In Missouri, the tax subsidy available for gifts to charity depends on what charitable cause the donor happens to support. Gifts to groups that aid wounded veterans or victims of natural disasters enjoy a state tax deduction worth up to 4.7 cents for every dollar donated. Gifts to support youth development and crime prevention yield a higher payout, in the form of a state tax credit worth 30 to 50 cents on the dollar.[1] But one of the best deals of all is reserved for gifts to anti-abortion pregnancy resource centers—those donations come with state tax credits valued at 70 cents on the dollar.[2]

While a 70 percent public match on donations to anti-abortion efforts might sound high to most people, some lawmakers think it is not high enough. A bill (HB 1176) currently being debated in the state would increase that matching rate to 100 percent—that is a full, state-funded reimbursement of gifts to anti-abortion groups.[3] As explained in recent reporting by ProPublica, the effect of such a change would be to let many residents give to such groups in lieu of paying any state income taxes at all.[4]

But it’s actually worse than that.

Qualifying gifts to anti-abortion groups include not just cash but also donations of corporate stock.[5] In practice, a large share of the gifts made under this proposal would take the form of corporate stock because those gifts receive additional tax subsidies beyond what is provided for cash donations.

In fact, one little-noticed feature of the bill is that the subsidies afforded to stock donations would be so large that “donors” to anti-abortion centers would find their tax savings to be worth more than the value of the stock they supposedly “donated.” Put another way, the true match rate, factoring in all the various ways that a “donation” changes one’s federal and state tax bills, would exceed 100 percent. The result would be a personal profit to the “donors” taking part in this program.

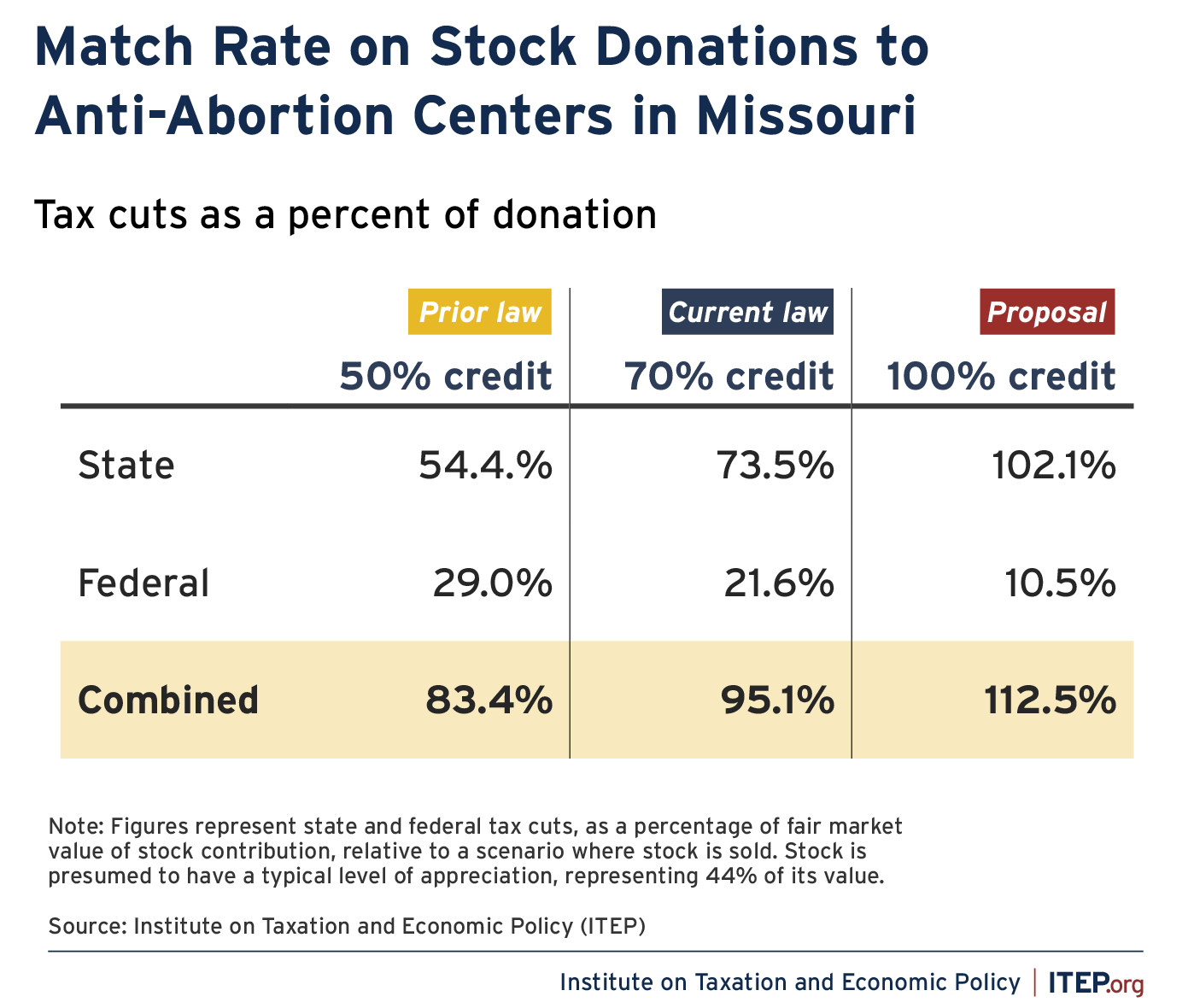

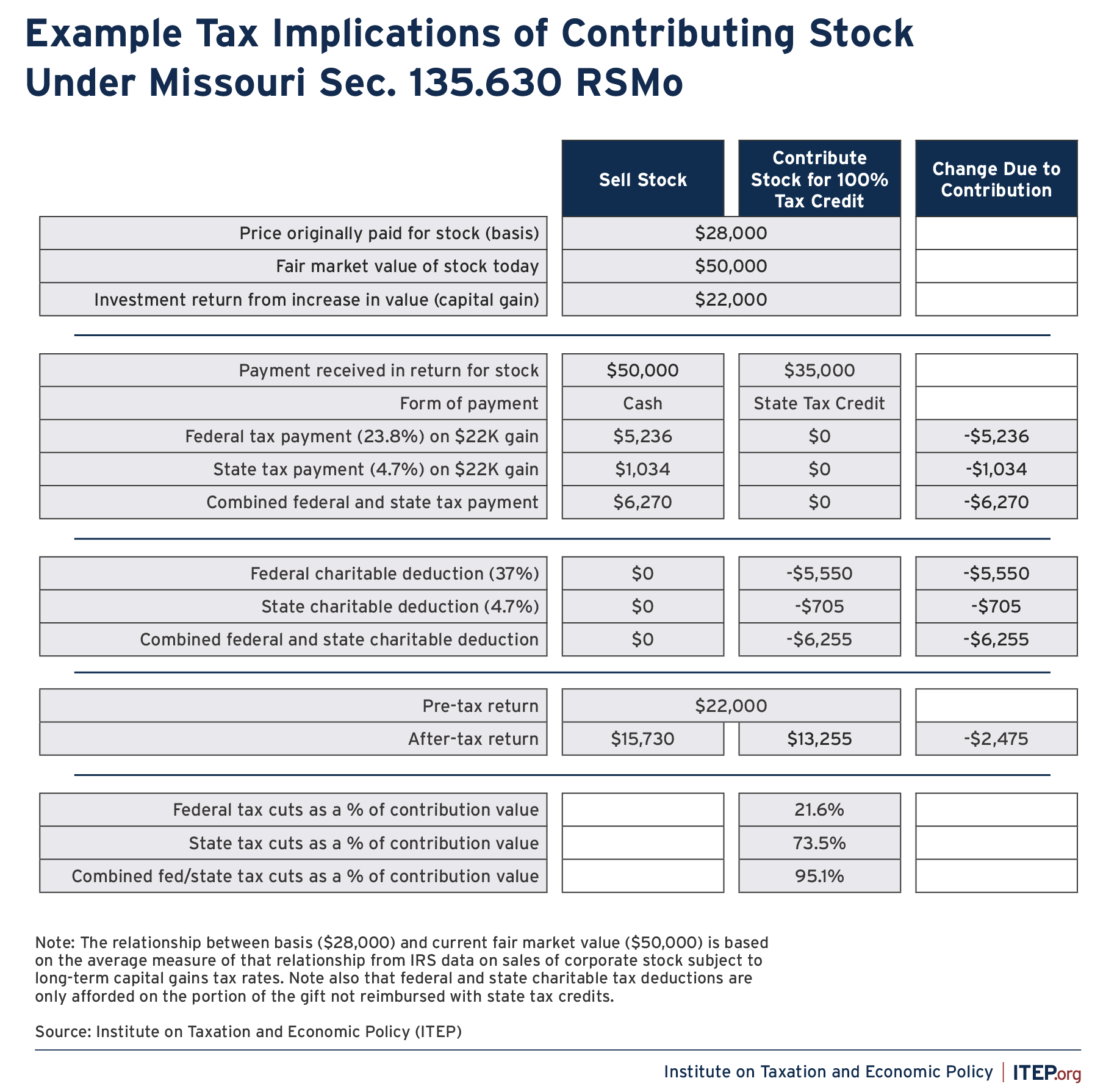

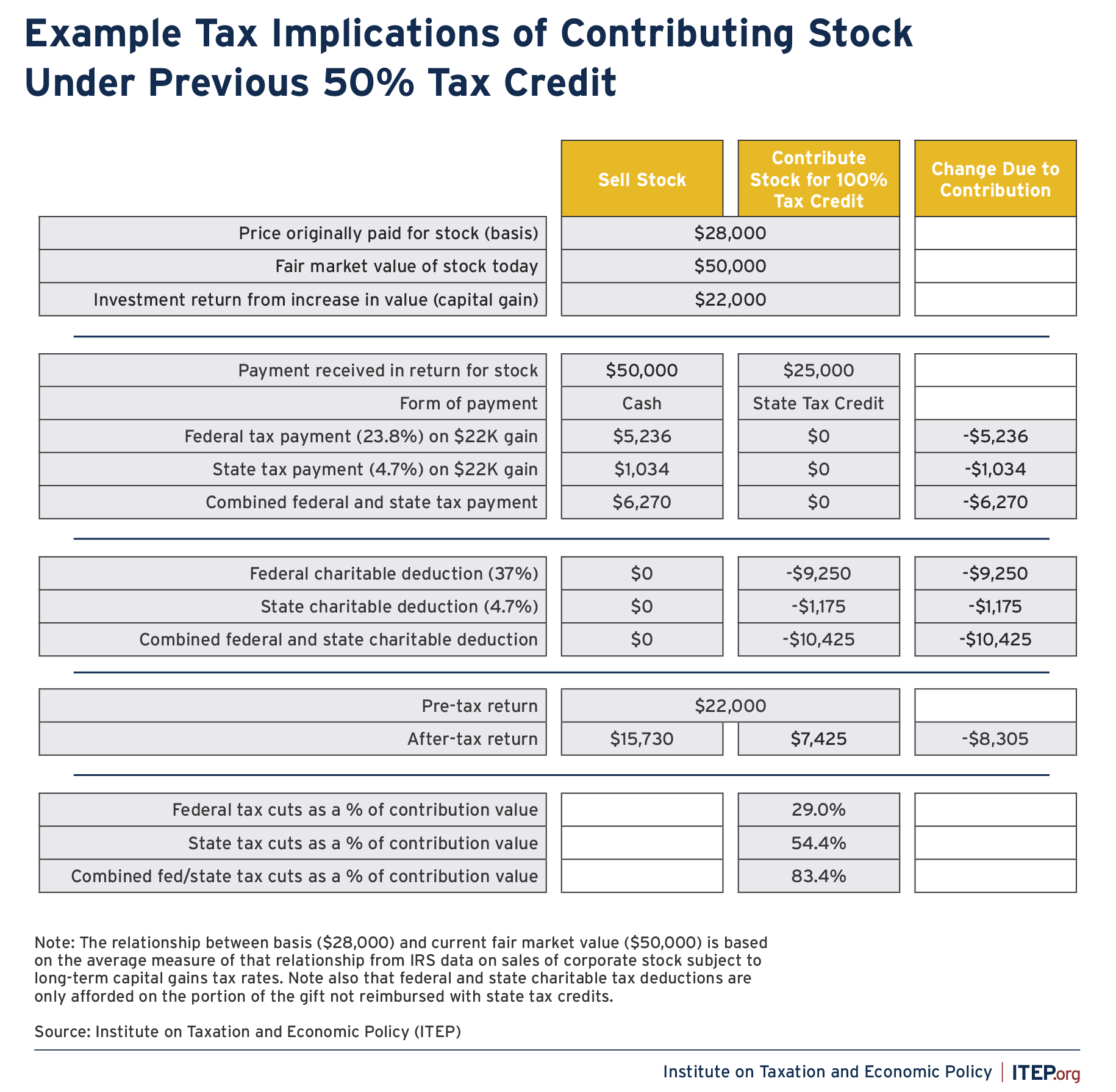

As seen in Figure 1, the true match rate on a typical stock donation would be over 112 percent under HB 1176, with a 102 percent match coming from Missouri and another 10 percent from the federal government. That’s compared to the true match rate of 95 percent under current law (with a 70 percent credit in place) and the match rate of 83 percent under prior law (with the 50 percent credit that the state offered up until 2021).

FIGURE 1

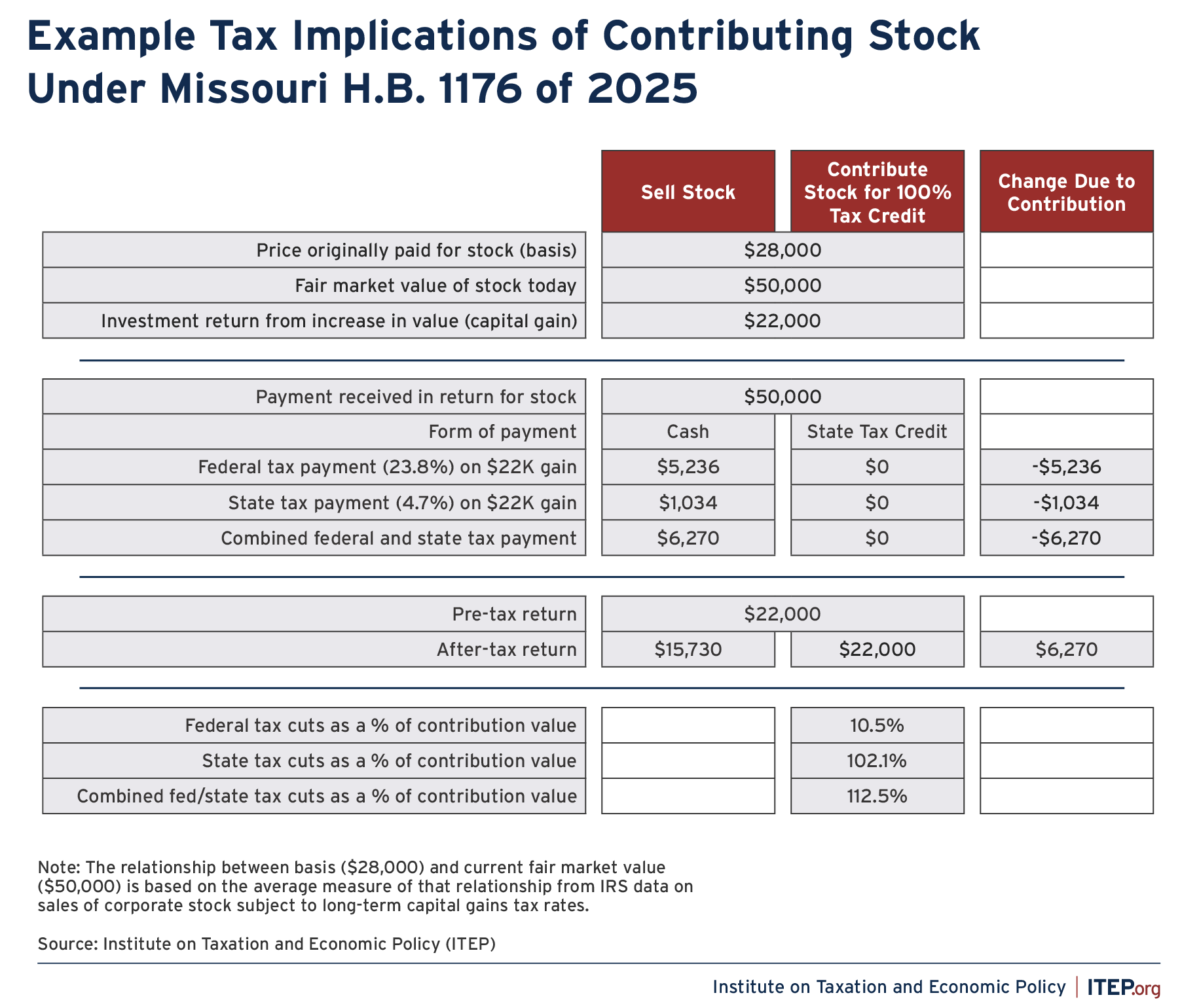

To understand why the true match rate is higher than the advertised tax credit percentage, imagine a high-income investor holding $50,000 of stock they are ready to sell. (The maximum tax credit available under both current law and this proposal is capped at $50,000.) Just prior to selling that stock, this person learns from their accountant that if they give away this stock to an anti-abortion pregnancy center, they will be paid out its full $50,000 value by the state of Missouri (in tax credits) and they won’t have to pay any federal or state tax on the portion of their stock’s value representing capital gains income.

In the example shown in Figure 2, where this investor is holding a stock that has seen a typical level of growth, choosing to give the stock to an anti-abortion group boosts the after-tax return of their investment by $6,270 relative to selling that stock to another buyer. That is, “giving” the stock away results in $6,270 of personal profit compared to selling it because the investor has managed to secure $56,270 in state and federal tax cuts in return for “donating” a stock valued at just $50,000. Making matters worse, the net profit amount would be higher—potentially $14,000 or more per year—for stock that has grown very significantly in value from its original purchase price.

FIGURE 2

This tax shelter opportunity has important implications both for individual Missourians and the state budget. If HB 1176 becomes law, Missouri would have an incentive making it in every investor’s financial interest to give away stock to anti-abortion centers, regardless of their personal views on the wisdom of supporting these groups. The result would be a flood of donations not just from people who are supportive of these centers, but also from people who are ambivalent on the issue and merely choose to participate because of the tax shelter.

With this in mind, it is clear that the official estimate of the cost of this legislation ($3 million per year) is significantly understated.[6] That estimate was arrived at under the assumption that the volume of donations made under the program would remain unchanged despite the significant increase in the incentive to donate afforded by a 100 percent tax credit (as seen earlier in Figure 1). This is highly implausible.

If HB 1176 were enacted, a significant number of wealthy Missourians planning on selling stock would find that they could enjoy a 12 percent markup, or more, by steering their stock holdings into anti-abortion centers instead. This risk-free, automatic return would prove too tempting for many investors to ignore and would fundamentally transform the program from a charitable giving incentive into a profitable tax shelter. The result would be a drastic increase in the volume of donations, at a high expense to the state budget.

Supplemental Tables

Endnotes

[1] Missouri Department of Economic Development. “Youth Opportunities Program.” Accessed March 2025. https://ded.mo.gov/programs/community/youth-opportunities-program-yop.

[2] Missouri Department of Social Services. “Pregnancy Resource Center Tax Credit.” Accessed March 2025. https://dss.mo.gov/dfas/taxcredit/pregnancy.htm.

[3] House Bill 1176 of the 103rd General Assembly, 1st Regular Session. Available at: https://house.mo.gov/bill.aspx?bill=HB1176&year=2025&code=R.

[4] Kohler, Jeremy. “A New Missouri Bill Would Let Residents Donate to Anti-Abortion Centers Instead of Paying Any Taxes.” ProPublica. March 5, 2025. https://www.propublica.org/article/missouri-pregnancy-resource-centers-anti-abortion-tax-credit-bill.

[5] Revised Statutes of Missouri, Section 135.630. Available at: https://revisor.mo.gov/main/OneSection.aspx?section=135.630.

[6] Committee on Legislative Research, Oversight Division. Fiscal Note for HB 1176. Available at: https://documents.house.mo.gov/billtracking/bills251/fiscal/fispdf/2353H.01I.ORG.pdf.