceptions still being debated.

But lawmakers should understand that regardless of tweaks being made to the B&O proposal, these two options are fundamentally different from a tax fairness perspective, as is demonstrated in the figure below.

Washington’s B&O Tax: A Sales Tax By Another Name

While the figure above paints a stark contrast between who pays the payroll tax proposal and the B&O surcharge, the difference has not been clear from press coverage. At face value, applying surcharges to the B&O tax on businesses grossing over $250 million seems like a way to ensure the wealthiest businesses bear the cost. But debated B&O proposals – whether a surcharge on the largest businesses or an across-the-board increase – are not the well-targeted solutions they are sometimes described to be.

The sales tax is Washington’s most regressive major tax, falling disproportionately on middle- and low-income families. However, the B&O tax is essentially a sales tax by another name. It is a form of Gross Receipts Tax, wherein businesses multiply their total sales (aka gross receipts) by a rate and pay the resulting amount to the state. Because the B&O tax is so broad and is based directly on sales – rather than profits – businesses account for such a tax by raising prices in proportion to the tax. So although it does not appear on the customer’s receipt (as does a sales tax), it is passed to the customer in the form of higher prices. And the customers of large businesses (e.g. shoppers at big box retail stores) are not necessarily any higher income than the customers of smaller businesses. In other words, the tax ultimately comes out of the consumer’s pocket, not the business owner’s, so much of the tax is paid by middle- and low-income families.

Payroll taxes are also passed on to others by business owners over the long run, but they are passed to employees through lower pay rather than to customers through higher prices. For this reason, if businesses are required to pay higher payroll taxes on amounts paid to employees exceeding $176,100, those highly paid employees will ultimately bear the incidence of the tax – resulting in a progressive structure.

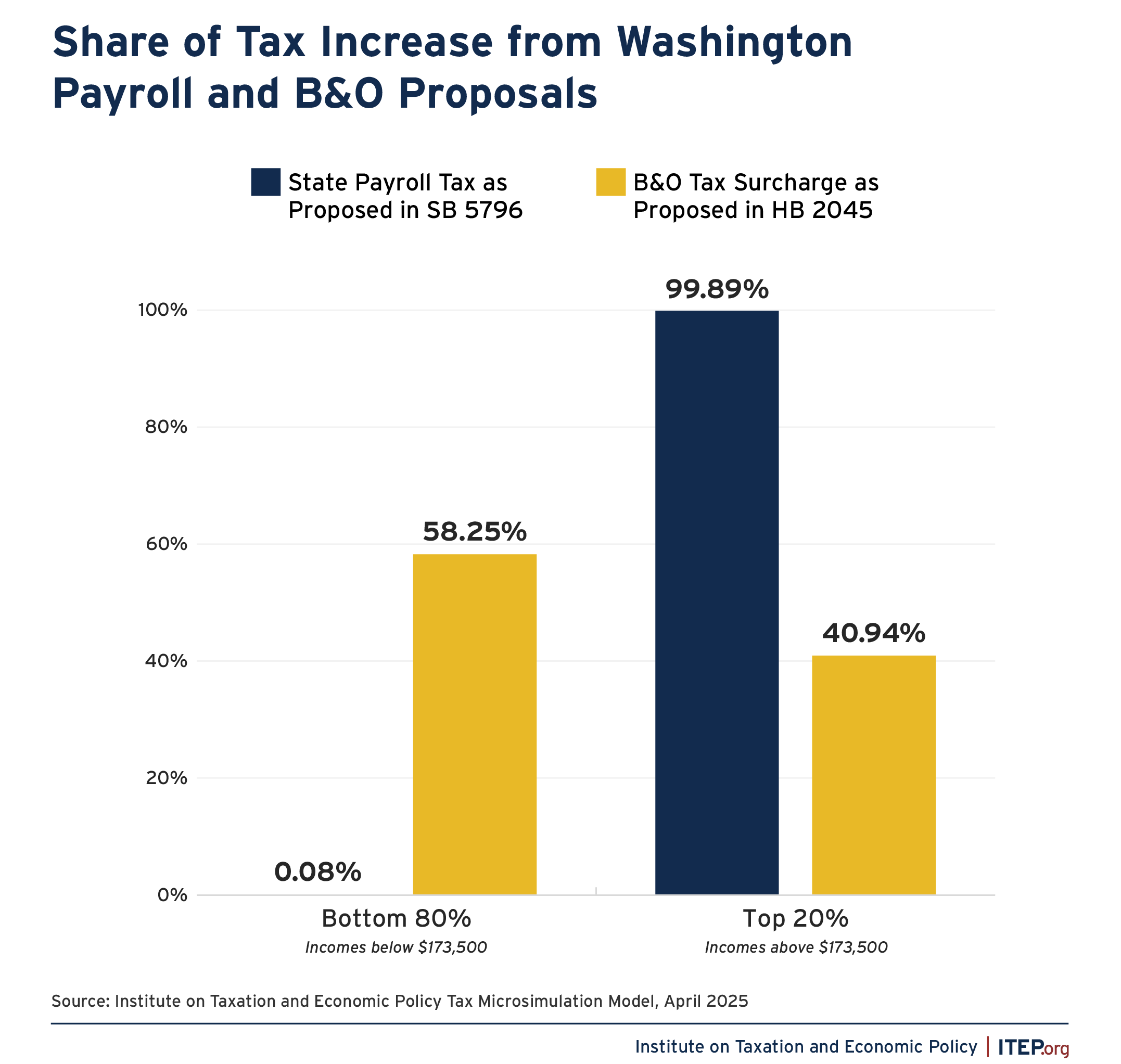

The tradeoff is presented in another way in the graph below, showing that nearly all of the payroll tax would ultimately be paid by households with income over about $175,000, while the majority of the revenue from the B&O proposal would ultimately come from households with income below that amount.

Making a Choice for Washingtonians

Washington’s legislative session is about to end, but there is still time for lawmakers to enact a progressive payroll tax rather than settle for a more regressive revenue raiser. The progressive revenue bills are written, the fiscal notes are complete, and the impact on everyday people is stark. The original B&O surcharge proposal would not, on its own, undo all the progress Washington has made on tax fairness over the last few years. But when combined with additional regressive tax policies under consideration (e.g. gas and property tax increases), the state risks backsliding on that progress and moving further away from a tax system designed with equity and sustainability in mind.

If lawmakers are unable to find the political will to return to the payroll tax this session, these lessons should be front and center for future tax debates.