The three tax bills that cleared the House Ways and Means Committee in June are reportedly stalled due to some House Republicans’ demands that the package include provisions weakening the $10,000 cap on deductions for state and local taxes (SALT). Modifying the House tax package in this way would make it much more expensive while benefiting the richest fifth of taxpayers almost exclusively.

The Republican House majority is unlikely to fully repeal the $10,000 cap on SALT deductions given that it was enacted as part of the Trump tax law in 2017 without a single Democratic vote. But many lawmakers from both parties hope to weaken the SALT cap in some way.

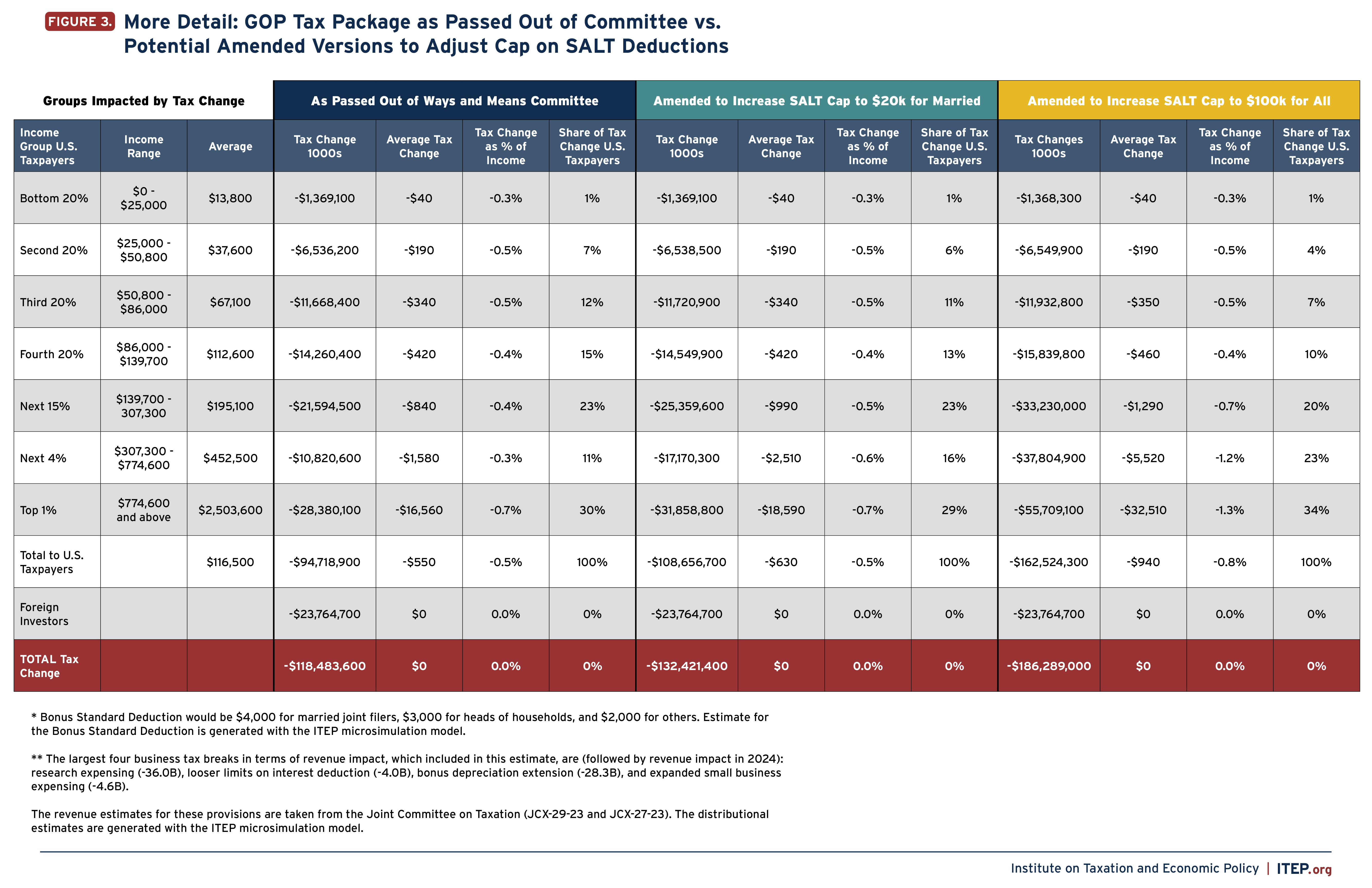

One proposal would allow married joint filers to deduct twice as much SALT ($20,000), under the logic that this would eliminate a marriage penalty in the existing cap, which does not vary by filing status. Another would increase the cap to $100,000 for all taxpayers.

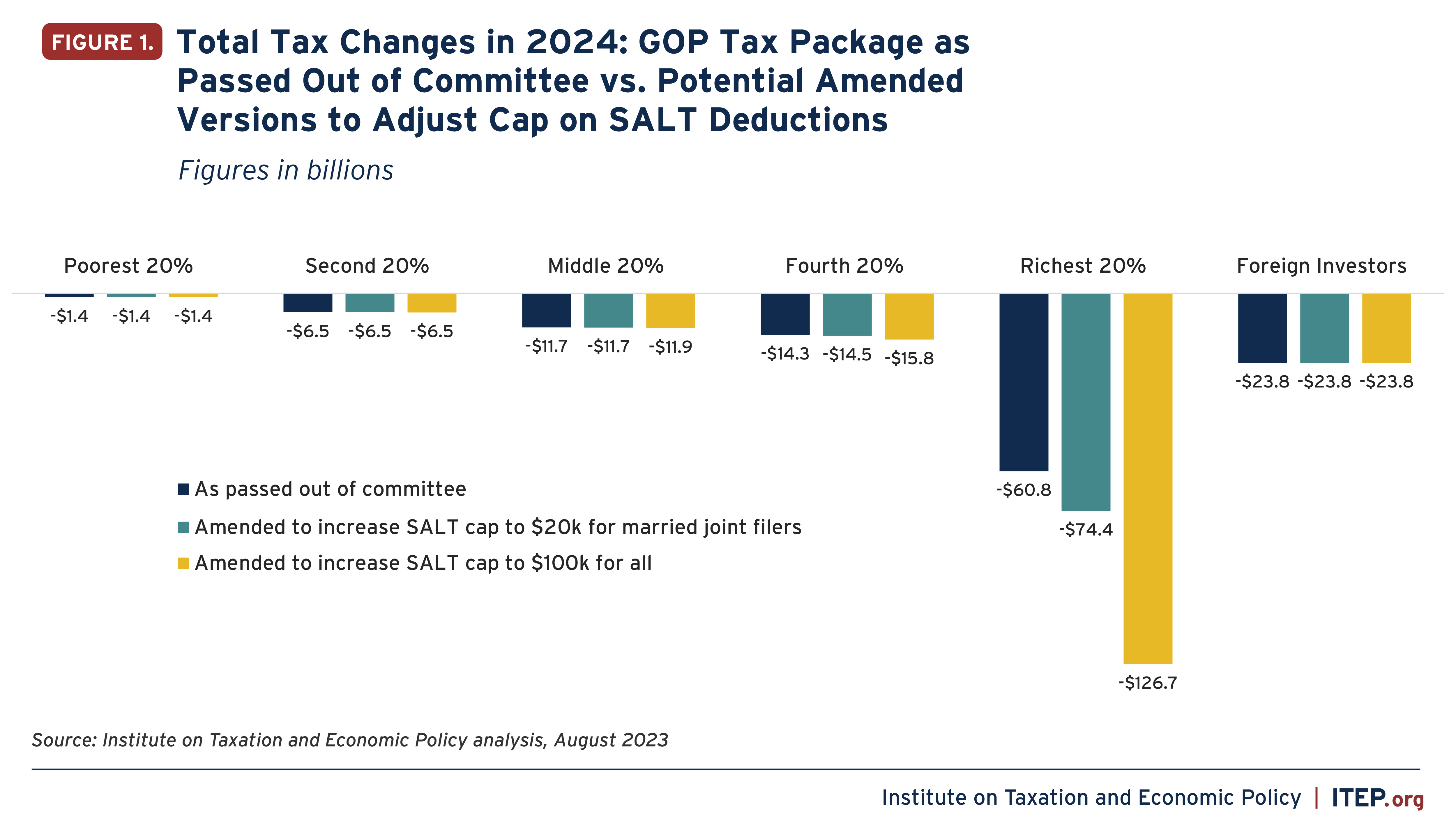

Amending the House tax package in either way would increase the total amount of tax cuts going to the richest fifth of taxpayers in 2024 while having virtually no effect on any other income group.

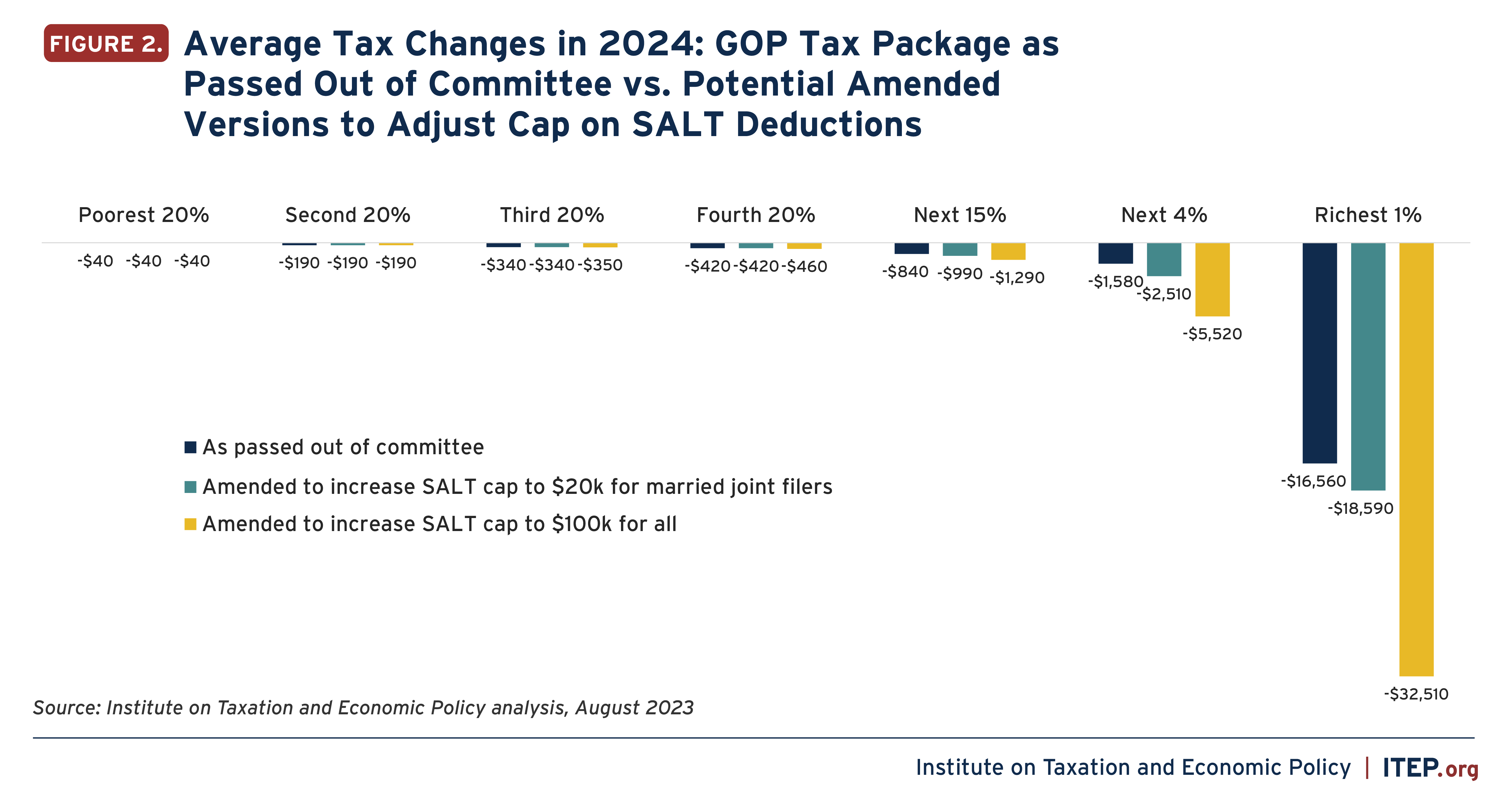

It would also substantially increase the average tax cut received by the richest taxpayers in 2024 but would have little or no effect on low- and middle-income taxpayers.

For example, the committee-passed package would provide the richest 1 percent of Americans with an average tax cut of more than $16,500 in 2024. That would be nearly doubled to more than $32,500 if an increase to the SALT cap from $10,000 to $100,000 is included.

Adjusting the SALT cap could add substantially to the cost of the tax cuts in the legislative package. The significant tax cuts in the bills passed out of committee would cost $118.5 billion in 2024 alone, as illustrated in Figure 3.

If the package included a SALT cap increase to $20,000 for married joint filers, the cost in 2024 would rise to $132.4 billion. If it included a SALT cap increase to $100,000 for all taxpayers, that cost would rise to $186.3 billion.

More About the House Tax Package

The estimates shown here for the tax package as approved by the Ways and Means Committee are from ITEP’s June analysis of that legislation. The new information presented here demonstrates how the two best-known proposals to modify the cap on SALT deductions would change the legislation’s overall impacts if they were added to the package.

As our June analysis explained, ITEP focuses on the tax cuts and does not address who ultimately pays for the revenue-raising provisions (which would repeal clean energy tax credits) because their costs would ultimately fall on everyone in the form of higher energy costs and greater climate damage.

While the legislation includes many relatively arcane tax cuts, ITEP focuses on the handful that make up most of the revenue impact. For example, the four business tax cuts included in this analysis account for 95 percent of the cost of business tax breaks in the legislation.

ITEP calculated that in 2024, about $23.8 billion of the tax breaks would ultimately flow to foreign investors in American corporations. This is because the portion of tax breaks going to corporations would benefit their shareholders, who would receive greater income (in the form of stock dividends, stock buybacks, or increased capital gains on stock sales). A large portion of these shareholders are foreign investors.

Potential amendments to adjust the SALT cap, which are the focus of this analysis, would not affect corporate taxes, which is why the $23.8 billion tax cut for foreign investors is the same in each scenario.

More About the Cap on Deductions for State and Local Taxes

The Tax Cuts and Jobs Act of 2017 placed a $10,000 cap on the amount of deductions taxpayers can claim on their federal returns for state and local taxes (SALT) they paid during the year. This provision was designed to force residents of higher-tax states (often thought of as politically “blue” states) to partly pay for the tax cuts included in that law. This is not a fair or sound way to make tax policy.

At the same time, eliminating or dramatically weakening this SALT cap would help well-off Americans far more than anyone else. ITEP has suggested different ways that lawmakers might approach this issue and has demonstrated that repealing the cap altogether would provide the largest tax breaks to the richest Americans.

In recent years, several states have enacted policies that allow business owners (typically among the richest state residents) to avoid the SALT cap. ITEP’s modeling takes these state “workaround” policies into account, as explained in the appendix to ITEP’s recent report on the proposal to make all the temporary tax cuts in the 2017 law permanent.

Download more detailed tables here for more information about the different parts of the House tax package and how it would be affected by amendments to weaken the SALT cap.